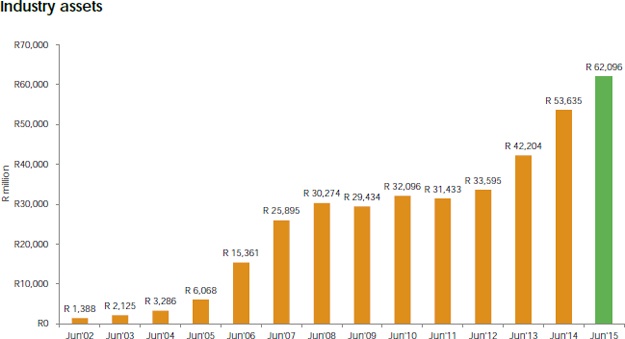

Cape Town - Assets under management by the South African hedge fund industry reached R62bn on June 30 2015, showing a 15.8% increase on the previous year, according to the Novare South African Hedge Fund Survey 2015, released on Monday.

“The surge in assets can largely be attributed to performance during the 12-month period. Net capital inflows contributed R4.6bn of the total increase in assets of R8.4bn," said Eugene Visagie, head of hedge fund investments at Novare.

“While this is slightly less than the previous 12 months to June 2014, when net inflows amounted to R5.1bn, the total assets figure illustrates the strong investment performance delivered during the period under review.”

Most participants outperformed the local equity and bond markets.

Visagie noted, however, that hedge fund inflows were still marginal when compared to the local collective investment schemes industry, which received net inflows of R77bn during the same time frame, taking total assets to R1.8 trn.

The bulk of the new hedge fund inflows were allocated to the larger asset managers, and those with hedge fund assets exceeding R1bn received almost three quarters of the flows.

The equity long/short strategy continued to dominate, representing close to 61% of industry assets. This strategy also received the largest proportion of new inflows. The fixed income strategy represented 14.1% of assets.

The 2015 edition marks the 12th year of the Novare Investments South African Hedge Fund Survey that represents the position of locally domiciled hedge funds. This year, 111 different hedge fund mandates and 53 asset managers participated.

The survey dispelled the misconception that hedge funds are managed by asset managers with a relative small asset base. In fact, close to half of industry assets were run by managers with total assets under management of between R10bn and R100bn. This is due to hedge fund managers having diversified their asset base beyond managing hedge funds, leading to hedge funds forming part of larger asset management companies.

The principal allocators of capital to hedge funds remained funds of hedge funds, which allocated approximately 60% of industry capital. There was substantially more interest from high net worth individuals who increased their allocation to hedge funds from 14.1% in 2014 to 26.2% in 2015.

Where retail investors are concerned, highly anticipated hedge fund regulation was released in February 2015 as a separate pillar under the Collective Investments Schemes Control Act (Cisca), which encompasses unit trusts.

“Classifying hedge funds as collective investment schemes places the oversight and supervision of these financial products under the jurisdiction of the Financial Services Board (FSB). Some of the requirements for hedge funds include additional reporting to investors and to the FSB, enhanced risk monitoring practices as well as independent trustee oversight," said Visagie.

“A tiered approach has been adopted by the regulation, with the establishment of two types of hedge funds, one for retail investors and the other for qualified investors.”

* Add your voice to our Wealth & Investment Issue by writing a guest post or sharing a personal story.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners