23 Jul 2015

From Fin24's Carin Smith and Matthew le Cordeur... thank you for joining us as we gave on-the-second updates from Sarb governor Lesetja Kganyago's repo rate announcement as well as in-depth analysis from a range of sector experts and commentary from the general public.

23 Jul 2015

David Crosoer, executive: research and investments at PPS Investments: Investors, however, should remain cautious as SA’s fundamentals continue to look poor, and the market might be too optimistic in dismissing the likelihood that the US Fed might still raise rates quickly as the economy improves.

23 Jul 2015

David Crosoer, executive: research and investments at PPS Investments: For now, at least, the Sarb has probably bought some breathing space given June’s CPI number, at 4.7%, was lower than most analysts expected and the US Fed might still not raise rates in September.

23 Jul 2015

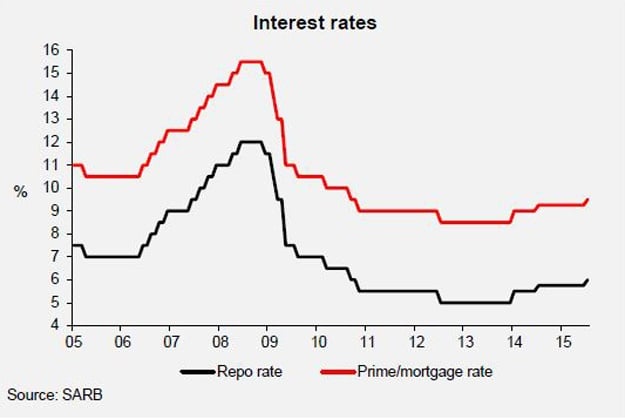

David Crosoer, executive: research and investments at PPS Investments: We anticipate that the South African Reserve Bank will continue to increase interest rates as US short-term rates normalise and SA CPI inflation threatens the 6% level.

23 Jul 2015

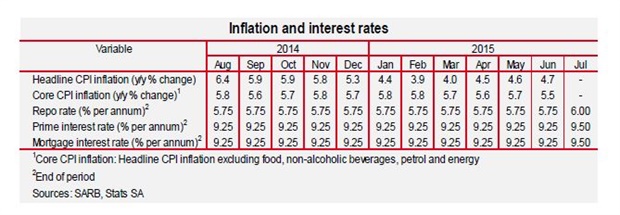

David Crosoer, executive: research and investments at PPS Investments: Despite being one of the few central banks to raise rates recently, the South African repo rate remains abnormally low and the increases so far are very measured when compared to previous cycles.

23 Jul 2015

Seeff chair Samuel Seeff: Bear in mind too, that property has been one of the few economic sectors that has shown good growth over the last two years. When more people are buying houses, more transfer duty is generated for government coffers. On top of that, there is a significant economic value chain that benefits and this is exactly what we are now losing out on.

23 Jul 2015

Seeff chair Samuel Seeff: This is a trend that we are seeing in many areas right now, especially in the R2.25 million-plus end of the market where, with the 20%-40% transfer duty hike, sellers are finding the high transaction costs as just too punitive. This, despite the wide scale stock shortages and good selling conditions, says Seeff.

23 Jul 2015

Seeff chair Samuel Seeff: Aside from the effect on existing home owners, the interest rate hike will have an inevitable slowing effect on the demand for property and sales volumes. While it will be an affordability issue for buyers, sellers are now seeing staying put and remodelling or renovating as a better alternative.

23 Jul 2015

Jacques du Toit, property analyst at Absa: Further rate hikes are expected towards year-end and in 2016 on the back of mounting inflationary pressures.

23 Jul 2015

Jacques du Toit, property analyst at Absa: Interest rate movements are expected to remain largely data dependent over the next 12 to 18 months, impacted by developments on the macroeconomic front, inflation expectations and trends in the factors driving inflation.

23 Jul 2015

Jacques du Toit, property analyst at Absa: The latest interest rate hike came against the background of trends in and expectations regarding domestic inflation and some of its major impacting factors, such as the exchange rate, food inflation, fuel prices, electricity costs, as well as the prospect of rising interest rates in the United States later this year.

23 Jul 2015

Absa consequently announced that its prime lending and variable mortgage interest rates will rise from 9.25% to 9.5%, effective from 24 July 2015. Lending rates have been hiked by a cumulative 100 basis points since the start of 2014.

23 Jul 2015

Jacques du Toit, property analyst at Absa: The interest rate hike came against the background of trends in and expectations regarding domestic inflation and some of its major impacting factors, such as the exchange rate, food inflation, fuel prices, electricity costs, as well as the prospect of rising interest rates in the United States later this year. Further rate hikes are expected towards year-end and in 2016 to curb inflationary pressures, which will add to financial strain experienced by consumers.

23 Jul 2015

Angelique Ruzicka of Justmoney: You don’t have to buy the most expensive brand when you do your groceries.

23 Jul 2015

Angelique Ruzicka of Justmoney: Go through your budget and all your expenses and see where you can cut back.

23 Jul 2015

Angelique Ruzicka of Justmoney: It’s possible to cushion yourself from this this rate hike blow and other increases through adjusting your spending behaviour or boosting your income in other ways.

