Cape Town - The first six months of 2014 have been relatively favourable for the local investment market.

The FTSE/JSE Top 40 index is up by 12.75% for the first half of this year and by 35.15% for the 12-month period ended June 2014. Over the past five years, the Top 40 index has risen by 21.59% per annum, one of the best continued expansion periods for many years.

etfSA MD Mike Brown gives his advice:

This has led certain asset managers and traders to question the continued endurance of the stock market rally. While the doomsayers talk of a market correction or temporary downcycle that has to be considered, it must not necessarily be taken as a clear indication of an impending market fall.

The financial market collapse of 2008/2009 worldwide was the most significant fall in nearly 90 years. The recovery from this collapse has been sharp, but it has been from a low base.

The JSE only passed its previous record highs late in 2013. If it is to show real returns of 5% to 7% per annum, the Top 40 and other major indices will be required to establish consistently higher record levels for some years to come.

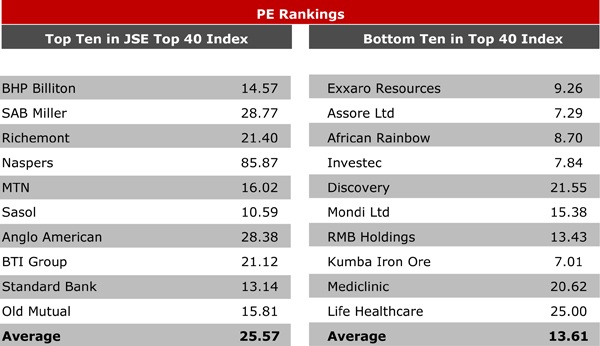

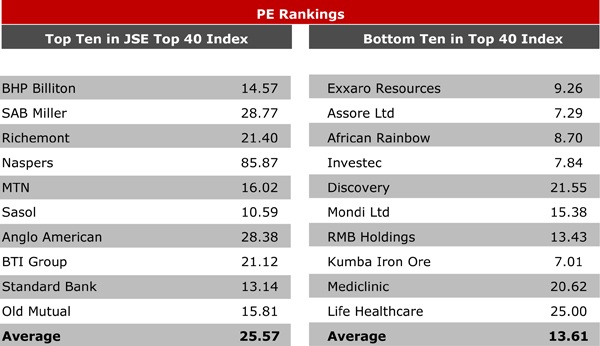

The high price to earnings ratios (PEs), which some value managers cite as a reason for a pending market decline, has to be taken with a pinch of salt. These high PEs affect only a limited number of JSE-listed shares (about 15 of the top 40 shares). The other 400 shares on the JSE are typically trading at well below the average PEs of past years.

Two-tier market

The average PE of the top five companies on the JSE (measured by market capitalisation) is 33.3 and the top ten 25.6, whereas the average PE of the bottom ten companies in the top 40 is only 13.6. Only a very small portion of the JSE is overvalued, using this measurement. So the JSE is a two-tier market, with global companies having a higher valuation than local stocks. This is nothing new, it is just that now there are more of these global companies listed on the JSE.

Is it not possible that the top quality shares on the JSE are being re-rated by investors, particularly foreign investors, and are likely to continue trading at high multiples, so long as they can maintain a consistent growth of earnings.

South Africa is being increasingly described as the “Switzerland of emerging markets”. This is in reference to the small group of global quality companies listed on the JSE with worldwide reach and earnings streams.

Is it not logical that these ten to 15 top quality companies should trade at PE multiples significantly higher than the non-global companies on the JSE?

This phenomenon of a two-tier market, with global large cap shares rated at higher multiples than the rest of the market, is common in emerging stock markets and is likely to become an even bigger feature in years to come.

Process of 'equitisation'

There appears to be a process of “equitisation” taking place in global financial markets. The poor performance in recent years of government bonds, together with the risky outlook for these instruments as interest rates rise, has switched investor attention to quality equities worldwide.

Couple this with the “retirement fund crises” now arising from the likelihood that people in retirement will live for 30 years on average and it means that probably only equity markets can deliver the long-term real returns necessary to sustain the lifestyles of the elderly.

This equitisation process could last for a considerable period and the investment flows into high quality equities might be enduring. This could consolidate the two-tier rating system on the JSE.

Top quality equities

The good news is that investors can share in such top quality equities by buying exchange-traded funds, giving direct exposure to Top 40 indices or the Satrix INDI 25, which gives the most focused access to South Africa’s “Switzerland” companies.

