Cape Town - The Parliamentary Standing Committee on Finance is conducting public hearings on Tuesday to discuss the planned tax on beverages such as soft drinks, energy drinks and sweetened milks by April 2017.

"The jobs impact is way below what we've seen in the media," said National Treasury's Ismail Momoniat. "Job losses could be prevented if the sugar content is reduced and less tax is paid on these beverages." (See his full presentation below).

31 Jan 2017

Yunis Carrim

The thing that strikes me from today’s deliberations is the people who don’t have vested interests are all taking one position. Not a single health expert has said anything contrary to the evidence presented here. All the (health) experts here agree obesity is a problem. I’m not saying it’s a consequence of the committee, though.

Secondly, although I have no doubt that scientists are able to spin a particular point of view I wonder who has material interest in this matter. We all agree we have to tackle obesity, save jobs and take into account history, culture and all these things.

Now we need to find the balance. I’d like civil society and stakeholders to think about the process we need to follow. And this has nothing to do with rushing legislation through before budget. This is an ongoing process. These deliberations were the initial process.

This is by the way not a sugar tax, but rather a tax that is levied on sugar-sweetened beverages (SSB).

These deliberations could have been far more heated. It’s been managed very well. Good bye all.

The public hearings adjourn.

31 Jan 2017

ANC MP

Pinky Kekana: Sama says there should be a comprehensive approach in this dilemma. Sugar is one of many things that contributes to obesity. I agree with them. I don’t want a microwave approach because the Minister of Finance has a budget speech in the next few weeks. We need to engage with the critical stakeholders on this matter. Health, have that dialogue. Treasury, have the dialogue and then you come back to us.

31 Jan 2017

The World Health Organisation (WHO)

Rufaro Chatora: Fiscal policies and taxes on sugar-sweetened beverages are the best practice to protect the population’s health and to demonstrate leadership in sub-Saharan Africa. The taxes raised should be used as investment in programmes to promote health.

We want more information on the range of policy options available to curb the consumption of sugary products. But that doesn’t mean we don’t support a sugar tax.We’ve waited too long to intervene in the tobacco industry. Obesity is out of control. We need to intervene now.

But South Africa is not alone in considering a sugar tax. SA as a member of the WHO should do what it’s agreed to at international level. You’ve set yourselves a target, calling a halt on adult and child obesity.

We’ve modelled the impact a sugar tax will have on longevity. It may prevent 477 680 deaths over 40 years in South Africa. It may also result in savings of R1.7bn in health costs over 10 years.

Temo Waqanivalu: Not one country in the world have so far been successful in turning around the obesity epidemic? Could South Africa be the first?

Quoting Margaret Chan, WHO director: “It’s a failure of political will to take on big business [in the sugar industry]."

31 Jan 2017

The Heart and Stroke Foundation

Pamela Naidoo: Epidemiological studies in SA are far more reliable so please trust the stats that we give you. Cardiovascular disease in SA is the second highest cause of death.

I know we’ve heard the other side of the argument that a sugar tax could lead to job losses, but we need to look at the long-term consequences that sugar consumption has on longevity and productivity for example.

We agree that the tax in itself is not going to be the solution, but it should be combined with other interventions. In Canada the anticipated effect of a sugar tax was found to be that it would prevent 2.4 million diabetes incidences per year and a saving of $17bn in health costs.

31 Jan 2017

Non-Communicable Diseases Alliance

Vicki Pinkney-Atkinson: We unequivocally support this as a cost-effective public health measure. But we ask for an equitable share of the budget. In the past with tobacco and alcohol taxes nothing was given to health. The revenue collected from these taxes need to be ring-fenced.

The only part of the budget that relates to NCDs is 0.67% and 17.2% from programme 4 of the Health Budget. The link between NCDs and sugar can’t be argued away. There’s a whole link chain. It’s not just about getting fat. It’s also about getting cancer (from sugar-sweetened products).

31 Jan 2017

31 Jan 2017

31 Jan 2017

31 Jan 2017

31 Jan 2017

South African Medical Association (Sama)

Sama president Daniel Ncayiyana: Where I grew up (in KZN) sugar is a staple. But having made that confession, I can summarise what our views are. Sama supports a tax on sugary beverages. The revenue from such a tax should be used in strategies to fight obesity. The tax alone is not going to be sufficient or make a difference unless accompanied by other interventions.

