Cape Town - Finance Minister Pravin Gordhan is set to explain last-minute concessions in the tax law amendment, a week before his budget speech.

Do you have a question for Gordhan? Tell us now and we will ask him.

What we know so far:

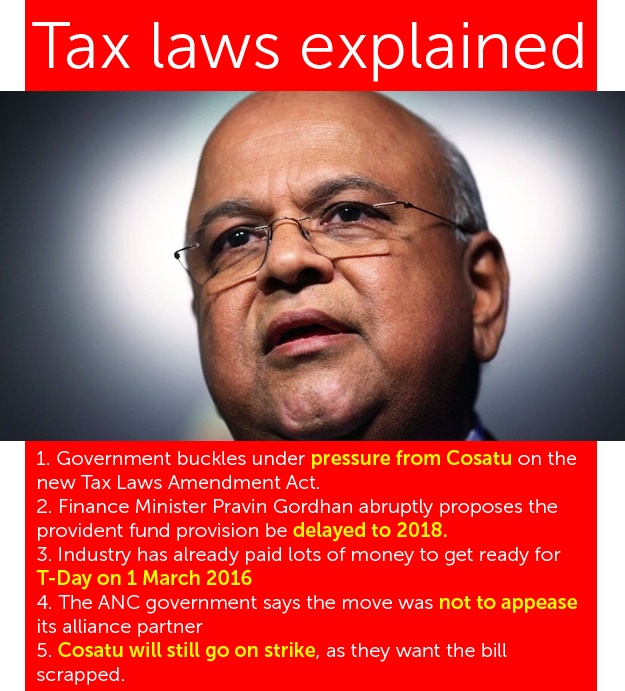

1. The Zuma government has again been forced to backpedal on a tax law amendment compelling two-thirds of provident fund savings to be put in a retirement annuity. READ

2. When President Jacob Zuma signed the Taxation Laws Amendment Act late last year he was unaware of Cosatu’s objections to provident fund proposals, says Jeff Radebe. READ

3. Finance Minister Pravin Gordhan has conceded that the last-minute proposal to amend the tax changes will be very costly for businesses and will need to be finalised quickly. READ

4. The government has denied that the decision to table a legislative amendment to the Taxation Laws Amendment Act was a move to appease the ANC's alliance partner, Cosatu. READ

5. A tax industry player has likened government's backtracking on the Tax Laws Amendment Act to starting a rocket and then getting someone out just before the launch. READ

6. At a time when South Africa needs policy certainty, the ANC has put its interests ahead of the country by postponing the tax law changes, says the DA. READ

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

The following amendments will continue as scheduled from 1 March 2016:

1. The tax deduction for contributions to all retirement funds (including provident funds) will increase to 27.5 per cent of the greater of taxable or remuneration, up to a cap of R350 000 per year, from 1 March 2016.

2. The minimum threshold required for annuitisation for pension and retirement annuity funds will still be increased from R75 000 to R247 500.

3. Aside from the issues covered in the urgent tax amendment bill, all other provisions legislated in the 2015 Tax Laws Amendment Act (and all other tax laws) will come into force on 1 March 2016.

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

Tax act delay will hit consumers long-term - expert

The problem with the latest delay in implementing the Tax Amendment Act is that it gives in to peoples' short-term use of provident fund savings to the detriment of long-term retirement needs, Ettiene Retief of the South African Institute of Professional Accountants (Saipa) cautioned on Thursday.

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

Treasury said the following changes will be introduced through an urgent tax amendment bill, to be tabled next week:

1. The bill will propose to Parliament to postpone the annuitisation requirement for provident funds for two years, until 1 March 2018.

2. Provident fund members will not be required to annuitise contributions to their funds that were made before 1 March 2018.

3. To ensure the integrity of

the retirement system, the ability to transfer tax-free from pension fund to

provident fund will also be delayed until 1 March 2018. Clarity on possible

misinterpretations will also be provided in the bill, to ensure that payroll

administrators apply the law in line with original intentions.

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

18 Feb 2016

Cabinet is to table an urgent legislative amendment to

postpone the implementation date of the Taxation Laws Amendment Act, reports Government's SA Government News Agency:

Briefing reporters on Thursday, following Cabinet’s fortnightly meeting, Minister in the Presidency for Performance, Monitoring and Evaluation Jeff Radebe said the amended act was supposed to come into effect on 1 March 2016.

“Cabinet has decided to table a legislative amendment to the Taxation Laws Amendment Act as a matter of urgency to postpone the commencement date from 1 March 2016 to 1 March 2018 to allow for further consultations with all key stakeholders,” said Minister Radebe.

18 Feb 2016

18 Feb 2016

What we know so far:

1. The Zuma government has again been forced to backpedal on a tax law amendment compelling two-thirds of provident fund savings to be put in a retirement annuity. READ

2. When President Jacob Zuma signed the Taxation Laws Amendment Act late last year he was unaware of Cosatu’s objections to provident fund proposals, says Jeff Radebe. READ

3. Finance Minister Pravin Gordhan has conceded that the last-minute proposal to amend the tax changes will be very costly for businesses and will need to be finalised quickly. READ

4. The government has denied that the decision to table a legislative amendment to the Taxation Laws Amendment Act was a move to appease the ANC's alliance partner, Cosatu. READ

5. A tax industry player has likened government's backtracking on the Tax Laws Amendment Act to starting a rocket and then getting someone out just before the launch. READ

6. At a time when South Africa needs policy certainty, the ANC has put its interests ahead of the country by postponing the tax law changes, says the DA. READ

Publications

Publications

Partners

Partners