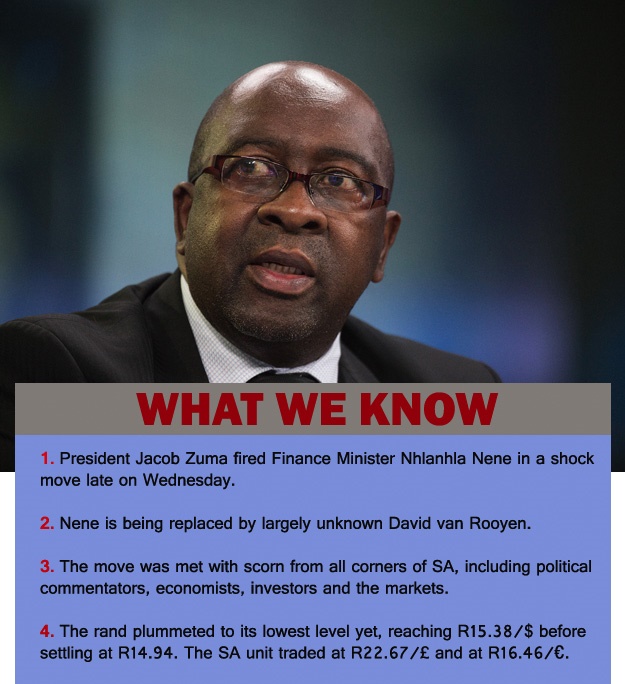

Cape Town - President Jacob Zuma's surprise announcement to replace Finance Minister Nhlanhla Nene with largely unknown David van Rooyen has sent shock waves throughout SA.

POLITICAL PARTIES SLAM MOVE

EFF: The appointment of new Finance Minister David van Rooyen is “a sign of a serious pathological crisis in the leadership and direction of the country”.

Publications

Publications

Partners

Partners