31 Jan 2017

Section 27’s Sasha Stevenson:

We think a sugar tax is a raft of measures that can be taken to reduce obesity. The health system has a limited amount of funding available and the burden of obesity and NCDs are increasing.

The state is under obligation to take measures to ensure access to healthcare services. Furthermore, everybody has a right to an environment that is not harmful to their well-being. A food environment in which sugary drinks are so easily accessible are harmful to health.

A country in which young children are being fed more sugary drinks than milk, is not constitutional. The state is obliged to realise the constitutional rights of its residents. Introducing a tax is well within the state’s means. Such taxes are not unreasonable and they’re entirely legitimate.

There’s competing evidence relating to the effectiveness of a sugar tax. But we’d argue the evidence in favour of such a tax is compelling. The evidence is particularly strong when combined with other interventions, such as healthy school feeding schemes, access to clean water, changing portion sizes, nutritional labelling etc.

There appears to be no dedicated budget to drive measures which will

compliment the tax. So we need more detail, plans and budgets for other

interventions. That however doesn’t mean we should not introduce a sugar tax.

This issue is urgent and we need to make this intervention.

31 Jan 2017

31 Jan 2017

Statutory bodies' input on #SugarTax

The Food and Allied Workers Union (Fawu): The lessons we drew from the proposed tobacco legislation 20 years ago taught us that stakeholder engagement is very important in the formulation of such legislation. It’s not about who wins the argument, but rather arrive at something that will have a wider support and be workable and implementable.

On the content of the proposed legislation, we start by saying it could well be that if you want to achieve reduced sugary beverages consumption the consequence will be reduced production and job losses as a result.

In the poultry industry for example we’re dealing with people who are facing job losses. We hope it’s not the same in the sugar value chain. We need to discuss how to mitigate these job losses.

Reduced obesity is being juxtaposed with the loss of 5 000 jobs. If you add that to the 9 million unemployed people in South Africa — it’s a difficult call to make — the trade-off between job losses and positive health outcomes. It would be good to have deeper discussions on where to strike that trade-off.

31 Jan 2017

SA Sugar Association responds:

We categorically state our support for healthy living, but we want evidence-based information (on obesity and NCDs). We sell 600 000 tonnes of sugar to the beverages industry — about one-third of our sales.

About alternatives — it doesn’t make business sense. The prices in terms of energy tariffs are too low to make it work. There’s no space for co-generation at the moment.

In terms of ethanol, the regulatory framework is uncertain.

31 Jan 2017

Tiger Brands responds:

The opportunity to reduce the sugar content should be something this (Parliamentary) Committee needs to consider. Industry is able to do that (reduce the amount of sugar) and it presents new opportunities.

31 Jan 2017

SA Fruit Association responds:

The trick is to find solutions to obesity problems, but by limiting injury to the economy. Regarding the question of fruit juices: a fresh apple has sugar in it, but health benefits. Juice is the same. It has sugar, but also nutrients. I’m sure nobody is suggesting we should tax the intrinsic sugar in fruit, right?

Doctors, however, seem to disagree about whether fruit juice should be excluded or included.

31 Jan 2017

SA cane growers responds:

We’ve been trying to generate electricity and that was a joint venture-type model. But we can’t participate in it at the moment. The same goes for ethanol. The process is still with Cabinet.

We interact with Beverages SA. From the organisation’s point of view we’re driving diversification as high as we can in KZN — especially to help the small-scale producers to do small-scale electricity generation. But at this point in time there’s no real alternative to sugar cane production.

31 Jan 2017

Beverage SA responds:

We need a total dietary intake study. That way we’ll know if the sugar tax is the right instrument to target obesity. We’re already reformulating our products since 2014. We’re taking sugar out of our products. It’s an ongoing process.

In terms of the job losses — the net impact on the economy has been modelled. The impact on GDP and job losses has a net negative impact of R3bn. One needs to understand there will be job losses, contrary to what was said earlier.

31 Jan 2017

Question time:

During question time ANC MPs of the Portfolio Committee on Health accused the sugar and beverages industry of only worrying about how a sugar tax will impact on their profits and not being concerned about the plight of workers who will lose their jobs.

