Take home pay would have increased a lot more in real terms if it was not for so-called "bracket creep" due to taxation, economist Mike Schüssler told Fin24 on Wednesday.

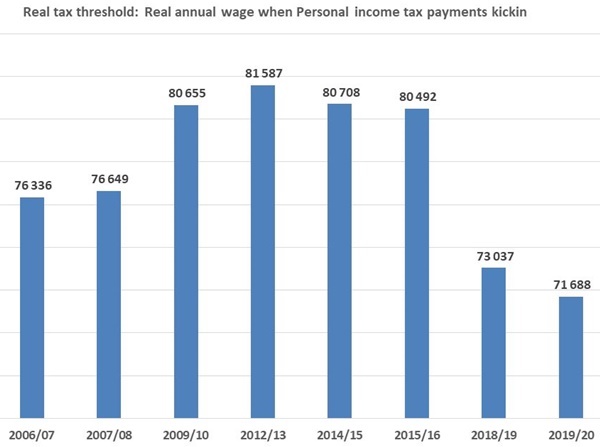

He explained that, in real terms (therefore when inflation has been taken into account) you would have had to earn a total of R81 600 per year before you started to pay tax in the 2012/13 financial year.

In the 2019/20 financial year you need to earn a total of R71 700 per year to start paying taxes.

"So, when taking inflation into account, now you actually start paying taxes with R10 000 less in earnings compared to 2012/13 and that has demolished quite a lot of the gains that employees have got on their gross salaries when they look at their take home pay," explained Schüssler.

South Africa's take-home pay in January reflected a year-on-year (y/y) increase of 1.5% in real terms as inflation for the month dipped, according to the latest BankservAfrica Take-home Pay and Private Pensions Index released on Wednesday.

Take-home pay averaged R14 126 in January in real terms and R15 423 for nominal terms.

Commenting on this, Schüssler said that, although the data shows take home pay being up 1.5% in real terms, when one looks at the overall picture over the past five years, there has not been much of a gain in terms of take-home pay increases. He estimates maybe 2% overall in real terms over the 5-year period.

"A large part of this has to do with when we start paying taxes. Also, all our other tax thresholds are the lowest since the 2006/2007 financial year," said Schüssler.

According to Shergeran Naidoo, head: stakeholder engagements at BankservAfrica, January was a turning point on the take-home pay front, showing the largest change from September on the back of South Africa's Consumer Price Index (CPI) reaching a low - mainly due to lower fuel prices. This has, in turn, raised the value of South African salaries.

At 4% in January, the CPI helped to "raise" the real-take home pay increase. The nominal take-home pay increase was 6.1% - not far off the last six months' average of 5.9%.

"While individuals may not have felt this with post tax and other deduction income not increasing, the 1.5% change is similar to the retail sales increases over the last few months. This explains the small significance of this movement," added Schüssler.

According to Naidoo, the BankservAfrica Private Pensions Index (BPPI) showed growth of 2% on a year-on-year basis in January. This is, however, a substantial decline in the real rate of increase, which not so long ago averaged over 5%.

"The actual private pension was R6 787 for January 2019 while the nominal value was R7 361," says Naidoo.

Schüssler believes the poorer market performance is not catching up to banked pensions, which are still at rates of increase nearly twice that of the inflation rate.

(Source: Economists Dotcoza)

Publications

Publications

Partners

Partners