AS A bookend to this year’s mining indaba my intention was to write a tech review.

My assumption was that in the face of the rising input cost onslaught, mechanised mining is the only viable path forward in South Africa’s mining sector.

This being the reality, technology companies should be jostling to capture market share in this burgeoning segment.

Alas, after walking the aisles of the exhibition hall and investigating hundreds of potential notables for my tech review, my line-up was barren - well almost, but more about that later.

Innovation theorists use the term “building a better mousetrap” as a metaphor for incremental improvements in product technologies. It’s usually a pejorative term, but as expected innovation junkies aren’t usually the lean six sigma types.

The expression actually misquotes Ralph Waldo Emerson, who didn’t say: “Build a better mousetrap and the world will beat a path to your door.”

Misquote or not, this philosophy of incremental improvements as an innovation strategy was the order of the day.

Being a fervent free market advocate, I decided to conduct a sanity check - after all, if the market wasn’t responding to surging demand, maybe I was misreading the market?

Perhaps my critique of mine technology companies is a little unfair - after all, getting rocks out of the ground isn’t exactly rocket science, it is in fact just plain rock science.

As it happens, mines have long planning horizons which are based on the costs of proven technologies at the time of project initiation and provide little urgency regarding innovation. The projects which are not profitable using current technologies won’t see the light of day anyway.

That is all good and well for new ventures, but there are thousands of existing projects under way at various stages in their life of mine which do benefit from product innovation. Surely these projects command market attention on breakthrough technologies?

To clarify my point, inventing a rock drill for mining is true innovation relative to its predecessor the pick and shovel, but inventing a drill that is 5% more efficient is building a better mousetrap: an incremental improvement leading to incremental performance enhancements.

In order for a technology to be truly disruptive in an industry, it requires a step change in performance akin to moving from horse to railways or fixed line telephony to the cellular variety.

These disruptive technologies cause tectonic shifts in an industry; successful adopters of the technology reap the rewards while let's just say the laggards experience a Kodak moment.

Disruptive technologies arise for various reasons, which are not the subject of this article.

Suffice it to say that there are cases where they enhance productivity - such as the invention of the personal computer - and there are cases where they save or destroy an industry. My favourite example of this is the buggy whip industry, which was destroyed by the advent of the motor car.

So the question now remains: is South African mining the buggy whip industry circa 2013?

It is always difficult to predict where a technology is going and how it will impact on stakeholders. In an effort to isolate specific technologies, let us investigate the economics of the mining industry without benefit of a crystal ball.

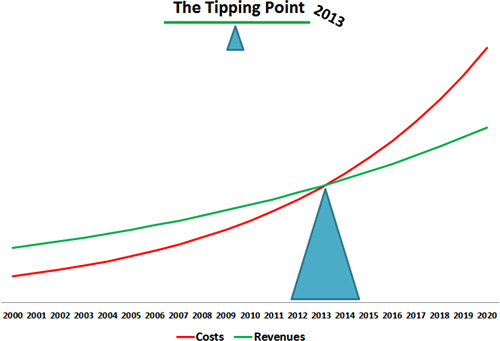

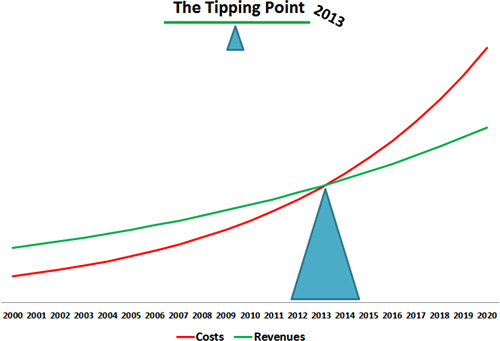

As illustrated in the tipping point figure below, we see the two factors, cost and revenue: you will notice that cost, the red line, is escalating at a much higher rate than revenue, the green line.

In a nutshell, this is the problem.

In a situation like this, there are essentially two options: insolvency or external intervention.

Insolvency requires little explanation, as do the associated job losses and economic consequences.

Famed economist Joseph Schumpeter coined the phrase “creative destruction”, describing this Darwinian survival of the fittest mechanism, where failed firms’ decomposition fertilises the economic soil for green shoots to emerge and reintroduce vigour into the capatalist ecosystem.

Creative destruction naturally requires sufficient vitality within the economy to function. There are entire schools of economic thought which would however prescribe the other option, external intervention.

On the firm level this would entail cross subsidies from the parent company, a perfectly palatable solution employed by diversified companies around the globe.

However, on a macroeconomic level these Afro-Keynesians would advocate old-fashioned state support - using taxpayers’ cash to prop up loss-making industries.

