29 Aug 2018

ICYMI: We're not friends - Steinhoff ex-CFO blames Jooste, auditors for accounting scandal

Steinhoff International Holdings' ex-Chief Financial Officer Ben La Grange blamed departed leader Markus Jooste and auditors including Deloitte for the retailer’s accounting scandal, saying he became aware of any wrongdoing only days before the crisis erupted.

29 Aug 2018

No substance to 3 cases under investigation by Hawks

Major-General Alfred Khana, head of specialised commercial crimes at the Hawks, told Parliament that there are three cases of investigation into Steinhoff, but none of them can reveal what happened at the retailer.

“There are three cases, but with no substance to it.” A statement of complaint to the Hawks relies heavily on media reports, he said.

The Hawks are still waiting for a statement from Steinhoff’s audit committee chair Steve Booysen. The statement would set the tone for the investigations. But the delay has been a constraint to the investigation and before they can proceed they need the statement.

Further, the Hawks cannot approach former CEO Markus Jooste for questioning without that statement under oath.

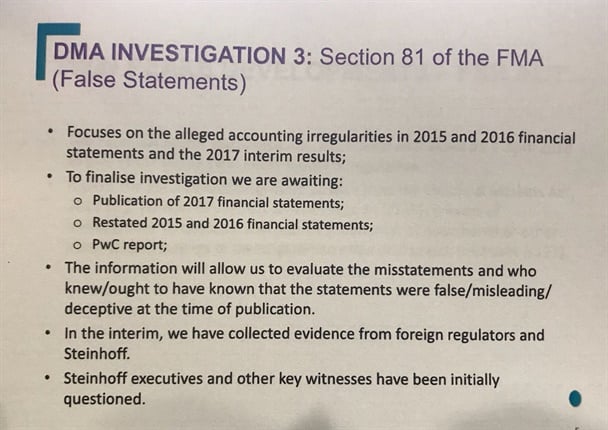

The primary focus of the Hawks investigation is on matters dealt with in the PwC report – which is still outstanding and will only be finalised in December 2018, he explained.

Khana stressed the importance of having access to the PwC report, for its own investigation. There would be a better understanding of what happened at Steinhoff, once the report is released, he said.

"The interim report from PwC should shed light of what happened and will inform the statement of Booysen as to what really happened."

He added that the mandate of the PwC investigation must be given – as that would indicate what to expect in the report.

He also updated on matters with Interpol. The investigations in Germany and in the Netherlands are of great importance, to give context of what was happening, said Khana.

The Hawks have also made progress with authorities in Germany and will be of assistance for an application to Interpol.

29 Aug 2018

Although la Grange said that he was questioned by the Financial Sector Conduct Authority, the regulator said it cannot reveal who has been interviewed as the Steinhoff matter is still an ongoing investigation.

However the FSCA confirmed that four executives have been questioned.

29 Aug 2018

Before leaving the hearing, Ben la Grange confirms that no shares were accrued to him since December 2017. He received a salary from Steinhoff, regarding his fixed-term contract which was in place after he stepped down as CFO in January.

La Grange however did not respond to a question posed by DA MP David Maynier regarding whether he acted negligibly and would take responsibility for what happened at Steinhoff. La Grange's lawyer John Dickerson, SC said that there are legal proceedings pending in SA and elsewhere and that the question iinvolves a legal conclusion.

Scof chair Yunus Carrim then excused la Grange and Dickerson for the remainder of the day's hearing. Additional questions from MPs that may arise following the regulators' presentation will be sent to la Grange in writing.

29 Aug 2018

29 Aug 2018

Steinhoff convinced it can secure 'some form' of return to shareholders

Chair of Steinhoff supervisory board Heather Sonn says the group is convinced it can secure 'some form' of return to shareholders, but for now it is prioritising saving the company and trying to grow it again.

“We are convinced that we can achieve some form of return for shareholders,” she said. Some shareholders have joined a litigation process to make recoveries and Sonn acknowledged that they have a right to do that.

Steinhoff is considering what form the restitution will be, what the size is and possible costs to stakeholders – for example if employees may have to take pay cuts. “The first priority is to attempt to save it (the company) and attempt to grow it,” Sonn reiterated.

Sonn also said it is difficult to make assurances regarding pension funds. “There are so many circumstances beyond our control.” But Sonn said that Steinhoff has committed not to “jump ship” and to see the process through.

Having stabilised the situation, Sonn said that they are

determining how they will use what they have to service existing debt and then

consider growth. This strategic decision is better than a decision to do a wind

down, and sell all assets, Sonn said.

29 Aug 2018

Steinhoff relationship with the PIC 'a good one'

Former Steinhoff CFO ben la Grange said that the relationship with the Public Investment Corporation (PIC) is a good one.

