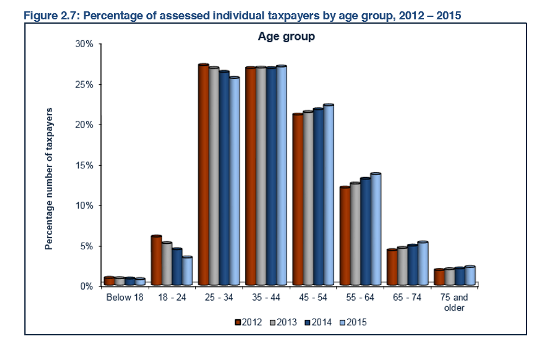

Johannesburg – Almost a third (27%) of taxable income is earned by tax payers aged between 35 and 44, the latest Tax Statistics report revealed.

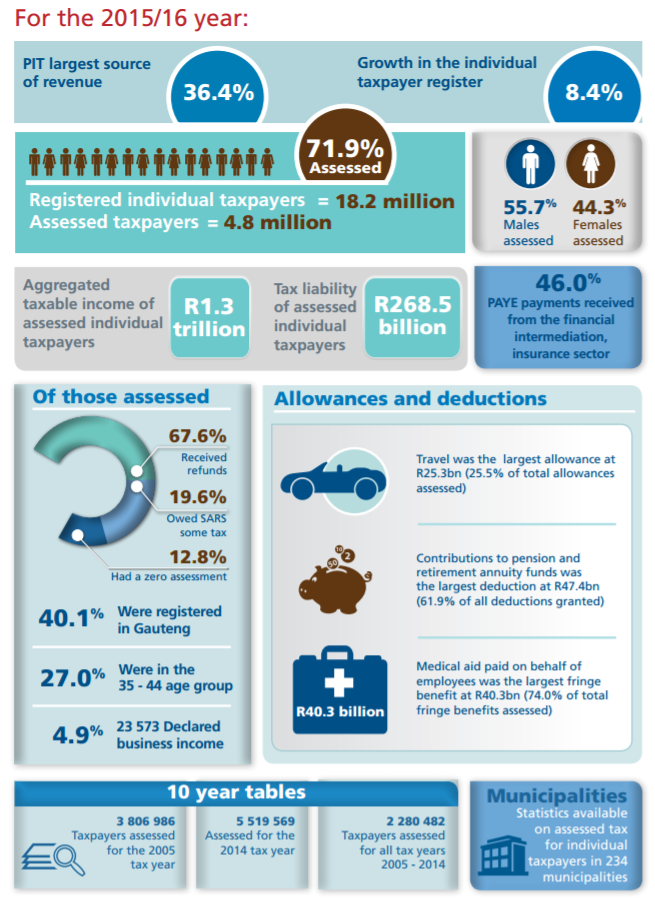

The Tax Statistics report, published jointly by National Treasury and the South African Revenue Service (Sars) was released last month. It takes the tax register as at March 2016, focusing mainly on the 2015 tax year. There are 18.2m registered taxpayers.

The aggregated taxable income was R1.3trn, but the tax liability of assessed individuals came to R268.5bn.

The age group 35 to 44 of tax payers contributes nearly a third of the total tax assessed, the report stated.

READ: 7 things to know from the latest tax statistics report

Trends show that the proportion of taxpayers aged over 35 has grown in 2015. The representation in age groups younger than 35 have declined. This is mainly due to the increase in the submission threshold. Younger tax payers probably would not have submitted returns.

In 2015, the income tax threshold for those younger than 65 was R70 700, for those older than 65 it was R110 200, and for those older than 75 it was R123 350.

ALSO READ: About 40% of SA taxpayers registered in Gauteng

The report also showed that the percentage of female tax payers has increased. About 44.3% of females were assessed for tax, this was up from 42.2% in 2012. More females than males became liable for submitting tax returns as their earnings increased above the threshold.

Females earned 37.2% of taxable income and contributed 31% of the tax assessed. “[They] were liable for tax of R39 290 at an effective rate of 16.6%,” the report stated.

Males accounted for 55.7% of tax which was assessed. “[They] were liable for tax of R69 416 at an effective rate of 21.9%.”

“Females on average earned 25.4% less than males, as measured by taxable income, and were liable for 43.4% less tax than males,” the report stated.

As taxable income increased, the proportion of female taxpayers decreased. Only 26.6% of taxpayers with taxable income between R750 000 and R1m in 2015 were female. Females accounted for 12.4% of taxable income of more than R5m.

Further, income from salaries, wages and remuneration as well as pension, overtime and annuities accounted for 63.6% of total taxable income. This is more than 5m individual taxpayers.

The infographic below shows tax collections for the 2015 tax year:

Read Fin24's top stories trending on Twitter: Fin24’s top stories

Publications

Publications

Partners

Partners