In any event, investors should consider allocating at least a portion of their portfolios to momentum type investments, which benefit from consistent growth in the equity markets. Market capitalisation ETFs are ideal for this purpose.

A portion of portfolios could be allocated to value-driven active managers, but this should only be a partial allocation.

While nobody can predict the future growth of financial markets, investors run the risk of being sidelined if they react to every bit of noise coming from the short-term traders and asset managers that have clogged up the newspapers over the past yea.

This could be for many years, while the market continues recording record highs and then waiting for a recovery to be established before reinvesting. The cost of being on the sidelines is very often greater than maintaining investment in the equity market.

In the long run, the age-old mantra is true: get invested and stay invested.

The FTSE/JSE Top 40 index is up by 12.75% for the first half of this year and by 35.15% for the 12-month period ended June 2014. Over the past five years, the Top 40 index has risen by 21.59% per annum, one of the best continued expansion periods for many years.

etfSA MD Mike Brown gives his advice:

This has led certain asset managers and traders to question the continued endurance of the stock market rally. While the doomsayers talk of a market correction or temporary downcycle that has to be considered, it must not necessarily be taken as a clear indication of an impending market fall.

The financial market collapse of 2008/2009 worldwide was the most significant fall in nearly 90 years. The recovery from this collapse has been sharp, but it has been from a low base.

The JSE only passed its previous record highs late in 2013. If it is to show real returns of 5% to 7% per annum, the Top 40 and other major indices will be required to establish consistently higher record levels for some years to come.

The high price to earnings ratios (PEs), which some value managers cite as a reason for a pending market decline, has to be taken with a pinch of salt. These high PEs affect only a limited number of JSE-listed shares (about 15 of the top 40 shares). The other 400 shares on the JSE are typically trading at well below the average PEs of past years.

Two-tier market

The average PE of the top five companies on the JSE (measured by market capitalisation) is 33.3 and the top ten 25.6, whereas the average PE of the bottom ten companies in the top 40 is only 13.6. Only a very small portion of the JSE is overvalued, using this measurement. So the JSE is a two-tier market, with global companies having a higher valuation than local stocks. This is nothing new, it is just that now there are more of these global companies listed on the JSE.

Is it not possible that the top quality shares on the JSE are being re-rated by investors, particularly foreign investors, and are likely to continue trading at high multiples, so long as they can maintain a consistent growth of earnings.

South Africa is being increasingly described as the “Switzerland of emerging markets”. This is in reference to the small group of global quality companies listed on the JSE with worldwide reach and earnings streams.

Is it not logical that these ten to 15 top quality companies should trade at PE multiples significantly higher than the non-global companies on the JSE?

This phenomenon of a two-tier market, with global large cap shares rated at higher multiples than the rest of the market, is common in emerging stock markets and is likely to become an even bigger feature in years to come.

Process of 'equitisation'

There appears to be a process of “equitisation” taking place in global financial markets. The poor performance in recent years of government bonds, together with the risky outlook for these instruments as interest rates rise, has switched investor attention to quality equities worldwide.

Couple this with the “retirement fund crises” now arising from the likelihood that people in retirement will live for 30 years on average and it means that probably only equity markets can deliver the long-term real returns necessary to sustain the lifestyles of the elderly.

This equitisation process could last for a considerable period and the investment flows into high quality equities might be enduring. This could consolidate the two-tier rating system on the JSE.

Top quality equities

The good news is that investors can share in such top quality equities by buying exchange-traded funds, giving direct exposure to Top 40 indices or the Satrix INDI 25, which gives the most focused access to South Africa’s “Switzerland” companies.

In any event, investors should consider allocating at least a portion of their portfolios to momentum type investments, which benefit from consistent growth in the equity markets. Market capitalisation ETFs are ideal for this purpose.

A portion of portfolios could be allocated to value-driven active managers, but this should only be a partial allocation.

While nobody can predict the future growth of financial markets, investors run the risk of being sidelined if they react to every bit of noise coming from the short-term traders and asset managers that have clogged up the newspapers over the past yea.

This could be for many years, while the market continues recording record highs and then waiting for a recovery to be established before reinvesting. The cost of being on the sidelines is very often greater than maintaining investment in the equity market.

In the long run, the age-old mantra is true: get invested and stay invested.

Publications

Publications

Partners

Partners