Alf Lees (DA): Why can’t we change the uses of sugar cane for renewables or ethanol? Why are you telling us something is stopping you? If there’s a blockage that we can unlock and help save the jobs of people working in the sugar industry. Surely we must consider that.

31 Jan 2017

Lütge: We don’t support this tax. If the consumption of sugar is going to go down we’ll have to export. We need alternatives. We don’t have access to any other value streams.

We are looking for a socio-economic impact assessment. I see no evidence of that and I’m concerned that this hasn’t been taken into account. There should be diversified evidence-based information on the diet of South Africans.

31 Jan 2017

South African Sugar Association Chairman Rolf Lütge:

The timing of this tax is really not good. We’re an industry under siege.

The impact this tax will have on our industry is going to be significant, especially on the sugar milling and sugarcane agricultural sectors of the local sugar industry.

The loss in revenue and reduction in sugar consumption will result in a shrinkage of the industry with accompanying job losses.

I was quite disappointed that the input from National Treasury and the academics earlier only focused on job losses in the beverage industry. But please don’t forget about us in the sugar industry.

It’s not appropriate to vilify sugar as the only contributor to obesity. We need to look at other things such as oil and maize as well. I don’t want to get into a spat about which scientific research is correct. As an industry we hope the stakeholders can come together and talk about the context and consider a range of options available to us.

31 Jan 2017

Yunus Carrim: We’ve received very technical representations from industry experts today. We need to think about how we’re going to take this process forward as Parliament.

31 Jan 2017

Tiger Brands’ Grattan Kirk:

Our issue is around concentrated beverages as these are our biggest products. Concentrated beverages like squashes and nectars need to be diluted before being consumed. So there’s a fundamental difference between this and ready-to-drink beverages.

The larger volume and longer-term use pattern makes concentrates a better value-for-money product.

If you apply the same tax to a concentrate you get a tax of up to 50%. This amounts to an effective tax rate on Oros for example which is 150% higher than the intended tax rate.

If we increase the price of Oros by 50% would be the highest ever levied for a food/beverage product worldwide and will have a drastic impact on the concentrate industry. I think that was an unintended consequence of this tax.

31 Jan 2017

SA Fruit Juice Association's Rudi Richards:

We strongly recommend National Treasury's intention to include 100% natural fruit juices. There's good reason for the exclusion.

It's a natural product and has no added sugar and a tax will disrupt the fruit value chain.

In the UK and US it is recommended that fruit juice should be consumed in moderation.

100% fruit juice is excluded by all countries - even in Mexico.

31 Jan 2017

SA Cane Growers Association's Thomas Funke:

We'd like to share with you that we cannot afford the impact of a tax on small-scale growers in KZN.

Our calculation shows a sugar tax will significantly reduce the volume we provide to the beverages industry.

It will threaten the existence of all the small-scale growers in the sugar industry. Already the environment is very stressed. Can we as SA really afford this? It will increase job losses in rural areas.

It will have negative impact on an industry that has been ravaged by the recent drought. We want to appeal to government to not impose a tax on sugar-sweetened beverages.

It's not true that there won't be any job losses. There's a perception that poor people from rural communities can't think for themselves. It's not so.

The impact on the fruit juice industry will be significant. 30% of apples and 25% of oranges are not suitable for the fresh fruit market and are therefore used for juicing. A tax will lead to job losses in this industry.

31 Jan 2017

The beverages industry will now make representations.

Beverage SA's Mapule Ncanywa:

About 25% of the jobs in our industry are at risk. Significant indirect job losses will be in the informal sector. We don't want to be a contributor to unemployment in this country. It's going to make it difficult for us to create new jobs.

As an industry we feel we punch way above our weight. We make a significant contribution to the country's GDP.

We're not just trading for the sake of trading. We support up to 300 000 jobs and contribute R17.5bn towards taxes.

This is a very vibrant industry in which competition thrives. Small and medium players have joined the industry in the past decade.

The tax proposal will go against the good work we've been doing.

As a responsible industry our mandate is shaped by government's key initiatives. We do so frankly in terms of challenges, but also to address inequality. It's sad that we want to debate an issue which intent is good, but will contribute more to poverty.

We believe the proposed sugar tax will have many unintended economic consequences. It will curtail our ability to create jobs and contribute to GDP.

We contribute towards revitalisation in agriculture. It will have a negative impact on agriculture and agro-processing. We realise sugar causes health problems. But we want to part of the solution.

We're a different market. We need to unlock the potential of SMMEs. We're a big player in the township areas and rural development. The good work we've done thus far will be negatively impacted.

There are people who say here in Mexico there were no job losses. But SA is different to Mexico. Our unemployment figure is a double digit number and our GDP growth is far less robust.

If we say the sugary beverages industry is the largest contributor to obesity in this country we need to contextualise it. Our studies show we only contribute 3%.

We believe there's a better way. Our proposal is a regulated approach. We're not saying there's no problem. We've been engaging with the Department of Health about healthier options.

We can reformulate our products and reduce the sugar content. We put forth a proposal to the minister to say we'd like to partner with you in awareness campaigns and policy. But the minister was not so happy to do this.

We're saying the measures we propose can be binding. If we raise our hands and say we'll reduce the sugar volumes: we've put a target for 2018 for this reduction.

Our proposal: Allow us to contribute towards making SA a better country. A holistic approach is needed. A sugar tax is not it. It will have dire consequences.

Can the attended outcomes of a sugar tax be attained through other means?

31 Jan 2017

Those appearing before Parliament answer the below MP questions...

Karen Hofman (Wits' Priceless): The evidence shows education alone is not very effective. As far as regulation is concerned there's no evidence in the world showing this works. The question why we're doing this to sugary beverages - it has a particularly toxic effect on the body. It gets into the bloodstream very quickly and that's why we focus on sugary beverages.

Ruder (from Society for Endocrinology): To reiterate, sugary beverages are the elephant in the room. It's the largest contributor to empty calories. One soft drink means you've dumped ten teaspoons of sugar in your bloodstream. But one hour after that you'll want to sleep.

Chaloupka (University of Illinois): As academics we are following a holistic approach. Obesity is a much more complicated area than tobacco though. It requires a comprehensive approach to change behaviour. Beverage tax does reduce consumption and it's cost-effective.

Puoane (UWC): In addition to the tax, we need to deal with the cultural perceptions about obesity and that it's a sign of affluence. Teach people about calories and what they mean.

Oni (UCT): We need education and awareness campaigns, but we also need to support people to make healthier choices. In the context of inequality we need to equip them to make those decisions. They need to be able to afford this (healthier products, for example).

31 Jan 2017

Politicians, back from lunch, are asking questions in Parliament:

Wilmot James (DA): Should the intervention (in the area of health, obesity and sugary drinks) be a tax at all? What about regulating sugar content in products? My question to the academic presenters: Why haven't you done research on using a regulatory instrument for sugary beverages?

Pule Mabe (ANC): We need to see how workers will be accommodated in other areas. The academics need to take that into account in their research.

Mkhuleko Hlengwa (IFP): Have we considered an age limit on sugary drinks for children, similar to alcohol? We need to discuss alternatives to a tax.

Pinky Kekana (ANC): There's also sugar in tomato sauce and in chutney. We need to look at this thing holistically.

Alf Lees (DA): There's a great deal of percentage of taxation. But it's not stated as a percentage by National Treasury. It's in relation to the amounts of grams of sugar.

Thandi Tobias (ANC): Are there any recommendations on lifestyle changes that can be incorporated?

Wilmot James (DA): I'd like to challenge the comment that regulation doesn't work.

31 Jan 2017

Thandi Puoane from the UWC School of Public Health:

63.9% obesity in SA. But there's evidence of success with policy interventions. It may be among the most effective strategies to create population-wide improvements in consumption habits.

A tax on sugary beverages would need to be part of a wider approach to address obesity that includes food labelling, advertising regulations and reformulation of foods.

We also need to deal with perceptions that people who are obese are well-off and can take care of themselves.

The revenue from sugary drink tax should be used to promote health. Currently, the policy document doesn't prescribe how the revenue should be appropriated.

31 Jan 2017

From the University of Illinois, Prof Frank Chaloupka:

In Mexico, a sugar tax has led to a 6% decline in the purchases of sugary drinks.

The impact of sin taxes on jobs - industry focuses on the gross impact instead of the net impact. Money not spent on the taxed goods are spent on other things, which represent gains.

There is job creation in other sectors of the economy as a result of government spending in other areas.

Mexico is the only country in the world that has implemented such a tax. There's been no decrease in total employment in the manufacturing sector for beverages.

