If Covid-19 has taught us anything, it’s that many of us tend to act impulsively and without getting the facts.

The ridiculous rush to collect as much toilet paper as possible when things started to get to a boiling point in March is a typical example.

Before then, toilet paper was just another item on your standard monthly shopping list, but certainly not the only thing.

Pretty much the same can be said for offshore investments. Many people don’t even consider an offshore investment as part of their investment needs until the rand takes a nosedive, and then, without proper research or expert advice, they invest impulsively without giving any thought to the products and currencies they choose.

Why should I invest offshore?

The reality is that an offshore investment should always be on your investment to-do list, and the main reason for this is diversification, both by asset class and currency.

In terms of currency, the benefits are obvious: to protect yourself against the depreciation of the rand. Sadly, as South Africans, we are quite familiar with political instability, though this is not unique to South Africa. Add to this, among other things, inflation and interest rate concerns, and negative perceptions about the country and you have a recipe for rand volatility.

By diversifying your investments across the currencies of several developed countries, you should benefit from the rand’s decline in value over the longer term.

Another aspect to consider is that certain factors that affect certain sectors are unique to SA. When we consider the local banking sector, for example, it’s affected by elements such as interest rates, risk and local consumers’ levels of indebtedness.

This causes the local banking sector to often behave quite differently to its offshore counterparts. Therefore, by investing in similar sectors offshore, you will essentially gain exposure to all the relevant industry sectors with their accompanying levels of risk, returns and business cycles.

Furthermore, the tax clearance process has become much simpler, and individuals may now invest up to R1m offshore without obtaining a tax clearance certificate, and up to R10m with tax clearance.

How much?

There are countless opinions on what the optimum amount to invest offshore is. This mainly depends on the level of risk you are willing, and able, to take, along with what you can afford to invest offshore.

You can also consider the impact of exchange rates on your living expenses. For example, are exchange rates likely to affect the cost of running your motor vehicle and do you travel overseas regularly? If so, you should invest offshore at least to the extent that you want to hedge against prices that will rise because of currency depreciations.

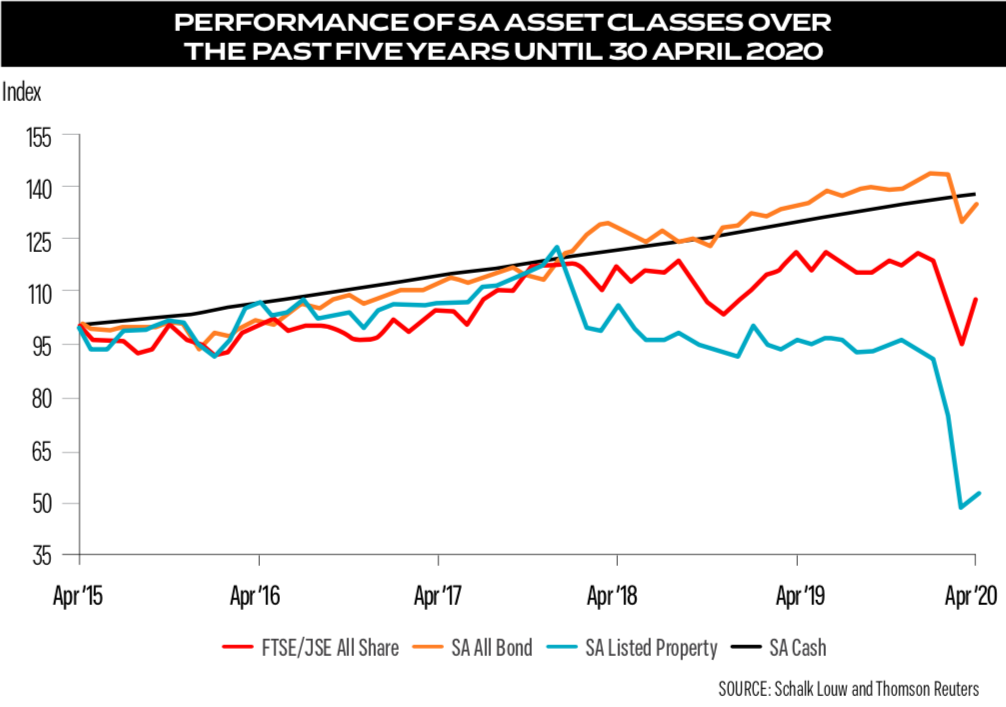

The truth is that SA asset classes in general, relative to their international peers, are performing poorly, with none of the local asset classes (local shares, bonds or property shares) having been able to outperform the local money market over the past five years (until the end of April 2020).

It is for precisely this reason that ever more financial advisers are encouraging their clients to invest literally all of their capital offshore. But the fact is that our local market hasn’t always performed this poorly.

If we look at the data at our disposal since the end of 2000, we will see that in rand terms, the MSCI All Country World Index (ACWI) has grown by 9.7% per year (until 30 April 2020), while theFTSE/JSE All Share Index (JSE) has grown by 13.3% per year (see graph). If you had invested 100% of your capital in the ACWI, your investment would have underperformed inflation 31% of the time over a 60-month (or five-year) rolling period.

Regulation 28 of the Pension Funds Act, however, currently restricts offshore exposure to 30%. Things looked much rosier for investors who invested their capital 50/50 in each of the above indices as it would have delivered returns of 11.7% per year, but more importantly, would have underperformed inflation only 4.6% of the time over a five-year rolling period over this period.

The second instalment of Schalk Louw’s offshore investing advice will be published in the upcoming (25 June) issue of finweek.

Schalk Louw is a portfolio manager at PSG Wealth.

This article originally appeared in the 4 June edition of finweek. Buy and download the magazine here or subscribe to our newsletter here.

Publications

Publications

Partners

Partners