Parliament plays a critical role ensuring that the laws drafted to regulate the economy - and govern public life in South Africa - are consistent with the supreme law of the land, our Constitution.

In 2018, in between tracking down agents of state capture, a prominent topic of discussion was once more the business of legislation.

Parliament handled several bills in 2018 which will undoubtedly have a significant impact on the economy in 2019. Some were passed by Parliament and made it to the Union Buildings, while others are still in the corridors of the legislature.

Here are some that industries will be keeping a close eye on in 2019.

National Minimum Wage Bill

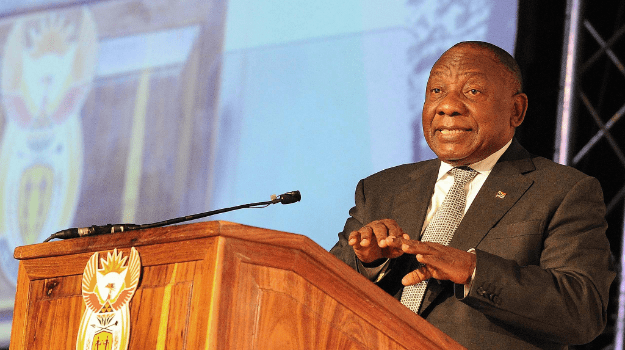

President Cyril Ramaphosa

President Cyril Ramaphosa signed the bill into law in November, after procedural delays made the bill’s enactment miss the symbolic deadline of May 1, Workers Day.

The wage is R20 per hour or R3 500 monthly, depending on the number of hours worked.

While the principle of a National Minimum Wage has been roundly welcomed, employer formations have expressed concern that price thousands of jobs out of existence, and labour organisations have slammed the wage figure as insufficient.

Ramaphosa has also assented to the Basic Conditions of Employment Amendment Bill and Labour Relations Amendment Bill, which were negotiated by the National Economic Development and Labour Council at the same time as the National Minimum Wage.

Competition Amendment Bill

Minister Ebrahim Patel

The National Assembly elected to pass the Competition Amendment Bill and refer it to the National Council of Provinces for concurrence in October.

The bill seeks to close loopholes in the current Competition Act and define contraventions and uncompetitive conduct by companies more explicitly.

Minister of Economic Development Ebrahim Patel has said practices the bill sought to deter included large companies servicing their subsidiaries at a lower cost than they do to the subsidiary’s competition.

The amendment bill also introduces means by which first-time offenders contravening competition laws can be punished.

Public Audit Amendment Bill

Auditor-General Kimi Makwetu

At the beginning of the year, Standing Committee on the Auditor General chairperson Vincent Smith reminded South Africans that despite a litany of transgressions by accounting officers, no one has been charged, tried or convicted with contravening the Public Audit Act.

Some argue that this is because the office of the Auditor General has limited powers to ensure consequences for failure to adhere to financial management standards as well as irregular expenditure.

The bill has made its way to the Union Buildings from Parliament, and the Presidency says it is receiving Ramaphosa’s attention.

South African Reserve Bank Amendment Bill

Reserve Bank Governor Lesetja Kganyago

This year the Economic Freedom Fighters set their sights on the South African Reserve Bank for reforms.

The party tabled the South African Reserve Bank Amendment Bill in August. The bill aims to nationalise the Reserve Bank.

It proposes that ownership of the Reserve Bank be transferred to the State and that the finance minister be given the power to appoint members of the board of directors, as opposed to shareholders.

While the ANC and government insist that the Reserve Bank’s independence is enshrined in the Constitution, Reserve Bank Governor Lesetja Kganyago has asked that the independence of the institution be jealously guarded.

Tax Administration Laws Amendment Bill

SARS Acting Commissioner Mark Kingon

National Treasury and the South African Revenue Service (SARS) published Taxation Laws Amendment Bill and the Tax Administration Laws Amendment Bill in February. They took in public comment on the bills from June.

The two draft laws seek to introduce tax reforms which allow for the introduction of tax exemptions, incentives and benefits for low income South Africans emerging into the tax paying class as well as for businesses trading beyond SA.

Among other things, the Tax Laws Amendment Bill proposes flexibility for retirement fund transfers and withdrawals, fringe benefit exemptions for lower-income employees receiving loans from their employers for low-cost housing, and clarification for the conversion of debt to equity.

Mineral and Petroleum Resources Development Amendment Bill

Minister Gwede Mantashe

Mineral Resources Minister Gwede Mantashe withdrew the Mineral and Petroleum Resources Development Amendment Bill in August.

The amended bill was first passed in 2014 and sent to then-president Jacob Zuma for ratification.

Zuma sent it back to Parliament, citing concerns about the lack of consultation with communities and the possibility that the beneficiation provisions in the bill were in contravention of international trade agreements.

Carbon Tax Bill

Finance Minister Tito Mboweni

Finance Minister Tito Mboweni introduced the Carbon Tax Bill to Parliament for consideration in November.

The bill is part of SA's commitment to the Paris Agreement on climate change.

Mboweni described it as a "benefit" for all of South Africa, and part of the country's contribution to the world, given the threat climate change poses to humanity.

It has been coming along for more than a decade and has gone through multiple consultative processes before reaching Parliament.

Publications

Publications

Partners

Partners