19 Nov 2015

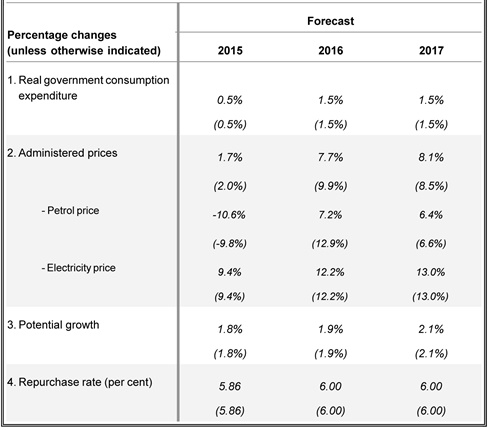

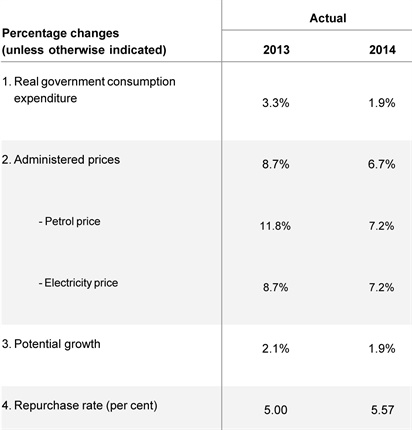

MPC's domestic assumptions:

19 Nov 2015

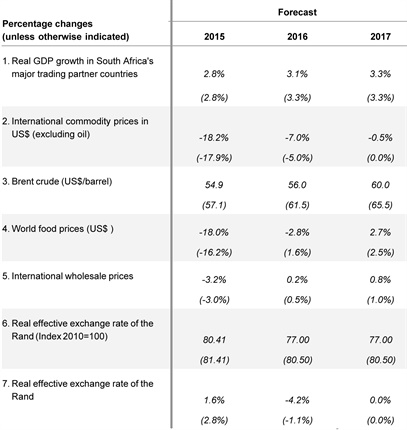

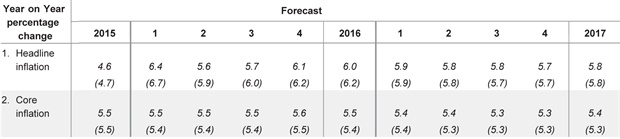

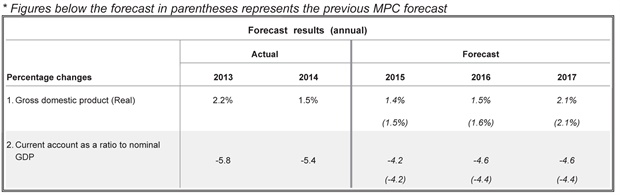

MPC's foreign sector forecast:

19 Nov 2015

MPC's Foreign sector assumptions:

19 Nov 2015

Geffen: Sellers need to curb their expectations and with more rates hikes in the offing, 2016 will not be an easy year for home owners.

19 Nov 2015

Geffen: We are already seeing growing debt defaults and the irrational exuberance that prevailed in the property market previously has calmed down to just exuberance. In 2016 house prices will continue to rise driven largely by stock shortages, but not at 2013/2014 rates. We’re likely to see year-on-year price increases slowing to around the rate of inflation from the 8% to 10% we’ve been seeing in recent years.

19 Nov 2015

Geffen: There is also a knock-on effect for consumers. The South African economy is stagnant, the currency is under enormous pressure, we are facing the prospect of having to import staple food stuffs for the first time in nearly a decade and electricity prices will continue to rise at a rate far above inflation.

19 Nov 2015

Lew Geffen, chair of Lew Geffen Sotheby’s International Realty: This was a double-whammy for cash-strapped home owners. A rise of 25 basis points is not large in itself, but this will be the third increase in little over a year and when one factors in the 8% to 11% increase in transfer fees imposed to swell government coffers, it puts immense strain on the housing market.

19 Nov 2015

The prime lending rate rises to 9.75%.

19 Nov 2015

Geldenhuys: This decision will unfortunately negatively impact many consumers who are already facing increasing financial strain through dealing with elevated levels of debt and the rising cost of living expenses.

19 Nov 2015

Kay Geldenhuys, ooba manager for property finance processing: South African Reserve Bank’s decision to increase the interest rate will negatively residential housing markets.

19 Nov 2015

Seeff: Those who need to or want to buy will continue to do so in the ordinary course of business. The market is still well balanced and we are still seeing relatively tight stock levels, quick sales cycles and good prices. We expect this to remain for most of next year.

19 Nov 2015

Seeff: We do not expect the economic weakening to have any serious impact on the housing market beyond an already expected tapering off of volumes. Save for any serious disasters, we are expecting it to be business as usual for the market next year.

19 Nov 2015

Seeff: The hike means that a homeowner with a 20-year housing loan of around R1 million will now see their monthly repayment increase from about R9 787 to R9 959.

19 Nov 2015

Seeff: This rate hike is unlikely to do much to improve the value of the rand and is likely to further stem the economy.

19 Nov 2015

Seeff chair Samuel Seeff: While not unexpected, we believe that today’s hike is poorly timed. In view of the poor economic performance, a hold on the rate would have been a vital boost for the festive season, an important period for the retail sector. The MPC could then have hiked the rate at their next meeting at the end of January.

19 Nov 2015

Neil Roets, CEO of Debt Rescue: Figures released by the National Credit Regulator and Statistics South Africa stated that the majority of indebted consumers already owed 75% of their monthly pay to creditors. More than half are three months or more behind in their debt repayments.