We've actually seen increases in some areas of the economy. Virtually no change in unemployment rates.

Tobacco control policies have similarly not negatively affected overall employment. Job losses in the tobacco industry were offset by gains in other industries.

Strong evidence that in Mexico this tax has had a positive impact and resulted in additional economic benefits likely as a result from tax-induced changes in behaviour.

31 Jan 2017

Prof Karen Hofman, Priceless SA (Wits University Public Health):

I look at where we can get the best buys for health in SA. Let me summarise: this tax will save lives, increase life expectancy at low cost, will send a public health message to counter marketing.

This tax will also avoid further impoverishment for poorer families. Caregivers and breadwinners are hugely affected by these NCDs.

There are healthy years lost in SA due to severe obesity. The health system is burdened, which is putting up costs. Private healthcare costs shoot up as well as public healthcare costs.

The hidden cost of sugary drinks - there's a 50% increased health cost for obesity in the 54 - 69 year age group. The public purse is indirectly subsiding our consumption of sugary drinks.

R11bn to R20bn is what we've spent on diabetes annually. This is the macroeconomic impact of NCDs through lost wages and it creates a poverty spiral.

I'm trying to show you what diabetes is doing to the public purse.

Smoking laws have decreased the incidence of smoking by half (from 40% to 20% of the entire population). This is historic. Let's do it. Will people still drink sugary drinks? Yes, but they will do it less.

What is harmful to health is hundreds of billboards in poorer areas urging us to consume sugary drinks. We're asked today to implement regulations.

We modeled the health impact of sugary drinks at Wits: the health impact increases with the magnitude of the tax. National Treasury proposed a 20% tax, but the health impact (positive) would be even more at 30%.

The potential impact of a 20% tax means the youth will be mostly impacted. The cost of inaction is costing us dearly: there will be a 16% increase in obesity by 2017. Sugary drink sales are projected to grow by 2.4% per year. This industry has already said it's targeting the lower income groups.

There's no evidence that self-regulatory approaches are effective. In Soweto there are boards advertising sugary beverages. Schools have promised to self-regulate - eight years ago already. But nothing has happened.

This is the first step - not the only one - which will allow the industry to reformulate. We need to consider the revenue that's been raised. It should go towards national obesity strategy and the health promotion foundation. This is a pro-poor policy. The tax is very well designed and we suggest it should actually be 30% as it will result in greater health gains.

There are over 40 groups that have signed on globally, which are all supporting this drinks tax in South Africa.

This is a historic moments, will save lives, cut healthcare costs and generate revenue.

31 Jan 2017

Sundeep Ruder from the Society for Endocrinology, Metabolism, Diabetes SA:

I'm speaking as a doctor who has worked in the rural areas and small farming areas.

I know the struggles of clinicians on the ground who try to help people on the 'salvage' level. Health is an intrinsic nature of human beings. We become unhealthy because of things that are being put into us.

Endocrinologists are doctors who deal with diabetes every single day. Many people with diabetes are unable to work and are dependent on state grants.

Our people are surrounded by misinformation. We're talking about nanny policies. But we're also being exposed to nannying through misinformation.

Non-communicable diseases (NCDs) are happening under our noses and we as clinicians need to battle with it every day.

In a country where education standards are poor we're expecting the consumer to make choices, but based on what knowledge?

Consuming sugar at a young age is correlated with cardiovascular disease later in life. We reflect on numbers without first world resources to deal with this problem. The women of our country are very obese - among the highest of the world. If a child-bearing woman is not healthy, the child won't be healthy.

Many cancers are driven by obesity and the food we eat. It can be reduced by simply changing our diet.

People who die from diabetes in Africa are the highest in the world.

Drinking one sugary beverage a day increases your chance of getting diabetes by 26%. It cannot be part of a healthy diet. You stimulate hunger for the entire day. It causes insulin resistance.

Secondary sugar is when a mother consumes sugar and it affects her unborn child. Just like secondary smoke. Where is the evidence that sugary drinks are good for you (as the advertisers of these products proclaim)? I haven't seen it.

There comes a time in the history of a nation when we must do what is right rather than what is pleasant. I ask you as a clinician to think about this carefully.

31 Jan 2017

Questions from MPs follow:

Thandi Tobias (ANC): In an environment where people are poor and then forced to buy cheaper products that are detrimental to their health - what can be done in this regard?

