Finance Minister Tito Mboweni has to tick many boxes in his medium-term budget: credible fiscal and debt numbers, plans to boost economic growth and policy steps that increase investor and business confidence. All this as the woes plaguing cash-strapped power utility Eskom cast a long shadow.

The following charts illustrate just how tough Mboweni’s task will be when he delivers the budget update in Cape Town on Wednesday:

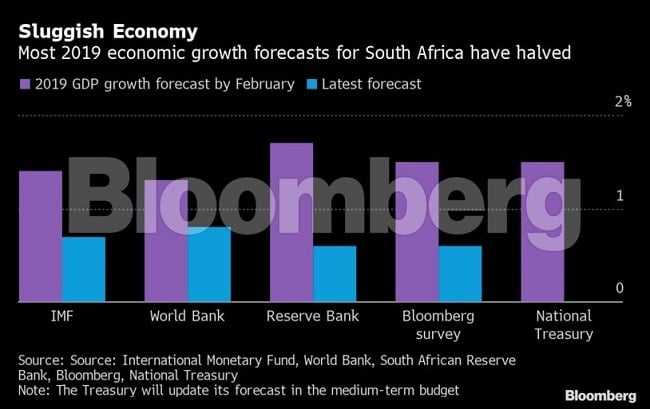

Mboweni will present a much lower economic-growth forecast than in February. Since the start of the year, the International Monetary Fund, the Reserve Bank and the World Bank have all cut their projections for 2019 as rolling blackouts and poor investor sentiment due to policy uncertainty weigh on output.

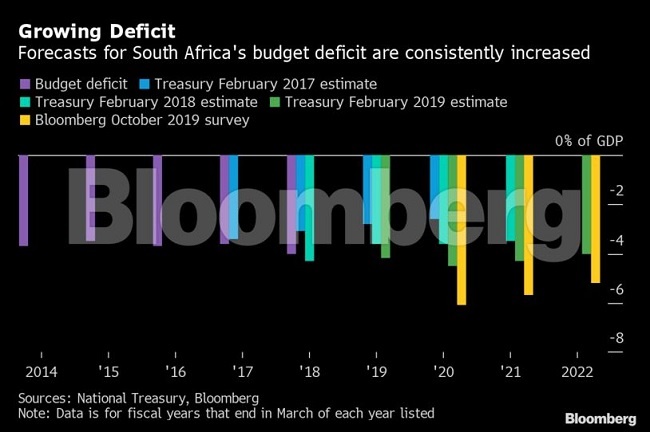

The budget deficit will probably widen to the biggest since the financial crisis as provisions for Eskom, the public broadcaster and national airline sap resources and revenue misses projections. Economists in a Bloomberg survey forecast a gap of 6.1% of gross domestic product for this year compared with the Treasury’s estimate of 4.5% given in February.

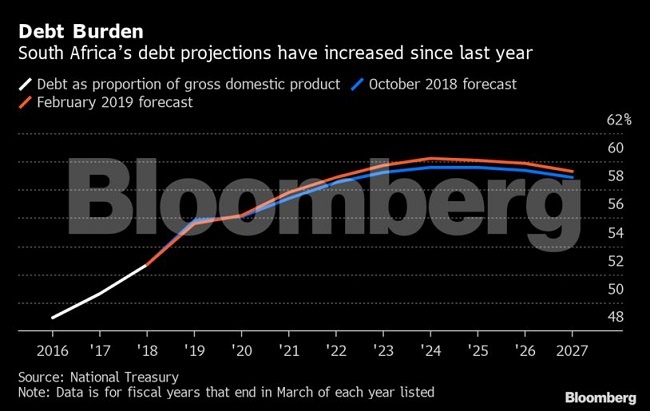

The Treasury presented higher government-debt estimates in February than it did last October, and will probably raise its forecasts again after lawmakers last week approved a law that allocates a R59bn bailout to Eskom in addition to a R69bn lifeline outlined in February. If the government takes some of the utility’s debt onto its balance sheet, the ratio of debt to GDP could surge to more than 70%.