The PIC is the second-largest shareholder of Steinhoff. Together the PIC and Steinhoff through a partnership established in 2016 support a supplier development programme to promote black suppliers in the retail environment.

“Our relationship with the PIC is a good one,” la Grange said.

Following the fallout of the share price, Steinhoff held meetings with the PIC informing them of what had happened, he said.

29 Aug 2018

Overstating of Steinhoff profit happened over years

Former Steinhoff CFO Ben la Grange said that the practice of stating false profits dates way back.

"This practice commenced a number of years back," he explained. No person, auditor or analyst could pick up any substantial growth simply by looking at the numbers as the increases are incremental over years.

"It started so long ago, each year it increased a little bit. It's not just a huge jump in profits," la Grange said.

La Grange, who got the consolidated information would compare reports to the previous year- which is why he could not see a jump in profits of say 10%

"In my view the practice started a long time ago," he reiterated.

29 Aug 2018

Ben la Grange was shocked by Deloitte report on fraud at Steinhoff

Former Steinhoff CFO Ben la Grange says he became aware of the fraud at Steinhoff on the weekend of December 2, 2017.

La Grange said he was called into a meeting with the audit committee and he was given the Deloitte report. “I was shocked at what is in the report,” he said. He said that he was surprised by Deloitte's findings that profits were inflated.

La Grange said he wanted to wait for CEO Markus Jooste to comment on the bulk of items on the report – Jooste was on a plane back to SA. When Jooste did not show up to an audit committee meeting, he said he knew something was wrong.

La Grange also said that he and Jooste are strictly business colleagues. They are not friends and they have not socialised outside the business environment.

“I believe there was limited sharing of information from Mr Jooste to myself,” la Grange said. According to la Grange certain relationships between Jooste and third parties were not disclosed to him or the company.

If he had known that transactions were influenced by Jooste he would have accounted for the transactions differently.

29 Aug 2018

Losses to pension funds permanent - Parliament hears

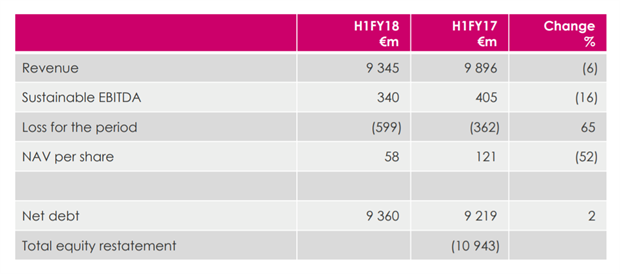

Former Steinhoff CFO Ben La Grange says losses to pension funds following the fallout of the share price.

He is also doubtful that the share price will ever climb back to levels it once was before December 2017.

“Pension funds have lost money up to the share price today,” la Grange said. He also spoke on the group’s financial situation and said that the group may have to restructure its debt once more because the debt needs to be repaid.

“The debt is still there,” he said. “The losses to pension funds are permanent losses, they’re not temporary.”

La Grange also provided more details leading up to his suspension as MPs wanted to understand why he was not given notice of his suspension in writing.

La Grange explained that at the beginning of the year he decided to step down in the interests of the group to maintain credibility among lenders. He stayed on in an advisory capacity to provide assistance to the management team and entered into a fixed term employment agreement.

The group had to ensure liquidity, it was also restructuring its automotive group and the PwC investigation was in progress. He also could provide the corporate memory for the litigations Steinhoff was facing.

La Grange said he had given three months notice as he felt he has assisted the group enough. He would have exited the company in September.

Steinhoff suspended him in early August and the group would have to explain why it was not put in writing.

29 Aug 2018

Steinhoff’s share price had risen by just over 8% by the early afternoon on Wednesday, as current and former executives continue to give evidence before the committee.

The shares, which opened the day at R2.22 a share, were changing hands at R2.39 at 12:42.

29 Aug 2018

La Grange reveals reason for suspension

Former Steinhoff CFO Ben la Grange explained that Steinhoff’s undoing happened in three ways.

“First of all, there were inflated profits,” la Grange told Parliament. The main source of the inflated profits was from contributions from an external buying group.

The external buying group would take volumes of products purchased by different brands and negotiate with suppliers to give additional rebates (contributions) to the group, which was reflected as profits on the income statement.

“But the buying group seems to be non-existent and funded with loans from Steinhoff.”

Essentially, Steinhoff paid loans to the buying group, the buying group paid profits to Steinhoff, which is why a profit was reflected in the income statement and a loan was reflected in the balance sheet, he explained.

It has taken PwC eight months to determine this, he added.

Secondly Steinhoff’s transactions regarding its assets which

were acquired at inflated values.

Lastly – there were a number of transactions, which were

thought to be valid transactions with valid parties. It has been found these

transactions have been influenced by former CEO Markus Jooste.

Another issue which led to problems is that Steinhoff did not have a single set of auditors of group.

For example there were inflated values of the cash and cash equivalents. Steinhoff Europe had loans receivable backed by warranties. Reflected as cash and cash equivalents. What should have happened when numbers were consolidated at group level is that the figure should not have been reflected as cash and cash equivalents.

“Having a single set of auditors would have decreased the

risk of what happened at Steinhoff.”

29 Aug 2018

I do not think I did anything deliberately wrong - la Grange

Former Steinhoff CFO Ben la Grange gave his version of events of what went wrong at the global retailer.

He said that he was saddened by the impact the fallout of the Steinhoff share price and the money that was lost and the majority of people affected.

He said he was willing to cooperate with Parliament to prevent something like this happening again. “I do not think I did anything deliberately wrong,” he told the committees before outlining the process leading up to the publication of the group’s annual statements.

At no point in time does the group do we re-audit numbers, and the group relies on institutions and individuals responsible for providing the flow of information to the group, la Grange said. The group was responsible for consolidating statements from the different parts of the business and would then note trends or movements of large balances.

If the group would find anything wrong in the submission, enquiries would be made and then the audited pack (of the entire group) would be resubmitted for the audit process to start again.

29 Aug 2018

29 Aug 2018

Steinhoff commits to release audited financial results

Chair of Steinhoff’s supervisory board Heather Sonn detailed the process leading up to Deloitte’s decision not to sign off on financial statements for 2017.

According to Sonn, at the time, Deloitte was in a process of reviewing statements when allegations came forward from various sources raised questions about the financials which raised concerns.

The audit committee worked with Deloitte on the matter and asked for audit evidence to address concerns. The audits could not be produced – which led Deloitte to decide not to sign off on the statements.

On December 5, 2017, PwC was approached to conduct an investigation.

Sonn also assured that Steinhoff will “not stop trying” to recover returns to individuals affected by the fallout of the share price.

She added that leadership would continue to try to save the company. The financial statements for 2017 will be released in December 2018, the financial results for 2018 will be released in January 2019.

29 Aug 2018

MPs not buying Sonn's PR exercise

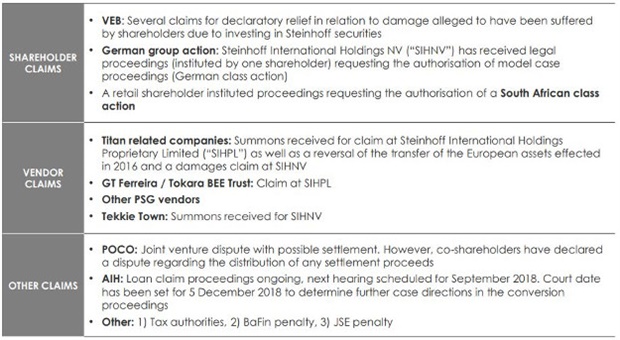

Members of Parliament want to know if there is any accountability and if there are disciplinary steps being taken against Steinhoff executives, following the retailer's fallout.

Steinhoff presented first, but ANC MP Thandi Tobias said that chair of the supervisory board's presentation appeared to be a PR exercise. It appeared that Sonn's answers to questions were too general and she did not answer to specifics, to MPs frustrations.

She echoed views of her counterparts who wanted to know if there would be consequences for implicated directors.

ANC MP Wilma Newhoudt-Druchen also asked for clarity on the actual reason Steinhoff's auditors did not sign off on the financial statements for 2017.

Steinhoff has committed to releasing the 2017 financial statements at the end of December 2018, and the 2018 financial statements will be released in January 2018.

DA MP David Maynier asked if contracts with former CFO Ben la Grange were suspended because la Grange may be implicated in the accounting irregularities being investigated by PwC.

Bloomberg reported of the suspension of the contracts with la Grange and ex-director Stehan Grobler, who remained in short-term consultancy deals with the retailer even after they stepped down from their official roles at the company.

In response Sonn said that the presentation is not a PR exercise and that Steinhoff is committed to concluding the processes promptly to provide certainty for pension funds.

Sonn added that even though she knows evidence presented before Parliament will not prejudice any criminal proceedings - she is making considerations of what the retailer is dealing with on a daily basis and she is not attempting to be evasive.

