The medium term budget policy statement (mini budget), to be announced by Finance Minister Tito Mboweni, is an opportunity for him to make adjustments that will influence the SA economy and its consumers.

These adjustments will either be made immediately or become effective in the next fiscal year.

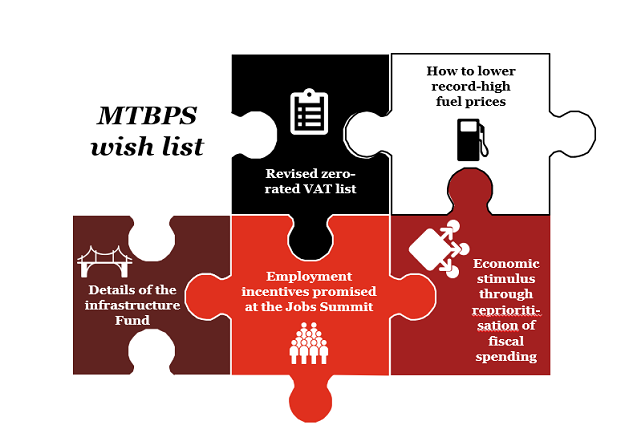

South Africans are looking to Minister Mboweni this month to bolster their personal finances, job prospects, and the economy as a whole. To achieve this, the finance minister would need to make announcements on several key topics.

1. Revised zero-rated VAT consumer goods

In May, an independent panel commenced a review of the list of zero-rated VAT items. Although the panel has delivered a report with relevant recommendations and Parliament’s Standing Committee on Finance has also received submissions, the finance minister has yet to make a formal indication on when (and what) changes will be implemented.

Following public submissions, the independent panel recommended the addition of white bread, school uniforms, sanitary products and nappies to the zero-rated list. Subsequent to this, the committee heard submissions in favour of adding certain chicken products as well. Treasury will need to weigh the benefit to the poor against the expected loss in VAT revenue.

2. Plans to lower record-high fuel prices

Secondly, and also intimately tied to household finances, the mini budget needs to address the issue of record-high fuel prices. The Department of Energy (DoE) indicated earlier that it cannot make adjustments to taxes currently forming part of wholesale and retail fuel prices, as these were adopted by Members of Parliament when they signed off on the 2018/19 fiscal budget.

A task team made up of officials from the Treasury and DoE have for several months been working on a strategy to reduce the impact of sharply rising fuel prices on South African households and businesses. They have also requested input from the petroleum industry on the matter. With another fuel price increase expected in November, their work needs to bare fruits.

3. Reprioritisation of fiscal spending

Thirdly, while Mboweni is facing pressure on tax revenues (even before relief is given from a VAT and fuel tax perspective), he also needs to recalibrate planned national expenditure. President Cyril Ramaphosa promised, as part of the economic stimulus and recovery programme, the "reprioritisation of public spending to support job creation".

The President envisioned spending towards activities "that have the greatest impact on economic growth, domestic demand and job creation, with a particular emphasis on township and rural economies, women and youth".

At the same time, he pledged that this reprioritisation "will take place within the current fiscal framework and in line with the normal budgetary process". The balancing act between fiscal restraint and maximum job and growth impact is a substantial challenge facing Minister Mboweni from the outset of his tenure.

4. Incentives to stimulate employment creation following the Jobs Summit

Fourth, a statement released after the recent Jobs Summit committed the government to financial and other obligations in the quest to increase employment creation. For example, government, together with big business and organised labour, agreed that the existing employment tax incentive encouraging youth employment will be extended for a further 10 years.

Other pledges for which fiscal funds would need to be allocated include a facility for the industrial sector to access finance at preferential rates, a guarantee facility to extend the term of financing provided to industrial projects, a R1.5b smallholder farmer support fund, and a R1.5bn township enterprise support fund.

5. Infrastructure fund

Finally, the mini budget will need to lay the groundwork for Ramaphosa’s new infrastructure fund. In a speech on September 21 detailing his economic stimulus and recovery programme, the Ppresident announced the establishment of this fund, aimed at "unlocking the potential to create more jobs on a large scale".

The president noted that the fund "will fundamentally transform our approach to the rollout, building and implementation of infrastructure projects". The fiscus will contribute R400bn to the Infrastructure Fund over the medium term. The hope is that this investment will attract additional resources from developmental finance institutions, multilateral development banks, and private lenders and investors.

These five elements will be important in supporting household finances and employment creation over the short to medium term. However, Minister Mboweni has inherited a precarious fiscal situation that will make it difficult to find money for these pledges while also keeping ratings agencies happy with regards to rising public debt. In light of this, the mini budget will be highly anticipated.

*Christie Viljoen is an economist from PwC Strategy&. The original article has been edited for brevity.

* Visit Fin24's 2018 mini budget hub for all the news, views and analysis.

* Sign up to Fin24's top news in your inbox: SUBSCRIBE TO FIN24 NEWSLETTER

Publications

Publications

Partners

Partners