Johannesburg - Finance Minister Malusi Gigaba and the government need a politically palatable plan to get out of the low-growth debt trap and avoid the country’s finances going to hell.

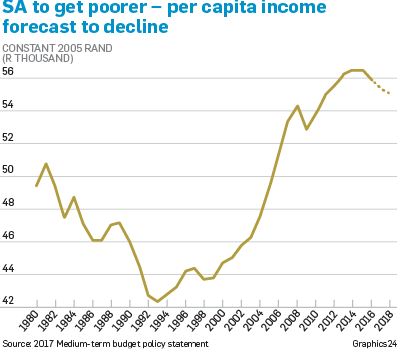

This picture was driven by poor growth and massive debt that could see South Africa slide further into “junk” credit rating status and even seeking an International Monetary Fund (IMF) bailout from 2022 onwards.

Two major rating agencies are expected to review the country’s score at the end of November.

While painting a dire picture, Gigaba didn’t produce any roadmap to escape the situation. He could make his plans known in his budget speech in February.

It was almost as though he and his team were stumped about what to do about the country’s horrific outlook. Or there are political forces at play, meaning changing course is going to take huge effort. Maybe Gigaba’s Cabinet colleagues don’t understand how bleak the economic situation is, or he is pointing at something no one dares to confront.

However, according to the Medium-term Budget Policy Statement (MTBPS) document “decisive action” and “hard choices” are required. The fact that Gigaba didn’t say what this would entail is acutely worrying. This is because he said that, for the three years to March 2020, there is a massive R209 billion shortfall in revenue relative to government’s previous forecasts, due to lower-than-expected growth.

The response from most quarters was pessimistic.

“Nothing is going to change in the coming months because government does not have a plan,” Cosatu said in a statement in response to Gigaba’s speech.

However, on Friday, Reuters quoted Gigaba as saying that he would unveil a stimulus package focusing on tourism and manufacturing.

Gigaba said Treasury would not wait for the ANC’s elective conference in December to take the “drastic decisions” needed.

Nedbank group chief economist Dennis Dykes said he interpreted Gigaba’s warning in the MTBPS as a “political message”, especially to his Cabinet colleagues.

“The country’s finances need a political solution,” Dykes said.

S&P Global Ratings said South African politics would probably trump near-term macroeconomic performance.

Fitch Ratings said the fact that no agreement on fiscal discipline measures was included in the mini budget highlighted how disputes in the ANC had made it difficult to agree on savings measures.

“We think that divisions in the ANC will persist beyond the party’s electoral conference in December, and it is not clear that the political environment will become more conducive to consolidation,” Fitch said.

Cosatu said it was clear that the nation was experiencing its worst governance and economic crisis since 1994.

Banking Association of SA managing director Cas Coovadia said a huge gap exists between Gigaba’s rhetoric and the macroeconomic indicators, which point to a worsening situation.

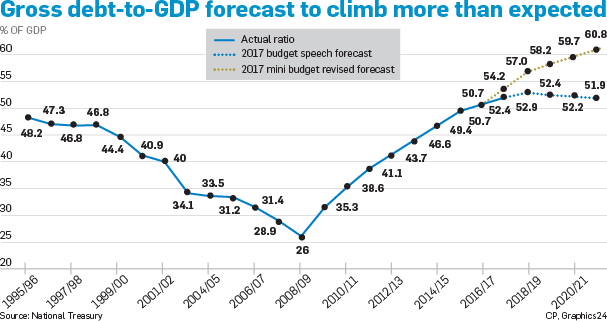

Most concerning is that the MTBPS warns that gross national debt is projected to continue rising, reaching over 60% of GDP by 2022. This is seen as a red light level for government finances. A debt to GDP ratio of 65% to 70% could see government forced to seek international help from organisations like the IMF. The ultimate call for IMF help comes when a country defaults on its debt payments.

Gross government debt is forecast to increase from R2.2 billion earlier this year to R3.4 trillion by March 2021.

Cosatu said the massive debt increase forecast would put workers’ jobs, their pensions, service delivery and the nation’s sovereignty at risk.

Dykes said an economic turnaround required corruption to be tackled and for “strange procurement processes”, especially at state-owned enterprises, to be eliminated.

SA Chamber of Commerce and Industry (Sacci) CEO Alan Mukoki said that decisive ideas were required to address the significant challenges the country faced. He said Gigaba engaged in platitudes and very general comments in his mini budget.

Mukoki said Gigaba should have been a lot clearer about his plans.

Mukoki said that to balance its books, government needed to cut wasteful spending, but that capital expenditure on infrastructure should continue.

Cosatu said the Auditor-General, senior Cabinet members and countless media articles indicate that more than R100 billion of the state’s trillion rand budget is lost to corruption, and wasteful and irregular expenditure.

“If government wants more revenue, it must deal with corruption and wasteful expenditure,” the trade union federation said.

Sacci’s Mukoki said Gigaba could have outlined savings that government could achieve. He said the boards of state-owned enterprises should be free of political interference and be appointed in an independent and transparent way.

A long-term fix to get the economy going would be to ensure the education system is working.

Economic growth could get a further boost by releasing further telecommunications spectrum, Mukoki said.

In another development expected to put pressure on government finances, two labour federations seemed to be unmoved by Gigaba’s plea this week that all parties play their part in improving the health of the fiscus.

Federation of Unions of South Africa (Fedusa) deputy general secretary Riefdah Ajam said that, despite the sad state of affairs revealed by Gigaba’s speech, they would not back down on any of their wage negotiation demands.

Fedusa was worried that Gigaba was mum on priority spending plans which, if not well navigated, might result in further credit rating downgrades.

Ajam said tax hikes would definitely be a bad move.

Cosatu spokesperson Sizwe Pamla said the fundamentals were there to turn the state and economy around. What was lacking was a bold, decisive and imaginative leadership.

Pamla said the federation’s wage hike demand would not change. They wanted between 10% and 12%.

* Visit our Mini Budget Special Issue for all the news, views and analysis.

SUBSCRIBE FOR FREE UPDATE: Get Fin24's top morning business news and opinions in your inbox.

Read Fin24's top stories trending on Twitter: Fin24’s top stories

Publications

Publications

Partners

Partners