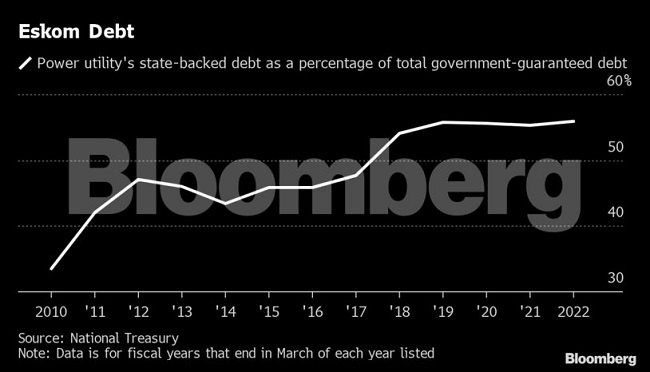

Mboweni’s medium-term budget should detail plans to fund the R128b, three-year package for Eskom - the utility that’s seen as the biggest risk to the economy and takes up the lion’s share of government guaranteed debt. It has amassed debt of R450bn and wants the government to transfer the borrowing it has guaranteed onto the state’s balance sheet.

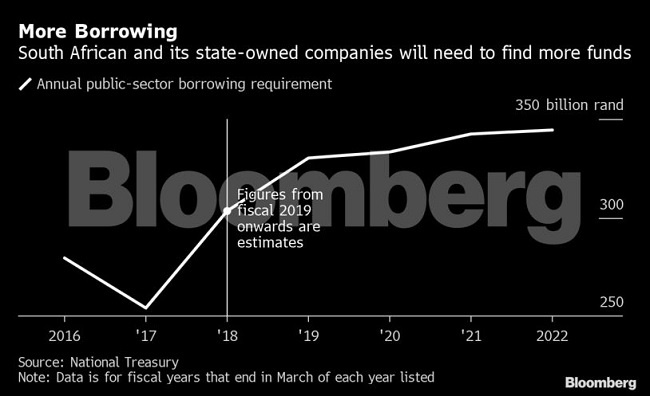

The financial burden of highly indebted state-owned companies could drive up borrowing requirements. The government announced plans to raise the equivalent of $2 billion on international capital markets in the February review and ended up selling $5 billion in its biggest Eurobond sale to date in September. Part of that, though, was to make up for not raising budgeted-for funds in foreign markets the previous year.

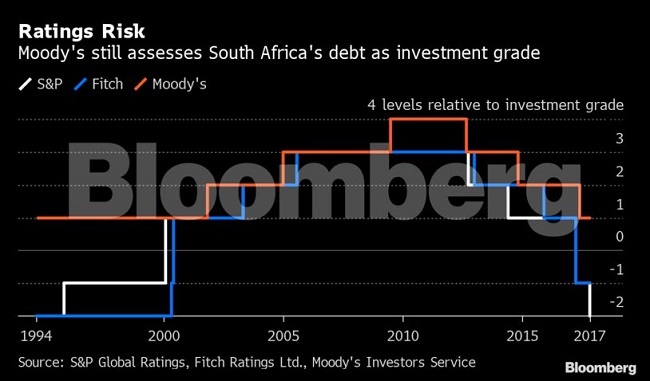

The deterioration in fiscal metrics could bring the country closer to losing its sole investment-grade credit rating from Moody’s Investors Service. Of the 17 economists in a Bloomberg survey, nine forecast that the ratings company will change its outlook on the credit assessment to negative before the end of the year. Moody’s wants to see a balance between credible fiscal and debt numbers and detail on policy decisions in the medium-term budget statement, Lucie Villa, Moody’s vice president and lead sovereign analyst for South Africa, said last month.

With assistance from Sarina Yoo.

Publications

Publications

Partners

Partners