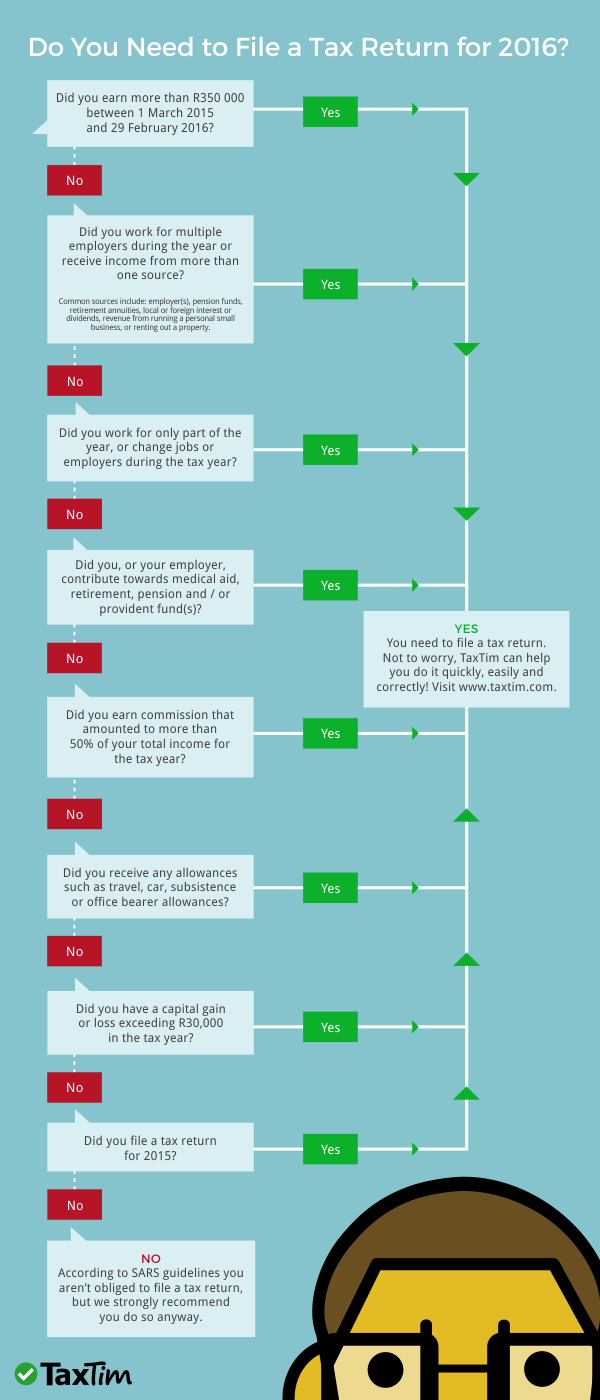

It is that time of the year where everyone is talking about doing their tax returns before the 25 November 2016 deadline for regular taxpayers (i.e. not provisional taxpayers). Should you be one of them? Should you be rushing to make sure that your tax information is in order?

SARS issued a statement before the opening of tax season that stated if you earned below R350 000 for the 2016 tax year, being 1 March 2015 to 29 February 2016, you need not worry about filing a tax return. This information has been misunderstood by some taxpayers leading to many believing they do not need to file a tax return when, in fact, they should. This is because apart from the R350 000 amount, there are several other criteria you need to satisfy in order to be excused from filing a tax return.

The Risks of Not Filing a Tax Return

Publications

Publications

Partners

Partners