The sea of business challenges presented by the novel coronavirus, particularly the world economy grinding to a halt, has left no industry unscathed. South African businesses are not only at odds with how to approach the impact of the virus, but also with the stagnating environment in which they operate.

Business confidence

Exports have been hit, tourism flows have been affected, and supply-chain disruptions are being widely felt.

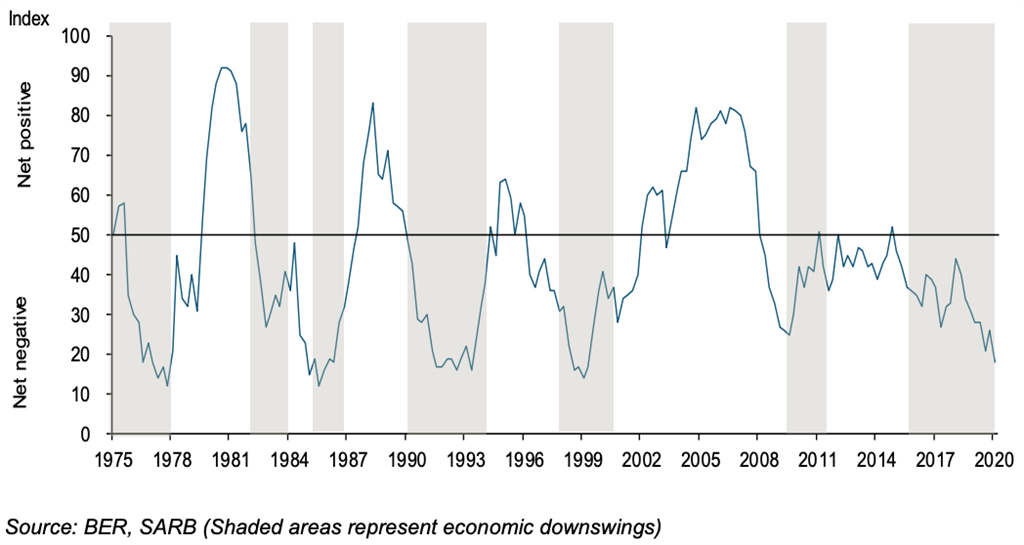

“In short, nothing here spells any good news for the RMB/BER Business Confidence Index (BCI) which in all likelihood will continue to trend lower in the period ahead,” says Etienne le Roux, chief economist at RMB, on the latest release of the index that slumped by eight points to 18 in the first quarter of 2020, marking a 21-year low.

Load-shedding, bailouts of struggling state-owned enterprises such as SAA, and the government’s budget were cited as some of the factors behind low confidence. To the dismay of an already gloomy business environment, the government initially imposed a 21-day lockdown until 16 April, during which citizens and residents will have to stay at home to contain the outbreak.

In an address to the nation, President Cyril Ramaphosa said that all shops and businesses will be closed except for pharmacies, laboratories, banks, the JSE, supermarkets, petrol stations and healthcare providers.

On 9 April, the president announced an extension of the lockdown by a further two weeks and said that “if we end the lockdown too soon or too abruptly, we risk a massive and uncontrollable resurgence of the disease.”

“The lockdown just completes the perfect storm,” says John Dludlu, CEO of the Small Business Institute (SBI).

Small businesses

Dludlu says that small- and medium- enterprises (SMEs) are vital to successful economies around the world, where they employ between 60% and 70% of the labour force, and that according to an SBI study conducted two years ago, SMEs constitute 98.5% of all businesses in the formal economy. SMEs are often suppliers to government, larger corporates and multinationals, says Jeremy Lang, regional general manager at Business Partners.

SMEs fill the gap of niche markets such as smaller supply runs and that they are job creators, which allows for employees, who are also consumers, to spend money in the broader economy. They also give rise to innovators, often introducing new products, services or technology into the industry, which is often absorbed and rolled out by larger corporates, he explains.

The ripple effects of thousands of small businesses closing will have a massive impact on increasing unemployment significantly, says Mike Anderson, founder and CEO of the National Small Business Chamber (NSBC). The Unemployment Insurance Fund set aside R40bn to help mitigate the surge in job losses owing to the Covid-19 crisis and by 9 April had already paid out R356m, according to Ramaphosa.

Anderson, Lang and Dludlu all agree that industries that will be directly affected include tourism, mining, events management, manufacturing, business services, education, fuel and transport businesses.

“Supply chains will struggle to get goods and services; the ancillary businesses supporting the employees of larger regional businesses like restaurants, laundry facilities, hardware stores, and repair shops will have to re-establish themselves if able; and any suppliers in the small businesses’ supply chain will suffer,” says Dludlu.

According to Anderson, the Covid-19 National Small Business Survey conducted one-day prior to lockdown showed that 90% of participants urgently needed cash flow or funding to sustain their business; 89% experienced a drop in sales due to no or fewer customers; 61% are in a financial crisis; and 23% have already laid-off their workforce, and indicated more upcoming layoffs.

Softening the blow

Lang tells finweek that no one really knows what the true impact is, but a recent similar client survey by Business Partners shows that more than 50% of respondents will need some form of intervention to survive. The department of small Business development (DSBD) was quick to launch a Debt Relief Finance Scheme while the Motsepe, Oppenheimer and Rupert families pledged billions of rand towards the establishing of similar programmes.

The NSBC set up a Covid-19 Small Business Relief Centre to help SMEs with, among other things, creating a business continuity plan, digital marketing strategies in a time of crisis, how to handle and implement hygiene protocols and new staff policies, and how to move from face-to-face to online meetings.

The big four banks (Standard Bank, FNB, Absa and Nedbank) announced measures for business customers impacted by the outbreak and lockdown with payment relief programmes that, for instance, allow customers to defer payments for a period of three months, or to pay reduced instalments by agreement with the bank.

The Industrial Development Corporation (IDC) put a R3bn package together to fund vulnerable firms and fast-track financing for companies critical to efforts to fight the virus such as essential medical supplies. The Small Enterprise Finance Agency postponed loan repayments for six months and set aside R500m in support. In agriculture, government reprioritised R1.2bn to provide relief to smallholder farmers and to contribute to the security of food supply.

Dludlu says the need appears to be bigger than what has been made available so far and that there is a significant amount of money in the venture capital industry and government departments (not just the small business department) to support SMEs and ought to be unleashed. He adds that “our [SBI] preference is for all businesses to press the ‘pause’ button, instead of rushing into liquidation and retrenchments.”

Survival also depends on how business owners are using their time during lockdown, says Anderson. “This is the time to be positive, adapt and find new opportunities. Now is the time to perfect products, services and efficiencies within the business.” It could take six months to a year or longer for businesses to recover from Covid-19 and the lockdown, depending on its extent and length, according to Lang. “This is the biggest unknown,” he says.

Meanwhile, Business Partners managing director Ben Bierman said on 6 April that domestic SMEs have applied for R2.8bn in support from the Rupert-funded Sukuma Relief Programme. The company is administrating Johann Rupert’s R1bn in donated capital to support small businesses. About 10 000 applications for aid were received, according to a statement released on 6 April. These applications were received within four days of the programme’s launch and led to Business Partners temporarily halting the acceptance of new applications.

Publications

Publications

Partners

Partners