Cape Town - What do people have in common who retire financially secure? They started saving early, and they didn’t ever cash in any of their pension savings.

Interest can be your friend if you’re earning it, and it can be your worst enemy if you’re paying it. Compound interest basically means you are earning interest on interest.

The earlier you start saving, the greater your compound interest will be. This is basically interest on interest or growth on growth.

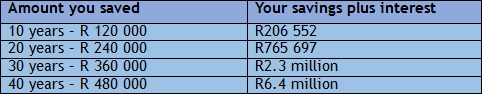

For example, an investment of R1 000 per month, growing at 10% p.a. will achieve (before any taxes) R206 552 after 10 years, R765 697 after 20 years, R2.3m after 30 years and R6.4m after 40 years. The fascinating thing is that, although you only invested R480 000 (R1 000 x 480 months) over the 40 years, your investment would have grown to R6.4m as a result of compounding.

This table shows clearly how an investment of R1 000 per month can grow in 40 years:

The importance of starting to save and invest early cannot be over-emphasised. Make the start as early as possible, even if you only begin with R100 a month – and do everything possible never to cash this money. Start now, not next year. If, for practical reasons you can’t start at 20, then start at 25, so that by the age of 40 you will begin to have a nice lump sum.

The magical ingredient is time – the more time you have, the more magic happens. Begin small and increase your savings amount over time.

Rich now, but poor later

Be money-wise from a young age, says Hedley Lamarque, Financial Planner at BDO South Africa’s Durban office. “When faced with a purchasing choice, ask yourself – do I want it or do I need it? Nowadays, young and upwardly-mobile people want that new expensive car now. It is a question of weighing up the benefits of material possessions now as opposed to having a healthy retirement package later.

He added that pension funds would provide a regular retirement income, but that most people at retirement found they needed to supplement their pension with other savings. He warned against the temptation of taking a pension pay-out when changing jobs, rather than saving it in a preservation fund.

If you decide to spend your pension pay out on a luxury item or a holiday, you will lose out significantly on the compounding effect. Don’t be tempted.

Just how long will you live?

If you don’t save – you will accumulate less for when you can’t work. People are living longer so it is more difficult to calculate how much will be enough to comfortably see you through your retirement. Not long ago, 70 years was the average life span; now people are living beyond 100 years and it won’t be long before it could be 130 years, due to advances in the medical field.

You don’t want to be forced to carry on working into your seventies, or have to rely on your children or other family to help you make ends meet.

So where do I put my money?

The main vehicles for investing are equities (including offshore exposure), property, bonds and cash, says Lamarque.

Historically the share market has always outperformed inflation in the medium to long term – over time you should get double-digit growth (above 10%) - and it offers liquidity, which means it is available quickly if you need it.

Many young investors will not have the knowledge to enter the share market directly, so unit trusts are the next best option as they offer a good spread over a number of shares. They also offer a variety of options. For example, an aggressive, high equity unit trust carries higher risk, but offers higher returns that would suit younger investors who have the luxury of time and can safely navigate a few turbulent years. As you get older you would opt for a more conservative balanced fund.

It is also advisable to diversify your portfolio, (asset-wise and geographically) as it is risky to have all your eggs in one basket.

He recommends starting to save 10% of your salary right from the beginning in unit trusts. Increase it with pay rises or promotions to keep pace with inflation. If you’re used to living without this money, you won’t feel the pinch.

Lamarque offers a few helpful tips to accumulate enough cash to start saving:

* Analyse your expenditure regularly. Do a budget and see where you can cut back on unnecessary expenses.

* Continually check for better pricing on your monthly expenses, such as insurance and bank charges – quite often you will find cheaper options.

* Cut back on luxuries such as more than one mobile contract or buy a smaller car when you are young, so you can take that first step onto the savings ladder. Accept that you have to live according to your means, and that this sometimes could involve sacrifice.

* Avoid debt. Obviously you need to balance this with your commitments, such as supporting a family, but always keep your debt as low as possible and get rid of the more expensive debt (for example credit card debt) as quickly as possible.

* Reduce your bond by increasing your monthly repayments or paying additional funds (such as your Christmas bonus) into it as soon as you receive it, and only accessing it when you absolutely have to. If you don’t touch it all, it will reduce your interest repayments.

Consider yourself a savings hero? Or just have something on your mind? Add your voice to our Savings Issue:

* Write a guest post

* Share a personal story

* Ask the experts

Publications

Publications

Partners

Partners