Neither solution is particularly attractive.

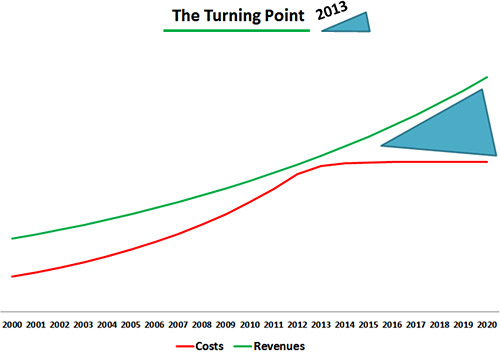

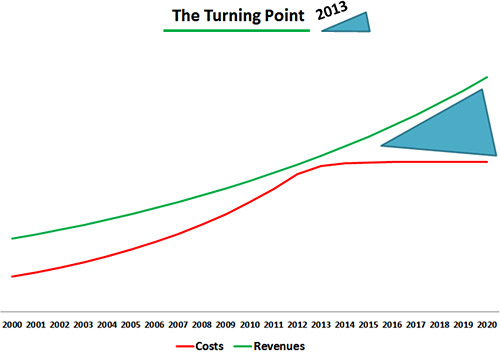

There is however a third option. This targets high input costs and fundamentally changes the cost curve, as illustrated in the turning point figure below: technology is introduced which alters the cost escalation problem, resulting in a viable industry.

Pretty illustrations notwithstanding, achieving this sort of turnaround on an industry level is a Herculean task. The difficulty is compounded with various stakeholders operating under a variety of often conflicting incentives.

The alternative of allowing loss-making companies to collapse or to be supported by state largesse is simply untenable, so a technological imperative now exists.

Mine robot?

With these thoughts in mind, I was delighted to stumble upon a robot (pictured top right). This little fellow is built by the Council for Scientific and Industrial Research (CSIR) and is designed to fulfil an array of inspection functions in underground mines primarily aimed at improved safety.

As with all technologies of this nature, the final uses for it will be far more diverse than its designers can currently fathom.

The project is a multi-disciplinary collaboration between three different departments at the CSIR and serves as a triumph for South Africa - solving its own problems through its best and brightest.

Or maybe not?

I’m hopeful that the chaps from the CSIR secured enough interest in their invention that they now have a firm roadmap for how this technology will be funded, manufactured, operated and integrated into all relevant shafts across the country.

However, in the absence of this happy ever after narrative, I’m concerned that SA just doesn’t have what it takes to accomplish this. This isn’t based on pessimism but rather on facts on the ground.

Mine technology watchers will be aware that in January this year, Anglo American [JSE:AGL] and Carnegie Mellon University (CMU) signed a five-year master agreement to develop robotic technologies for mining.

This agreement is great news. CMU is arguably the world’s best in the field of robotics and I have full faith that they will develop great products that will in time provide the disruptive innovative technologies required for South Africa to loosen the noose of input costs.

So why the cause for concern?

As it happens, several researchers from the CSIR who built the above-mentioned robot have moved to CMU in order to build it again.

Their expertise will no doubt be invaluable to the project, but part of me still can’t come to terms with the fact that local brains have to leave the country to develop solutions which will be redeployed back home.

On the plus side, at least the technology will emerge and it will hopefully form part of the solution to the technology imperative we face.

*Jarred Myers is a resources strategist and can be followed on Twitter on @JarredMyers. Opinions expressed are his own.

My assumption was that in the face of the rising input cost onslaught, mechanised mining is the only viable path forward in South Africa’s mining sector.

This being the reality, technology companies should be jostling to capture market share in this burgeoning segment.

Alas, after walking the aisles of the exhibition hall and investigating hundreds of potential notables for my tech review, my line-up was barren - well almost, but more about that later.

Innovation theorists use the term “building a better mousetrap” as a metaphor for incremental improvements in product technologies. It’s usually a pejorative term, but as expected innovation junkies aren’t usually the lean six sigma types.

The expression actually misquotes Ralph Waldo Emerson, who didn’t say: “Build a better mousetrap and the world will beat a path to your door.”

Misquote or not, this philosophy of incremental improvements as an innovation strategy was the order of the day.

Being a fervent free market advocate, I decided to conduct a sanity check - after all, if the market wasn’t responding to surging demand, maybe I was misreading the market?

Perhaps my critique of mine technology companies is a little unfair - after all, getting rocks out of the ground isn’t exactly rocket science, it is in fact just plain rock science.

As it happens, mines have long planning horizons which are based on the costs of proven technologies at the time of project initiation and provide little urgency regarding innovation. The projects which are not profitable using current technologies won’t see the light of day anyway.

That is all good and well for new ventures, but there are thousands of existing projects under way at various stages in their life of mine which do benefit from product innovation. Surely these projects command market attention on breakthrough technologies?

To clarify my point, inventing a rock drill for mining is true innovation relative to its predecessor the pick and shovel, but inventing a drill that is 5% more efficient is building a better mousetrap: an incremental improvement leading to incremental performance enhancements.

In order for a technology to be truly disruptive in an industry, it requires a step change in performance akin to moving from horse to railways or fixed line telephony to the cellular variety.

These disruptive technologies cause tectonic shifts in an industry; successful adopters of the technology reap the rewards while let's just say the laggards experience a Kodak moment.

Disruptive technologies arise for various reasons, which are not the subject of this article.

Suffice it to say that there are cases where they enhance productivity - such as the invention of the personal computer - and there are cases where they save or destroy an industry. My favourite example of this is the buggy whip industry, which was destroyed by the advent of the motor car.

So the question now remains: is South African mining the buggy whip industry circa 2013?

It is always difficult to predict where a technology is going and how it will impact on stakeholders. In an effort to isolate specific technologies, let us investigate the economics of the mining industry without benefit of a crystal ball.

As illustrated in the tipping point figure below, we see the two factors, cost and revenue: you will notice that cost, the red line, is escalating at a much higher rate than revenue, the green line.

In a nutshell, this is the problem.

In a situation like this, there are essentially two options: insolvency or external intervention.

Insolvency requires little explanation, as do the associated job losses and economic consequences.

Famed economist Joseph Schumpeter coined the phrase “creative destruction”, describing this Darwinian survival of the fittest mechanism, where failed firms’ decomposition fertilises the economic soil for green shoots to emerge and reintroduce vigour into the capatalist ecosystem.

Creative destruction naturally requires sufficient vitality within the economy to function. There are entire schools of economic thought which would however prescribe the other option, external intervention.

On the firm level this would entail cross subsidies from the parent company, a perfectly palatable solution employed by diversified companies around the globe.

However, on a macroeconomic level these Afro-Keynesians would advocate old-fashioned state support - using taxpayers’ cash to prop up loss-making industries.

Neither solution is particularly attractive.

There is however a third option. This targets high input costs and fundamentally changes the cost curve, as illustrated in the turning point figure below: technology is introduced which alters the cost escalation problem, resulting in a viable industry.

Pretty illustrations notwithstanding, achieving this sort of turnaround on an industry level is a Herculean task. The difficulty is compounded with various stakeholders operating under a variety of often conflicting incentives.

The alternative of allowing loss-making companies to collapse or to be supported by state largesse is simply untenable, so a technological imperative now exists.

Mine robot?

With these thoughts in mind, I was delighted to stumble upon a robot (pictured top right). This little fellow is built by the Council for Scientific and Industrial Research (CSIR) and is designed to fulfil an array of inspection functions in underground mines primarily aimed at improved safety.

As with all technologies of this nature, the final uses for it will be far more diverse than its designers can currently fathom.

The project is a multi-disciplinary collaboration between three different departments at the CSIR and serves as a triumph for South Africa - solving its own problems through its best and brightest.

Or maybe not?

I’m hopeful that the chaps from the CSIR secured enough interest in their invention that they now have a firm roadmap for how this technology will be funded, manufactured, operated and integrated into all relevant shafts across the country.

However, in the absence of this happy ever after narrative, I’m concerned that SA just doesn’t have what it takes to accomplish this. This isn’t based on pessimism but rather on facts on the ground.

Mine technology watchers will be aware that in January this year, Anglo American [JSE:AGL] and Carnegie Mellon University (CMU) signed a five-year master agreement to develop robotic technologies for mining.

This agreement is great news. CMU is arguably the world’s best in the field of robotics and I have full faith that they will develop great products that will in time provide the disruptive innovative technologies required for South Africa to loosen the noose of input costs.

So why the cause for concern?

As it happens, several researchers from the CSIR who built the above-mentioned robot have moved to CMU in order to build it again.

Their expertise will no doubt be invaluable to the project, but part of me still can’t come to terms with the fact that local brains have to leave the country to develop solutions which will be redeployed back home.

On the plus side, at least the technology will emerge and it will hopefully form part of the solution to the technology imperative we face.

*Jarred Myers is a resources strategist and can be followed on Twitter on @JarredMyers. Opinions expressed are his own.

Publications

Publications

Partners

Partners