Johannesburg - The use of passive investment products, like Exchange Traded Funds (ETFs), to deliver consistent and low-cost investment performance is taking off around the world.

A number of research papers, particularly in the US, have shown that over time, having the correct asset allocation between different types of investment returns and asset classes, is much more important than the stock-picking associated with active asset managers. In fact, 90% or more of long-term investment performance is typically delivered by the asset allocation mix and not by active investment strategies.

It is, of course, quite possible to choose a strategic asset allocation, like the one below, which fully adheres to the requirements of Regulation 28 of the Pension Funds Act in South Africa, and also meets all requirements of risk management and portfolio diversification.

With over 70 Exchange Traded Products (ETP) now listed on the JSE, some of these ETFs can be used to provide exposure to the different asset classes in the strategic asset allocation above.

Watch:

etfSA MD Mike Brown talks about how ETFs can be used to establish a well-balanced retirement portfolio:

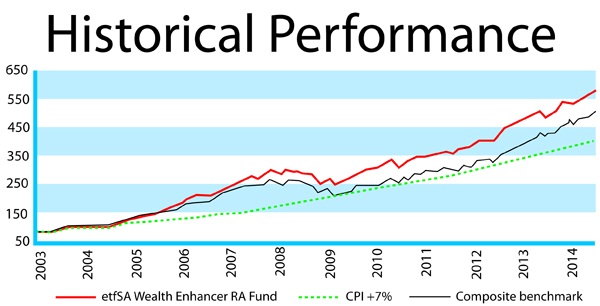

The graph below shows:

- The historic performance of the benchmark CPI +7 target,

- The strategic asset allocation portfolio (using indices for the different asset classes); and

- The top line, which uses a portfolio of ETPs to deliver the required strategic asset allocation. As can be seen, the ETP portfolio comfortably outperforms the benchmarks, to deliver a return of 17.8% per annum over the past 10 years in the South African market.

ETFs provide what is known as “passive” investment management. They only replicate indices in the different asset classes, and these indices are not chosen by the ETF manager, but by the compilers of the index. So the ETF manager passively follows an index, but does not choose the components of the index nor have any other independent stock selection.

The independent stock selection process is followed by the active asset manager, who specifically tries to outperform the index. However, research has established that, on average, in South Africa, 80% of professional active unit trust managers fail to outperform the index over time.

Also, the risk increases because of the continuous churn of portfolios as the active manager tries to outperform the average return of the market (the index). Risk is measured by the standard deviation (volatility) against the index. As a passive manager delivers the index, the passive ETF portfolio has very low risk. This is typically not the case with the active portfolio manager.

etfSA Retirement Annuity Fund

Finally, there is costs, The etfSA Retirement Annuity Fund, which provides purely passively managed RA Funds, charged 35 basis points (0.35%) per annum for its portfolio management, which covers all the costs, including brokerage and transaction fees, to deliver the required investment performance. This is about one-quarter of the fees payable to an active manager of retirement fund portfolios.

Taken together with the other costs associated with retirement funds in administration, compliance, commissions, financial advice, etc. a passive fund typically has, at least, a 2% per annum, lower cost structure than the typical active manager. Research in the US has shown that a 2% per annum reduction in costs can increase the pool of funds available for your retirement by 40% over 30 years and by over 60% over 40 years.

The reduced risk, lower cost, often better performance solution of using passive index tracking ETFs in retirement fund portfolios, is likely to increase in popularity in South African in coming years.

A number of research papers, particularly in the US, have shown that over time, having the correct asset allocation between different types of investment returns and asset classes, is much more important than the stock-picking associated with active asset managers. In fact, 90% or more of long-term investment performance is typically delivered by the asset allocation mix and not by active investment strategies.

It is, of course, quite possible to choose a strategic asset allocation, like the one below, which fully adheres to the requirements of Regulation 28 of the Pension Funds Act in South Africa, and also meets all requirements of risk management and portfolio diversification.

With over 70 Exchange Traded Products (ETP) now listed on the JSE, some of these ETFs can be used to provide exposure to the different asset classes in the strategic asset allocation above.

Watch:

etfSA MD Mike Brown talks about how ETFs can be used to establish a well-balanced retirement portfolio:

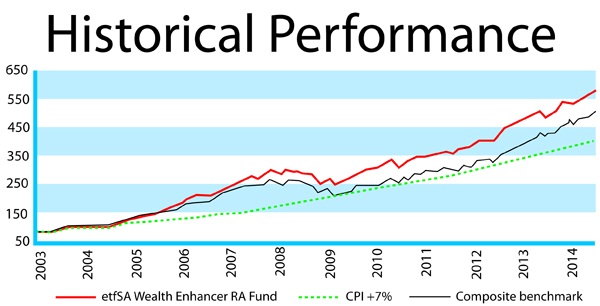

The graph below shows:

- The historic performance of the benchmark CPI +7 target,

- The strategic asset allocation portfolio (using indices for the different asset classes); and

- The top line, which uses a portfolio of ETPs to deliver the required strategic asset allocation. As can be seen, the ETP portfolio comfortably outperforms the benchmarks, to deliver a return of 17.8% per annum over the past 10 years in the South African market.

ETFs provide what is known as “passive” investment management. They only replicate indices in the different asset classes, and these indices are not chosen by the ETF manager, but by the compilers of the index. So the ETF manager passively follows an index, but does not choose the components of the index nor have any other independent stock selection.

The independent stock selection process is followed by the active asset manager, who specifically tries to outperform the index. However, research has established that, on average, in South Africa, 80% of professional active unit trust managers fail to outperform the index over time.

Also, the risk increases because of the continuous churn of portfolios as the active manager tries to outperform the average return of the market (the index). Risk is measured by the standard deviation (volatility) against the index. As a passive manager delivers the index, the passive ETF portfolio has very low risk. This is typically not the case with the active portfolio manager.

etfSA Retirement Annuity Fund

Finally, there is costs, The etfSA Retirement Annuity Fund, which provides purely passively managed RA Funds, charged 35 basis points (0.35%) per annum for its portfolio management, which covers all the costs, including brokerage and transaction fees, to deliver the required investment performance. This is about one-quarter of the fees payable to an active manager of retirement fund portfolios.

Taken together with the other costs associated with retirement funds in administration, compliance, commissions, financial advice, etc. a passive fund typically has, at least, a 2% per annum, lower cost structure than the typical active manager. Research in the US has shown that a 2% per annum reduction in costs can increase the pool of funds available for your retirement by 40% over 30 years and by over 60% over 40 years.

The reduced risk, lower cost, often better performance solution of using passive index tracking ETFs in retirement fund portfolios, is likely to increase in popularity in South African in coming years.

Publications

Publications

Partners

Partners