I WAS amazed to read of Prime Minister David Cameron’s ‘Help to Buy’ (a Home) Scheme.

One of the reasons why South Africa has not experienced the same crisis in the housing sector as America, the UK, and others is because they have NOT tried to inflate the prices of homes with too-cheap-to-be safe mortgages.

The problem with over-large mortgages, by which I mean something more than about 3.5 years’ net spendable income for a single person, lies with the following reasons:

Firstly, it inflates house prices, making the resulting valuations unsafe. The value of a home is what a potential buyer is willing and ABLE to pay. The amount that can be borrowed is a significant part of what CAN be paid.

So if you can borrow more, you will have to borrow more to compete with others who can also borrow more. Then property prices will rise.

In the International Monetary Fund Country Report on the UK, it was said that currently house prices average 4.5 times income compared to a longer-term average of 3.5 times income, a figure that chimes well with the mortgage finance theory that I have published.

Currently mortgages in the UK can finance around 4.5 times income quite easily, due to low interest rates.

Secondly, if house prices are inflated it does not mean that better homes will result. What it certainly means is that too much of a person’s retirement savings are blocked by the need to service these inflated loans before retirement savings can commence - it can take 4.39 years’ income to repay 3.5 years’ income at average interest rates, based on my UK data for the period 1970 to 2002.

At inflated mortgage sizes, once interest rates return to mean values these can cost well over 5 years’ income - even around 6 or more years’ income depending on what kind of mortgage you have and a few other factors.

I am using UK data because it is available and because the lending industry managed to stay relatively safe over that period, despite some trouble in the 1970s.

Thirdly, when interest rates rise property prices are likely to revert to their old values of around 3.5 years’ income, and because interest rates have risen, anyone with a variable rate mortgage is likely to find difficulty in meeting the repayments. More cost, less property value.

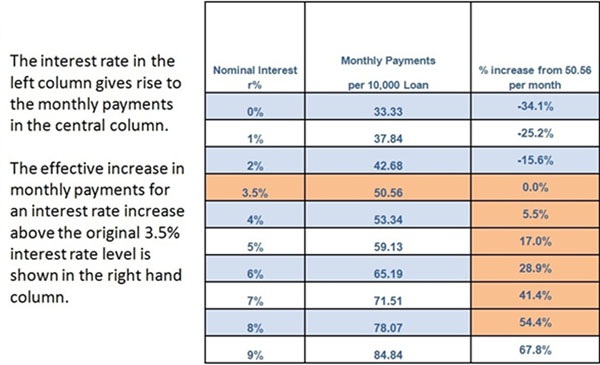

The table below is based on the actions of the Federal Reserve Bank in 2007/8. Home loans reached 3.5% interest over 30 years – which means that the figures in this table for 25-year loans would be more sensitive than this to a raise in the interest rate.

As the table shows, when the Federal Reserve raised interest rates by over 4% (intending around 4.5%) the effect on mortgage costs was going to be a 54.4% increase in costs. I really do not think that the Fed had a copy of these figures. Then they blamed subprime for the instability caused!

In fact, the problem lies with the structure of mortgage finance which interprets its costs and ‘loan/income multiples’ (amount that can be lent), in this very unstable fashion.

The same instabilities occur in South Africa but less so because the country has not taken interest rates that low. The housing sector is smaller as a result, and the instability in borrowing costs is a lot more manageable at the higher interest and inflation rates.

But the problem in South Africa is that things are still unstable, and less can be lent than could be lent using my new model for mortgage finance.

The instability problem as shown in the table above also means that the Fed is trapped into perpetuating low interest rates.

It is trapped by the mortgage model in use - this table. It is also trapped by the way government debt is structured, because that structure also gives rise to interest rate-sensitive bond values and all of the same funding problems for government that home buyers face with their fixed interest mortgages.

Fixed interest rates are fine for borrowers if incomes are rising, but are very dangerous if incomes/government revenues are falling, or if inflation rates are slipping. Borrowing costs can go way out of control. Yet if things go the other way, the value of the bonds can almost vanish. “Investor beware!”

Bond values cannot be found. It is guesswork and that guesswork about the value of bonds is the basis for pension planning and all kinds of other plans, including government budget plans.

The same kind of restructuring that I have suggested for mortgage finance if applied to government debt would reduce costs for government and create a lot of financial stability within the whole economy.

Robert Shiller just won a part of the 2013 Nobel Prize for pointing this out, but his solution has not considered how to market his bonds properly – whereas my work does this in great detail.

Going back to the UK, here is an extract from the BBC report:

Under the first phase of 'Help to Buy', launched in April, the government will give home buyers in England equity loans of up to 20% of the price of a new property worth up to £600 000.

Home buyers need to contribute at least 5% of the property price as a deposit, with a 75% mortgage to cover the rest.

Under the second phase of ‘Help to Buy’, which had been due to launch in January, the government will underwrite 15% of the value of a mortgage, allowing people to buy properties with a 5% deposit.

It will apply to all home purchases in the UK of up to £600 000.

Applications for loans from the scheme will now be brought forward to the week beginning October 7, but the loans will not be paid out until January 1. Anyone hoping to complete on their home purchase using the second phase of ‘Help to Buy’ before 2014 will not be able to.

'Less than responsible'

Adam Marshall, of the British Chambers of Commerce, said: "With all the concern expressed about Help to Buy - rushing into it seems less than responsible on the part of government.

“House prices rose at their fastest rate in more than six years in September, according to property analysts Hometrack...”

This is one of the major reasons why those economies that are using low interest rates are unstable.

- Fin24

*This is a guest post from Edward Ingram, a leading specialist in mortgage finance and macro-economic design for sustainable growth. He is pioneering an alternative model for mortgages many bankers say would be of considerable benefit to all economies, including that of South Africa.

One of the reasons why South Africa has not experienced the same crisis in the housing sector as America, the UK, and others is because they have NOT tried to inflate the prices of homes with too-cheap-to-be safe mortgages.

The problem with over-large mortgages, by which I mean something more than about 3.5 years’ net spendable income for a single person, lies with the following reasons:

Firstly, it inflates house prices, making the resulting valuations unsafe. The value of a home is what a potential buyer is willing and ABLE to pay. The amount that can be borrowed is a significant part of what CAN be paid.

So if you can borrow more, you will have to borrow more to compete with others who can also borrow more. Then property prices will rise.

In the International Monetary Fund Country Report on the UK, it was said that currently house prices average 4.5 times income compared to a longer-term average of 3.5 times income, a figure that chimes well with the mortgage finance theory that I have published.

Currently mortgages in the UK can finance around 4.5 times income quite easily, due to low interest rates.

Secondly, if house prices are inflated it does not mean that better homes will result. What it certainly means is that too much of a person’s retirement savings are blocked by the need to service these inflated loans before retirement savings can commence - it can take 4.39 years’ income to repay 3.5 years’ income at average interest rates, based on my UK data for the period 1970 to 2002.

At inflated mortgage sizes, once interest rates return to mean values these can cost well over 5 years’ income - even around 6 or more years’ income depending on what kind of mortgage you have and a few other factors.

I am using UK data because it is available and because the lending industry managed to stay relatively safe over that period, despite some trouble in the 1970s.

Thirdly, when interest rates rise property prices are likely to revert to their old values of around 3.5 years’ income, and because interest rates have risen, anyone with a variable rate mortgage is likely to find difficulty in meeting the repayments. More cost, less property value.

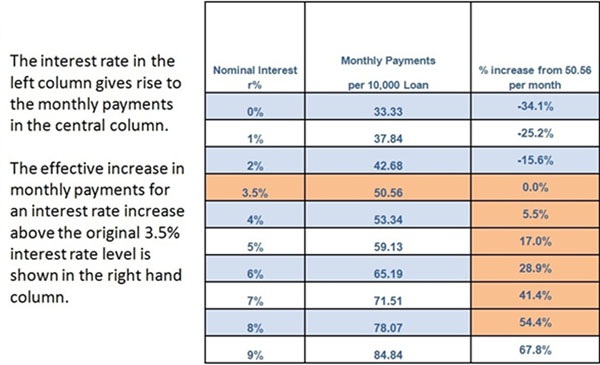

The table below is based on the actions of the Federal Reserve Bank in 2007/8. Home loans reached 3.5% interest over 30 years – which means that the figures in this table for 25-year loans would be more sensitive than this to a raise in the interest rate.

In fact, the problem lies with the structure of mortgage finance which interprets its costs and ‘loan/income multiples’ (amount that can be lent), in this very unstable fashion.

The same instabilities occur in South Africa but less so because the country has not taken interest rates that low. The housing sector is smaller as a result, and the instability in borrowing costs is a lot more manageable at the higher interest and inflation rates.

But the problem in South Africa is that things are still unstable, and less can be lent than could be lent using my new model for mortgage finance.

The instability problem as shown in the table above also means that the Fed is trapped into perpetuating low interest rates.

It is trapped by the mortgage model in use - this table. It is also trapped by the way government debt is structured, because that structure also gives rise to interest rate-sensitive bond values and all of the same funding problems for government that home buyers face with their fixed interest mortgages.

Fixed interest rates are fine for borrowers if incomes are rising, but are very dangerous if incomes/government revenues are falling, or if inflation rates are slipping. Borrowing costs can go way out of control. Yet if things go the other way, the value of the bonds can almost vanish. “Investor beware!”

Bond values cannot be found. It is guesswork and that guesswork about the value of bonds is the basis for pension planning and all kinds of other plans, including government budget plans.

The same kind of restructuring that I have suggested for mortgage finance if applied to government debt would reduce costs for government and create a lot of financial stability within the whole economy.

Robert Shiller just won a part of the 2013 Nobel Prize for pointing this out, but his solution has not considered how to market his bonds properly – whereas my work does this in great detail.

Going back to the UK, here is an extract from the BBC report:

Under the first phase of 'Help to Buy', launched in April, the government will give home buyers in England equity loans of up to 20% of the price of a new property worth up to £600 000.

Home buyers need to contribute at least 5% of the property price as a deposit, with a 75% mortgage to cover the rest.

Under the second phase of ‘Help to Buy’, which had been due to launch in January, the government will underwrite 15% of the value of a mortgage, allowing people to buy properties with a 5% deposit.

It will apply to all home purchases in the UK of up to £600 000.

Applications for loans from the scheme will now be brought forward to the week beginning October 7, but the loans will not be paid out until January 1. Anyone hoping to complete on their home purchase using the second phase of ‘Help to Buy’ before 2014 will not be able to.

'Less than responsible'

Adam Marshall, of the British Chambers of Commerce, said: "With all the concern expressed about Help to Buy - rushing into it seems less than responsible on the part of government.

“House prices rose at their fastest rate in more than six years in September, according to property analysts Hometrack...”

This is one of the major reasons why those economies that are using low interest rates are unstable.

- Fin24

*This is a guest post from Edward Ingram, a leading specialist in mortgage finance and macro-economic design for sustainable growth. He is pioneering an alternative model for mortgages many bankers say would be of considerable benefit to all economies, including that of South Africa.

Publications

Publications

Partners

Partners