19 Nov 2015

Neil Roets, CEO of Debt Rescue: Deeply indebted consumers are incredibly vulnerable at the moment because of issues such as the weakening rand which is going to translate into increased prices for all imported goods.

19 Nov 2015

Neil Roets, CEO of Debt Rescue: The combination of the severe drought in prime food producing areas coupled to the increase in the interest rate and the rapidly weakening of the rand is going to have dire consequences for poor people.

19 Nov 2015

Dr Andrew Golding, CEO of Pam Golding Property Group: Our outlook for the remainder of 2015 and into 2016 is that the current supply and demand environment will continue to prevail, notwithstanding the weakness in the economy.

19 Nov 2015

Dr Andrew Golding, CEO of Pam Golding Property Group: With municipal tariffs such as rates, electricity and water receiving increasing attention, we anticipate as the new year unfolds the trend towards the containment of such costs and conservation of our precious natural resources will further stimulate the growing demand for convenient sectional title living and use of energy saving features. Although generally smaller in size, although not necessarily cheaper, sectional title offers low overheads and improved security. This is coupled with the growing trend towards urban living in proximity to the workplace.

19 Nov 2015

Dr Andrew Golding, CEO of Pam Golding Property Group: A stable repo rate would have sent a positive signal to South Africa’s housing market, which despite ongoing economic headwinds, continues to experience sustained demand which in many key nodes and metros exceeds the supply, resulting in ongoing stock shortages.

19 Nov 2015

Dr Andrew Golding, CE of the Pam Golding Property group: With inflation within the target range and a sluggish economy struggling to regain impetus while the country experiences the worst drought in decades, the Monetary Policy Committee’s decision to further increase the repo rate by another 25bps was ill-timed, as a stable rate would have helped boost business and consumer confidence at a time when it is needed most.

19 Nov 2015

In the second interest rate hike for the year, the South African Reserve Bank hiked the repo rate.

FULL STORY

19 Nov 2015

Ian Wason, CEO of DebtBusters: We are already seeing how the heavy reliance on credit is impacting consumers with clients requiring 106% of their net income to service their debt, at the time of applying for debt counselling.

19 Nov 2015

Ian Wason, CEO of DebtBusters: Following the announcement today by South African Reserve Bank (Sarb) governor Lesetja Kganyago that the repo rate will increase from 6% to 6.25% is bound to leave South Africans high and dry this festive season.

19 Nov 2015

Ian Wason, CEO of DebtBusters: "Jingle Bells” are sounding more like alarm bells as South Africans reach their ‘debt-end’.

19 Nov 2015

Kganyago: A 50 basis point increase was not discussed by the MPC.

19 Nov 2015

Goslett: It is important for consumers to bring down their debt levels and place themselves in the most optimum financial position they can before the next Monetary Committee meeting.

19 Nov 2015

Goslett: The Reserve Bank had to address the current economic conditions that the market is facing at the moment, however it will be a balancing act to try and counteract inflation pressure while not stunting growth. It is expected that there will definitely be further rate increases during the course of 2016. Prospective property buyers, along with those who currently own property should prepare for this by tighten the reigns on their spending habits and building a savings reserve. While those with high debt levels will be adversely impacted by a hiking cycle, those who have saving in place will benefit greatly.

19 Nov 2015

Kganyago: Of course any Fed decision will affect us. We will be reacting to the impact a Fed hike would have on the key factors in SA - one of which is the exchange rate.

19 Nov 2015

Goslett: Concerns that the weakness of the rand would impact on inflation had economists expecting that the Reserve Bank would raise the rates to counteract the effects. However, while a higher rate could mitigate the inflation pressure, an excessive rate would slow economic growth and place more pressure on prospective property buyers and homeowners.

19 Nov 2015

Goslett: With the US dollar strengthening over the rand in the last two weeks and the US Federal Reserve expected to raise its rates at their next meeting, economists had predicted that the South African Reserve Bank would follow suit and hike rates by at least 25 basis points.

19 Nov 2015

Adrian Goslett, CEO of RE/MAX of Southern Africa: The decision to raise the rates has been on the cards for some time, with current economic conditions leaving the Reserve Bank little choice.

19 Nov 2015

SA Reserve Bank governor Lesetja Kganyago has increased the repo rate by 25 basis points to 6.25%.

19 Nov 2015

Jacques Du Toit, Absa Senior Economist: Commercial banks will raise prime lending and variable mortgage interest rates by the same magnitude to 9.75% per annum. Today’s hike was announced against the background of expected inflationary pressures due to the lagged effect of the severe drought on food prices, a weakening rand exchange rate and the prospect of rising interest rates in the United States before year-end and during next year. Further hikes in lending rates are forecast for 2016, which will cause debt repayments to increase, contributing to additional financial strain on consumers. Banks will continue to monitor economic and consumer-related trends, possibly impacting their risk appetite and lending criteria.

19 Nov 2015

Kganyago: Any future moves will therefore be highly data dependent.

19 Nov 2015

Kganyago: We will remain sensitive to the fragile state of the economy.

19 Nov 2015

Kganyago: Continuing challenge is to achieve fine balance.

19 Nov 2015

Kganyago: Increase decided on 25 basis point increase.

19 Nov 2015

Kganyago: The deteriorating economic outlook complicated the MPC's decision.

19 Nov 2015

Kganyago: Delaying could require even stronger action in future.

19 Nov 2015

Kganyago: MPC had to decide whether to act now or later.

Publications

Publications

Partners

Partners