Makhosi Khoza (ANC): Why are you not saying anything about the regulatory environment? Tax alone is not going to deal with this scourge.

Wilmot James (DA MP): Sugar tax is one option. What about regulating sugar content? Has this matter been put to UCT's medical faculty to a vote? I'm an honorary member and I can't remember this being put to a vote.

UCT School of Health and Public Medicine's Prof Tolu Oni responds:

I agree that we can't come across as punishing people without supporting them with healthier options. The evidence in terms of the different types of interventions show that fiscal measures are cost effective.

31 Jan 2017

UCT School of Health and Public Medicine's Prof Tolu Oni:

There needs to be a multi-sectoral approach to addressing health issues at different levels - public, societal etc.

The population approach: As a population, where are we in terms of the exposure and the burden of disease. How can we shift the population to a more healthier side of the curve.

Shifting the norms are crucial. When you do that, it results in the maintenance at an individual level. It doesn't mean it replaces the need for health education, but by shifting that it is reduced.

What kind of interventions are required? Can't we just get people to move more? No, we know consumption matters more. We know poor diet generates more disease than physical inactivity, alcohol and smoking combined.

What are the interventions to decrease likelihood of diabetes? We have to look at the source of calories. Sugar calories promote fat storage and triggers to hunger compared to fats, proteins and complex carbs.

With high sugar intake - you can see it in fat storage in the liver.

I want to make the point that focusing on physical activity alone does not effectively address obesity at a population level. Especially not at the population approach.

Alternatives to taxation suggested consumer education to balance calorie choices, but systemic reviews confirm that such interventions lack evidence for effectiveness.

In SA the intake of sugar-sweetened beverages in 9 - 10-year olds is second highest in the world. US is first.

We need radical intervention - a population intervention. We cannot afford to delay.

There is a connection between the health of woman of reproductive age and the health of her child. The offspring of an obese mother is likely to also be obese.

Obesity is more than just the physical. Maternal obesity leads to lower cognitive function in children.

The use of tax instruments to boost public health is not only limited to South Africa. It happens all over the world. We strongly support National Treasury's proposals to help combat this.

31 Jan 2017

31 Jan 2017

National Treasury's Ismail Momoniat:

We don't like earmarking when it comes to revenue raising. But you need to fund a set of activities, whether it's health promotion and so on.

This is a simple straightforward excise tax. I'm not sure if the Davis Tax Committee can add anything to it, but we have nothing against referring it to them.

The issue of job losses: It depends on your assumptions and how substitutions will be taking place. No policy is going to have only winners and losers.

The regulation and the tax are not either/or. We use both. Take tobacco for example. There are significant regulations coupled with an excise tax. One option of combining a suggestion of a particular benchmark (one or two teaspoons of sugar) we can for example say if the sugar content is below a certain amount there will be no tax.

The tax system as a whole is progressive. But certain things may be regressive, such as excise tax on tobacco. Those are difficult issues certainly. You find that bad foods are cheaper than good foods.

Members are not appreciating what a good measure tax is in changing bad behaviour. As price rises consumption drops. There will be evidence shown here to this effect. This is the main reason why we are doing this. Sugar-sweetened beverages are not essential products. It's not the increasing the burden on poor people.

31 Jan 2017

31 Jan 2017

31 Jan 2017

31 Jan 2017

31 Jan 2017

31 Jan 2017

31 Jan 2017

31 Jan 2017

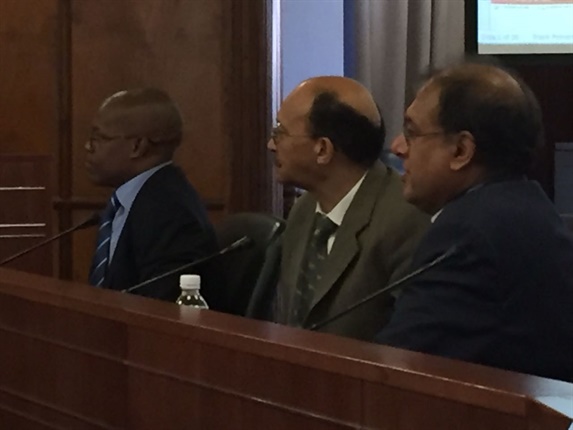

National Treasury's Ismail Momoniat (far right in below photo):

Momoniat is Deputy Director-General and head of Tax and Financial Sector Policy.

