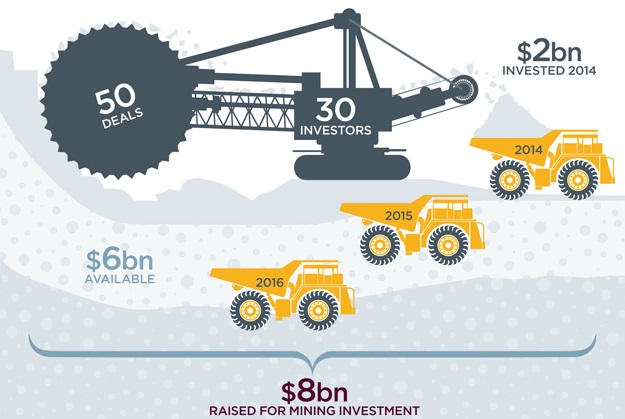

Cape Town - Over $2bn (R23.18bn) of private equity funds was injected into mining projects during 2014, according to a report released this week.

The research report by International law firm Berwin Leighton Paisner (BLP) was published to coincide with the start of Investing in African Mining Indaba 2015 in Cape Town, which started on Tuesday.

It goes on to show that there were 50 private equity investments in mining companies in 2014, executed by 30 different private equity funds.

Following previous calculations in February 2014, which showed that $8bn (R92.71bn) had been raised by private equity funds for mining projects, BLP’s report highlights that there is still significant scope for further investment in a market that is starting to build momentum.

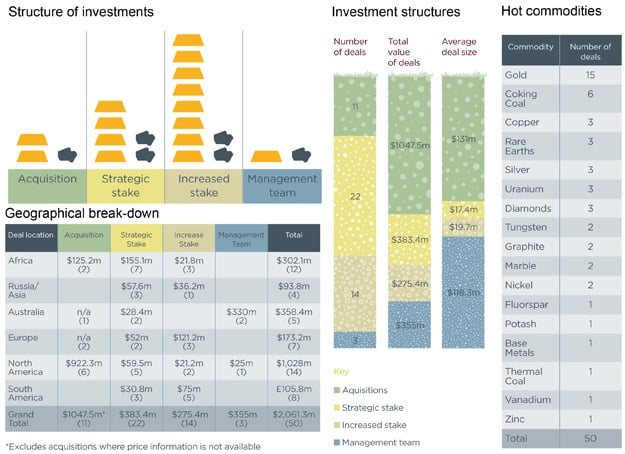

BLP’s report also illustrates that half of the money invested was in 11 acquisitions with an average transaction size of over $110m (R1.3bn). The acquisition of strategic stakes was the next most significant with over $380m (R44bn) invested across 22 deals. The average size of the strategic stake taken was 21%.

Other key findings within the report include:

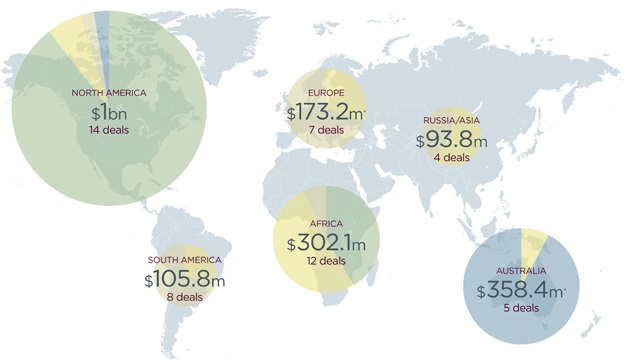

- North America has seen the greatest value of deals – with over $1bn (R11.6bn) invested in 14 deals

- Nearly a quarter of the investments made were made into African mining projects – however, these only accounted for 15% of capital deployed with $302m (R3.5bn) invested

- Gold is the most popular commodity for funds with 15 investments, followed by coking coal with 6 investments

Alexander Keepin, Partner and co-head of mining at BLP, said: “While private equity fund was heralded of as a potential saviour of the mining industry, in part due to continuing falls in commodity prices, 2014 was another difficult year for the mining industry.

"However, with $8bn (R92.71bn) having been reported as being raised for private equity investment in the mining industry and over $2bn (R23.18bn) invested in 2014, momentum is building and we can expect further, more significant private equity investment in the next 1.2 months."

Geographical breakdown:

Private equity investment:

Publications

Publications

Partners

Partners