29 Aug 2018

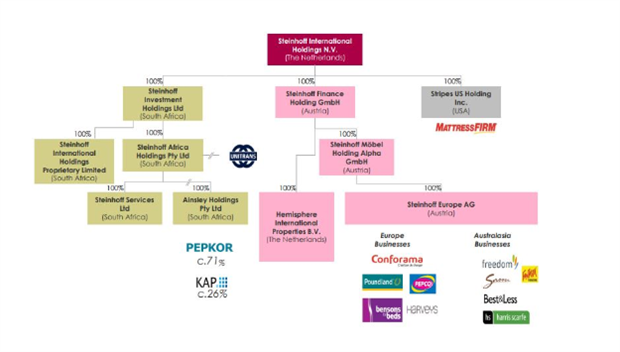

Steinhoff has averted an 'implosion' - Parliament hears

Steinhoff which presented first said it is “deeply aware” of the current impacts of events at the retailer on stakeholders- including investors and pension fund holders.

"We understand matter of interest and exposure to pension funds. We understand the gravity of it and we come here because of that understanding,” said Heather Sonn, chair of Steinhoff’s supervisory board.

Steinhoff is doing their “utmost to uncover the truth, to rectify any wrongdoings and to communicate as fully as we can on an ongoing basis”. Steinhoff said it has cooperated with regulators - and auhorities like the Hawks and PwC which is conducting a probe. Steinhoff will continue to maintain cooperation, Sonn said.

The group has also undertaken a “massive exercise” to restructure the group’s international debt.

Steinhoff employees now stand at 120 000 people – down from 130 000 following the disposal of some subsidiaries. Of Steinhoff’s employees 50 000 of them are from SA. Steinhoff has managed to secure jobs in SA, Sonn said.

As far as jobs go, the company has paid down most of its African debt to a large extent. It secures the SA aspect of the business and its Africa position, Sonn added.

Following meeting with committees in January- Steinhoff has worked to stabilise the group - stability remains a core objective, Sonn said. The group is also committed to finalising audited financial statements and to make sure investigations proceed and ensure further steps are taken based on outcomes.

"A crisis of complete implosion of the company has been averted – through a standstill agreement with banks," said Sonn. The standstill with banks will help Steinhoff provide an opportunity to grow shareholder value.

Banks have given the company three years to go through assets to decide which assets to sell to bring down debt and henerate cash flow to service remaining debt.

Sonn added that the PwC report is on track. Sonn said the company is committed to the finalisation of the PwC investigation and the report so that the company can remain listed on the JSE.

If the financial reports are not signed off or ready for publishing, Steinhoff stands the risk of the share being suspended - preventing shareholders to trade shares.

29 Aug 2018

La Grange and Steinhoff witnesses won't be legally prejudiced by Parly hearing

Advocate Frank Jenkins briefed the committees and those presenting evidence on the legal implications of the hearing.

Parliament has the right to summons anyone in terms of the Constitution to conduct its legislative functions of oversight.

The committees may inquire into the cause, or nature of the cause for Steinhoff's collapse to see if it is due to a lack of performance of a regulatory body.

The witnesses - are protected from self-incrimination. Witnesses therefore must answer questions legitimately put before them. Members cannot inquire on the civil or criminal culpability of the witness- this is outside the mandate of Parliament.

Last week National Assembly Speaker Baleka Mbete issued a statement indicating that the inquiry is not a criminal investigation establishing criminal liability, nor is it a civil inquiry establishing civil liability of Steinhoff or its employees.

29 Aug 2018

Former Steinhoff CFO Ben la Grange will present evidence before Parliament’s committees on Wednesday.

The Portfolio Committee on Trade and Industry, the Standing Committee on Finance (SCOF), the Standing Committee on Public Accounts and the Portfolio Committee on Public Service and administration, will follow-up on matters at the retailer, since its last meeting in March.

At the time the committees resolved to subpoena former CEO Markus Jooste and La Grange, both of them had failed to appear before Parliament despite being invited to attend.

The Speaker of the National Assembly Baleka Mbete authorised SCOF to summons the pair to present evidence which will focus on the “institutional flaws and challenges” in the country’s financial regulatory framework which may have given rise to the “Steinhoff debacle”, Parliament said in a statement last week.

Jooste resigned from Steinhoff in December 2017, this after revelations of accounting irregularities in the retailer’s annual financial statements. This saw the share price tumble by more than 80%, causing losses to investors and pension funds invested in the share.

Since then, the credibility of Steinhoff’s annual financial statements dating as far back as 2014 has been called into question.La Grange, resigned as Steinhoff CFO and as CEO and at Steinhoff Africa Retail (STAR), now known as Pepkor. La Grange remained at STAR as a non-executive director, before stepping down entirely in January.

La Grange continued to work for Steinhoff through short-term consultancy deals, according to a Bloomberg report. But earlier this month Bloomberg reported that La Grange and ex-director Stehan Grobler were suspended pending the outcomes of the investigation by PwC into financial irregularities at the group.

Earlier Fin24 reported that Jooste will appear before Parliament next Wednesday, September 5.

The Steinhoff hearing will kick off at 10:00 on Wednesday.

Publications

Publications

Partners

Partners