THE release of the latest national savings statistics by the South African Reserve Bank last week raised yet another debate on private savings in South Africa.

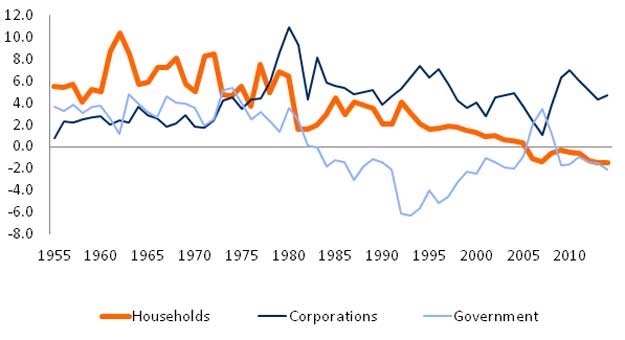

Indeed, the country’s national accounts suggest that South African households save worryingly little. Household savings rates have been declining steadily over the last fifty years, from about ten percent of GDP to almost nothing today.

In net terms - that is, when depreciation expenses are subtracted - household savings rates have been in negative territory for almost a decade, meaning that they are insufficient to replace even existing capital, let alone fund new investment.

Since government net savings are also negative, this means that all South African savings are undertaken by the corporate sector. Given the importance of savings and investments for individual households and for the overall economy, it is clear that these figures are raising real concerns.

'Financial savings' vs 'genuine savings'

However, economists have often pointed out how elusive the concept of savings actually is. Indeed, it is not quite clear whether the savings rate we measure in the national accounts corresponds to the concept we are worried about. Take these two examples:

• “Active savings” versus “wealth accumulation”: The main reason we save is that we seek to accumulate assets; assets that we can use to finance unexpected expenses or losses or to retire when we grow old. However, the value of these assets depends not only on how much we actively add every year, but also on how much our existing assets—our houses or stocks—appreciate over the same period. Due to the enormous success of the Johannesburg Stock Exchange and the increases in real house prices, these asset revaluations add between five and ten percentage points to the conventionally measured household savings rate.

• “Financial savings” versus “genuine savings”: Another reason why we save is because we seek to invest and increase our income in the future. Some of these investments are financial in nature, but large parts also flow into our human capital. These investments—in education and healthcare—are not reflected in the conventional measure of savings. If they were, our savings rate would increase by another three to six percentage points.

Not a 'free pass'

In summary, the fact that households “don’t save” according to the national accounts does not necessarily mean they are unprepared for retirement or that they cannot afford to invest in their future earnings potential.

Before becoming too optimistic, though, it is important to note that access to property, stocks and a good education is widely unequal, such that these considerations are much more relevant for some segments of the population than for others. Indeed, it is likely that “true savings rates” are even more unequal than conventionally measured ones.

Overall, these measurement issues are not a “free pass” for South Africans to not worry about their savings.

However, being precise about what it is we are talking about when we are talking about savings (and what we are measuring when we measure it) will allow us to ask more precise and relevant questions than whether or not South Africans as a whole save too little.

Annual net savings rates by institutional sector, In % of GDP. Source: SARB Quarterly Bulletins

* Anna Orthofer is a PhD Candidate at Stellenbosch University. Her paper “What we talk about when we talk about saving: Concepts and measures of household saving and their application to South Africa”, can be found as ERSA Working Paper 530

Consider yourself a savings hero? Or just have something on your mind? Add your voice to our Savings Issue:

* Write a guest post* Share a personal story

* Ask the experts

Publications

Publications

Partners

Partners