23 Jul 2015

Ian Wason CEO of DebtBusters: I would urge consumers that are already struggling with debt not to borrow any more money now and to concentrate efforts on paying loans that are currently outstanding.

23 Jul 2015

Fin24 user Val Tutty: "For the poor and widows not good."

23 Jul 2015

Ian Wason CEO of DebtBusters: There are a number of positive developments that could relieve borrowers in the future, such as the proposed new interest rates and inflation fees for credit agreements and the proposed cap on credit life insurance premiums.

23 Jul 2015

Ian Wason CEO of DebtBusters: Consumers already struggling with debt need to prepare themselves and find ways of cutting back on expenses so that they are not forced into opening other lines of credit to pay back loans that they already have.

23 Jul 2015

Dr Andrew Golding: Recent market commentary in general provides a less optimistic economic outlook – with consumer confidence at a low level, manufacturing and mining production down, concerns around job security, and load-shedding coupled with Eskom’s proposals to further increase electricity tariffs weighing further on South Africa’s weak economy.

23 Jul 2015

Dr Andrew Golding: Apart from the fact that the winter months tend to be somewhat quieter transactional periods, the pressure of rising costs leading to reduced affordability as well as dampened economic sentiment are factors impacting on concluded sales. While the appetite for property acquisitions remains strong, some consumers are displaying an understandable tendency towards moderation rather than over-committing financially.

23 Jul 2015

Dr Andrew Golding of Pam Golding Properties: It is hoped that the interest rate will now remain steady for the rest of 2015, providing stability and incentive for aspirant home buyers who realise the investment potential of property.

23 Jul 2015

Dr Andrew Golding of Pam Golding Properties: Positively, we are also noticing a trend towards expatriates returning to our shores and acquiring homes for permanent relocation back home or for use during extended periods of the year.

23 Jul 2015

According to the latest FNB Property Barometer, household debt-to-disposable income levels are now at around 78.4%, down from 83% in early 2009 while credit growth remains muted, at just above the 3% growth mark year-on-year.

23 Jul 2015

Samuel Seeff, chair of Seeff Properties: A home owner with a housing bond of R995 000 and a current monthly repayment of R9 113 will see his/her repayment increase to R9 275 and will thus need to find an extra R162 out of an already embattled household budget. For some, this is the equivalent of a week’s transport costs.

23 Jul 2015

Samuel Seeff: While it is widely accepted that we are in an interest rate hiking cycle, we do not believe that now is the right time for a rate hike. Holding this off until later in the year would have been preferred in view of the mounting challenges that consumers and home owners face.

23 Jul 2015

Palmer says that banks are favouring bigger property transactions over smaller ones and that as a result, high net worth individuals wanting to transact smaller property deals are turning to non-bank lenders for finance, as they are not bound by the same stringent regulations as banks, and are able to assist with loan and origination transactions.

23 Jul 2015

Gary Palmer, CEO of Paragon Lending Solutions, says that banks are now more than ever before likely to continue to implement stricter lending regulations. “An interest rate hike has been on the cards for a long time, especially with inflation increasing fueled by petrol and food price hikes and the devaluing of the rand, which may reduce business confidence further. As such, all indications are that consumers will battle with the price hikes and consequently default on loan payments and lead to banks tightening their lending restrictions once again.”

23 Jul 2015

Dr Andrew Golding: Despite these factors, Pam Golding Properties continues to see healthy capital growth in residential property values in major metropolitan areas and high-demand nodes around the country, with stock shortages prevalent and also limiting sales. Cash is proving king in sought after areas where high-demand properties are attracting multiple offers.

23 Jul 2015

Ian Wason CEO of Debt Busters: A repo rate hike on its own wouldn’t have been impactful, but consumers are being squeezed by other prices going up too, such as food, electricity and petrol. To make ends meet many South Africans borrow money through personal loans, microloans, payday loans and credit cards to tide them over and with the latest hike in the repo rate credit is bound to get more expensive.

23 Jul 2015

Debt Busters: Tough times ahead for borrowers as SARB hikes repo rate.

23 Jul 2015

Fin24 user Avinash Bhervia says: "Good news to reward 'savers' since July being national savings month with additional interest can be earned on their investments, extra pressure if you have debt to service."

23 Jul 2015

Cruickshanks: And remember mining is more than 50% of SA's exports.

23 Jul 2015

Nxedlana: Mining is less than 10% of GDP and manufacturing less than 15%, but a lot of SA manufacturing is actually part of the mining supply chain.

23 Jul 2015

Cruickshanks: Look at the state of the commodity markets. The mining sector is getting devastated.

23 Jul 2015

Nxedlana: Monetary tightening reduces domestic expenditure so that we stop living beyond our means.

23 Jul 2015

Nxedlana: All of a sudden China slowed and we did not get the inflow we had anymore. So now monetary policy must tighten.

23 Jul 2015

Nxedlana: We had a commodity boom and had a lot of income and we spent it and started to live beyond our means.

23 Jul 2015

Cruickshanks: It is an SA malaise - labour gets rewarded way above inflation and there seems to be no agreement that wage increases should be in line with inflation. And yet productivity does not improve.

23 Jul 2015

Nxedlana: Sarb has to lean against inflation spiral and only way it could is by the increase.

Publications

Publications

Partners

Partners