Treasury is moving on this proposal to tax sugary drinks (not to tax sugar per se). This was announced by the Minister in the 2016 budget. We're not saying this in itself this will solve the obesity problem. It has to go hand in hand with education etc.

We'll continue to deal with comments received on the proposed tax. The minister will then announce how we'll respond to these comments. He will do that in the Budget delivered on 22 February.

The fiscal measures can take the form of excise taxes or subsidies. The role of excise taxes is to compensate for the negative effects of unhealthy foods.

(Excise tax refers to an indirect type of taxation imposed on the manufacture, sale or use of certain types of goods and products.)

With beverages that contain added calories including natural sugars, the amount of sugar becomes the tax base. It comes down to R2.42 per litre.

The administration of the tax will be through the customs and excise tax.

On the fruit juice matter - we are looking at including 100% fruit juice in the tax proposals. However, the consultation process will continue.

It will be in producers' interest to correctly label their beverages. This is a concerted effort. The Department of Trade and Industry for example needs to make sure the labelling is done right. We need a simple labelling system. From the public finance side we need to align health promotion with national priorities. We are not doing enough currently.

Government has committed to addressing health promotion and supporting such programmes to target NCDs. It's critical to get buy-in from the public.

Sugar-sweetened beverage industries have multi-million rand budgets for advertising. They need to play a role in promoting healthy living though.

We're not saying we don't want particular drinks. But substitutes need to be created that have less sugar. In terms of process, we're looking at introducing legislation on budget day.

There's been a significant increase in the availability of sugar-sweetened drinks and price of soft drinks has come down. It has therefore become more affordable to buy.

Volumes increased by 5% per annum, while price increased at 3% per annum.

31 Jan 2017

Melvyn Freeman from the National Department of Health (chief director for non-communicable diseases):

The consequences of for non-communicable diseases (NCDs):

Being overweight increases the risk of an NDC and is four to five times higher.

Productivity is also compromised. The American Chamber of Commerce did a study including SA. 6.8% of our GDP is spent on absenteeism (employees not coming to work). Much of this due to NCDs. This is how illness impacts our economy in terms of growth and development.

Increased school absenteeism is mainly due to tooth problems.

The impact of fiscal policies to improve diet and NCD prevention is in the range of 20% to 50%.

Alcohol, tobacco and sugar-sweetened beverages are targeted in such fiscal policy measures.

Food taxes were one of the most cost-effective ways of reducing NCDs.We hope some resources will come to us as via the Health Department should a sugar tax be implemented so that we can share information and play an educational role.

This is not for us the only thing that needs to be done.

We realise this tax is part of a number of interventions. There are other things that the private sector can also do like reformulating products.We are partners in this development.

We should be together in this endeavour to get a healthier population. Sugary beverages and unhealthy foods should be less freely accessible.

Sugary beverages have a particularly negative impact.

The jobs impact is way below what we've seen in the media. Job losses could be prevented if the sugar content is reduced and less tax is paid on these beverages.

We know sugary beverages are not the only cause of obesity, but at least it's a start.

31 Jan 2017

Melvyn Freeman from the National Department of Health (chief director for non-communicable diseases):

A look at sugar in beverages: Coca Cola for example has 18 spoons of sugar in it. The acidity of Coke is not that much different from the acidity of a lemon.

Sugar also causes dental diseases and that puts a major burden on the health system.

31 Jan 2017

Melvyn Freeman:

There is a high level of hypertension in South Africa as well as diabetes. Even in the 15 - 24 year old group, there is a significant prevalence of diabetes and pre-diabetes.

Prevalence of obesity in SA: males roundabout 10% and females 40%. So this is something we really need to worry about.

In children, there are large numbers as young as 2 to 5 years old who are already overweight and obese.

The intake of added sugar is increasing steadily. Children consume about 40-60g per day, which increases to 100g per day in adolescents.

Our health system is burdened by NCDs and it increases healthcare expenditure. It has a significant opportunity cost to governments.

Sales of sugar products are projected to rise. This product of consumption is driving NCDs. The more we have, the more of a burden it will have on our health system.

Publications

Publications

Partners

Partners