Johannesburg – Taxes on income and profits contributed more than half (56.7%) of the total tax revenue of R1.07tr for the year 2015/16.

These are just some of the facts listed in the ninth edition of the annual Tax Statistics publication. The report is published jointly by National Treasury and the South African Revenue Services (Sars). It takes the tax register as at March 2016.

The report indicated that total tax revenue was up 8.5% from the previous year’s (2014/15) revenue of R83.7bn. It also showed that 80.8% of income revenue was generated from personal income tax (36.4%), corporate income tax (18.1%) and VAT (26.3%). Further, personal income tax grew by 10% or R35.4bn.

On Monday, Sars announced it received 5.74m tax returns by the close of the tax season on November 25.

READ: Sars receives 5.74 million submissions as tax hikes loom

Here are seven key findings from the Tax Statistics report:

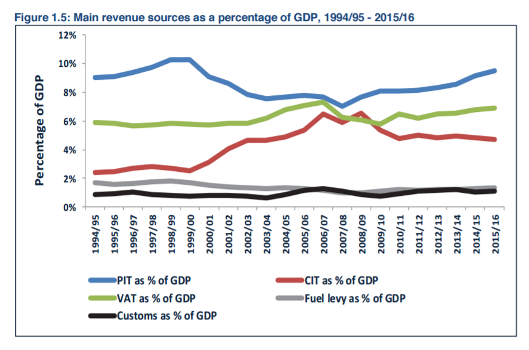

1. The global financial crisis (GFC) impacted all tax types, but mainly corporate income tax (CIT). Following the GFC, tax revenue from CIT (corporate income tax) declined from 20.6% reported in 2011/12 to 18.1% in 2015/16. Personal income tax (PIT) contributions increased from 33.8% in 2011/12 to 36.4% in 2015/16. PIT provided R195.9bn more than CIT in 2015/16, according to the report. VAT contributions remained fairly constant, increasing marginally from 25.7% in 2011/12 to 26.3% in 2015/16.

2. The Tax-to-GDP ratio, which measures the tax effort of the government, increased from 25.5% in 2014/15 to 26.2% in 2015/16. This is the highest tax-to-GDP ratio achieved in the past eight years. Before the GFC, the tax-to-GDP ratio peaked at 26.4% in 2007/08. This was mainly driven by the commodity boom and reforms in the financial sector. Following the GFC, the Tax-to-GDP ratio dipped to 23.5% in 2009/10.

3. The cost of revenue collections ratio decreased from 0.97% in the previous tax year to 0.96%. This is within the international benchmark of 1%, according to the report. The cost of tax revenue collection indicates the efficiency of Sars in collecting revenue. In the past five years the ratio has ranged around the 1% mark, reporting a high of 1.11% in 2011/12. This indicates that Sars has contained operational costs while increasing the amount of revenue collected, the report stated.

4. The number of individuals registered for PIT increased to 19.1m, as at March 31, 2016. This is up 4.9% from 18.2m recorded in the previous year. The increase is a result of a new requirement by Sars for employers to register all employees as taxpayers, regardless of their tax liability. Sars has also implemented tax education and outreach and enforcement programmes to increase the number of registered taxpayers.

5. The number of companies registered for CIT increased by 11.7% from 2.9m in 2014/15 to nearly 3.3m in 2015/16. Of these, 900 000 submitted income tax returns. The number of vendors registered for VAT increased by 4.1% to 706 874.

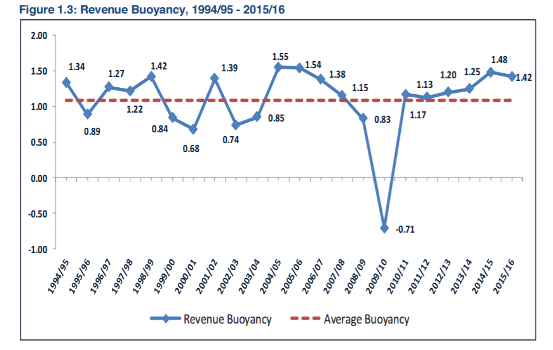

6. The tax buoyancy ratio, which measures the sensitivity of tax revenues to economic growth, shows a recovery from -0.71 in 2009/10 to 1.42 in 2015/16. This shows that collections remained buoyant despite tough economic conditions.

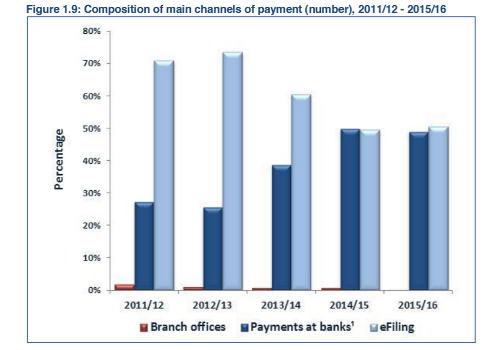

7. The majority of taxpayers migrated to electronic payment platforms via eFiling. Cash payments at branches have also reduced significantly, the report stated. About three quarters (75.9%) of payments were made through eFiling compared to the figure in 2011/12 where eFiling payments only accounted for 64.2% of total payments.

Read Fin24's top stories trending on Twitter: Fin24’s top stories

Publications

Publications

Partners

Partners