When I decided on the topic for this article I did what most of us do, I started with a Google search. If you google “retirement statistics in South Africa”, the top results are “South Africans among the world’s worst savers”, “Most South Africans are nowhere near ready for retirement” and “Why only 6% of South Africans can retire comfortably”.

It’s no secret that South Africans don’t save nearly enough, and the purpose of this article is not to bore you with statistics about what we already know. So this leads me to the next question: why?

There are various reasons and some of them are very obvious… we have a very high unemployment rate. Also, according to a World Bank report published not too long ago, South Africans are the world’s biggest borrowers. And why do we borrow so much? Apparently it’s either to splurge or to survive. According to the report, 86% of South Africans borrowed money between 2013 and 2014. So we borrow either to put food on the table, or to demonstrate our (perceived) wealth. Either way, we are spending too much and not saving enough.

Bloomberg also recently published the 2016 edition of its misery index. The index is calculated by adding the inflation rate to the unemployment rate. According to the index, South Africa is currently the third- most miserable country to live in, out of 74 economies in the index, with only Venezuela and Bosnia topping us. South Africa’s unemployment rate is currently over 26%, with factors such as the drought and the decrease in the demand for commodities undoubtedly playing a big part.

People are struggling to hold onto their jobs, and they are changing jobs more often. Every time they leave employment they have the opportunity to access their retirement savings, and it’s not preserved for retirement.

With the “why” now in perspective, let’s take a closer look at the impact of not saving enough for retirement, and specifically, not starting to save for retirement early enough. Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.” To put this very wise statement in perspective, let’s look at an example.

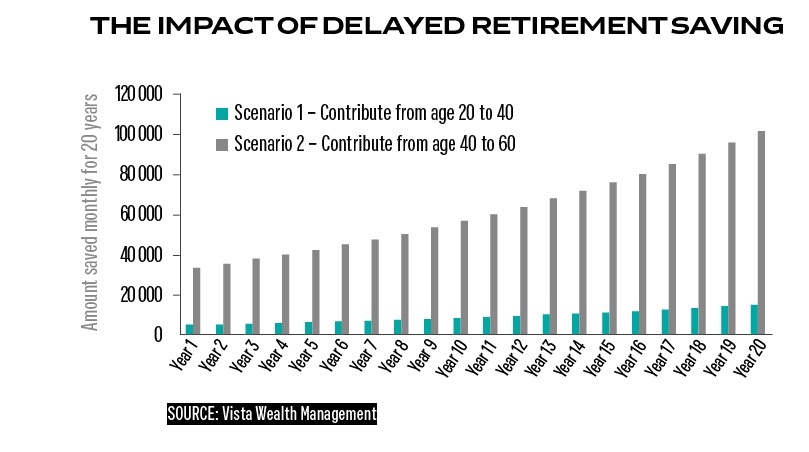

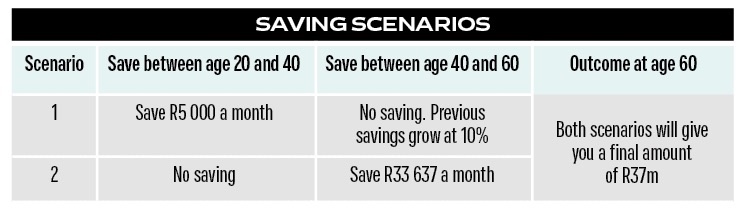

If we were to take two individuals saving for retirement, and the one starts saving at the age of 20 and only saves up to the age of 40. This person then leaves the money to grow for another 20 years, up to the age of 60. How much would the second individual, who only starts to save at the age of 40, have to save over the 20 year period up to the age of 60 to get to the same final amount?

If you started saving R5 000 a month from age 20 to 40, and then left the money to grow for the next 20 years without making any further savings contributions, you would end up with an amount of approximately R37m, assuming a 10% per annum investment growth rate. If you only started saving at the age of 40 and you wanted to reach the same goal of R37m at the age of 60, you would have to start your savings contribution off at R33 637 a month, in nominal terms.

Assumptions: Monthly contributions increasing by 6% p.a. and an investment growth rate of 10% a year.

The total contributions if you started saving at the age of 20 was R2.2m compared to R14.8m if you only started saving at the age of 40.

If one further considers that, as a rule of thumb, you should be saving at least 15% of your gross salary every month to be able to reach your retirement goals, the picture becomes even more daunting, and we can understand why South Africans face such a bleak future when it comes to retirement.

The bottom line is that it’s never too late, and every little bit helps, even if you can’t reach your goals completely. It is however very important to make use of the correct savings products and underlying investments in order to maximise the effectiveness and growth on your retirement savings, and this is where financial advice is invaluable. Speak to an experienced and qualified financial adviser without delay.

Rupert Giessingis a director at Vista Wealth Management, a representative under supervision of Accredinet Financial Solutions.

This article originally appeared in the 8 September edition of finweek. Buy and download the magazine here.

Publications

Publications

Partners

Partners