Cape Town - Although the higher VAT rate will be a challenge for household budgets, an analyst says it is the correct way for government to go about raising tax revenue.

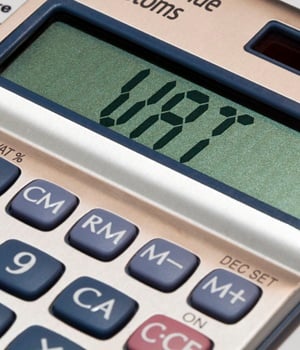

On Wednesday Finance Minister Malusi Gigaba announced in his budget speech that the VAT rate would increase one percentage point to 15%, as of April 1 2018.

This is expected to raise an additional R22.9bn to help plug the tax revenue shortfall of R48.2bn.

“This will result in additional costs for consumers as they will now have to pay an additional VAT on any purchases of goods or services from VAT vendors,” Lesley O’Connell, PwC VAT partner.

However, O’Connell said the reliance on indirect taxes is the correct approach to take. “This raises large amounts of revenue with relatively small increases in rates due to its broad base and economic efficiency,” she explained.

O’Connell added that the fact that there is no amended list of zero-rated foodstuffs is positive and maintains the “integrity and efficiency” of the VAT system. Basic food stuffs such as paraffin and brown bread remain zero-rated, according to the budget. However, the zero-rate will not apply to low GI bread and rye.

O’Connell added that the implementation date in just over a month does not allow enough time for business to effect the necessary system changes.

Drag on consumer spending

Managing Director of the Banking Association of South Africa (BASA) Cas Coovadia said that the budget showed government’s willingness to take hard decisions to restore fiscal stability. He added that the VAT increase will be a drag on consumer spending, which is a major source of economic activity in South Africa.

“Considering this, the smaller increase was a reasonable decision.”

Businesses and consumers will also have to deal with an increased fuel levy, among other proposed hikes. Gigaba said that below inflation increases will be introduced for personal income tax.

“The decision to increase VAT was an important signal that government is willing to take unpopular decisions to restore the fiscal health of the country.

“This will further boost investor and business trust and confidence,” said Coovadia.

In a statement the Chamber of Mines said the tax hikes may be painful but are necessary to encourage investment.

“In due course government will have to take steps to incentivise higher levels of investment through greater tax competitiveness compared with South Africa’s peers,” the Chamber said.

South Africa is now in line with similar countries, including Mauritius, Ghana and Ethiopia, but would seem uncompetitive on tax relative to Nigeria, which has a VAT rate of 5%, although there are plans to increase it to 10%. The VAT increase will negatively impact the financial well-being of South Africans. Other taxes are also on the rise:

VAT the price of Zuma corruption

The Cape Chamber of Commerce and Industry said that the higher VAT rate is the cost of [Jacob] Zuma years of corruption, wasteful spending and low growth. Chamber president Janene Myburgh echoed views that although painful, VAT will set the scene for healthy growth in the future.

Deep cuts in government spending and a wage freeze would have been a better option to bring in extra revenue Myburgh explained. Gigaba announced spending cuts of R85bn.

The VAT increase was not expected, she explained. “Our VAT rates are low by international standards but very difficult to increase because of strong opposition from trade unions and others.

“However, we are in a crisis situation and still in danger of a credit downgrade, so it was the time for government to put the crisis to good use.”

In the circumstances it was right that a minister appointed by Zuma should make the unhappy announcement.

- Visit our Budget 2018 Special for all the news, views and analysis.

* Sign up to Fin24's top news in your inbox: SUBSCRIBE TO FIN24 NEWSLETTER

Publications

Publications

Partners

Partners