My friend and I are contemplating relocating to South Africa after 10 years abroad.

Upon seeking employment we have experienced a remarkably positive response and were quite enthusiastic about our decided return. Then we were advised of taxes.

We were advised that should someone receive an annual salary in the range of R700 000, he/she would be left with around R500 000 after tax deductions. That seems like a lot of money.

As we are more familiar with the European tax system, we were wondering if you could help us by explaining the healthcare, educational and social security benefits that that R200 000 every year, or R1 000 000 every five years, pays for.

We have been advised that there are no benefits, but I am certain that there is no way that this could be true. And so we would really appreciate some accurate advice from the people in the know rather than disgruntled individuals complaining about the country.

I apologise if these questions seem trivial, but we have never been employed in the country and the numbers are just not making sense.

We know we do not have accurate information, but from what we can tell it appears 40% is tax, 30% mortgage, 10% transport, 15% provident fund, 5% left to live.

Also, we have been told that one has to pay for one's own medical aid and security and that topped with the provident fund it seems as though there's a either a misunderstanding or a duplication in what tax pays for and what we are opting to pay for.

My friend is in the UK where government housing and medical aid as well as social security is really not bad. I am in the UAE where medical aid is provided for by the employer and housing is either provided by the employer or an allowance is given.

Participating in a retirement fund is at your discretion. But there is no income tax here, so we are really and truly at a loss.

Look, our bags are packed to leave in a week and we are pretty much ready to come home, but if this information is correct, while we still have an option to stay where we are we would really appreciate your guidance in this regard.

I have emailed the South African Revenue Service and tried again on their Facebook page. I'm sure we'll get a response but if you could guide us before then, it will really be a huge help in making an informed decision.

FISA member Cheryl Howard and Janet Malcolm, tax consultant at Cheryl Howard & Associates, respond:

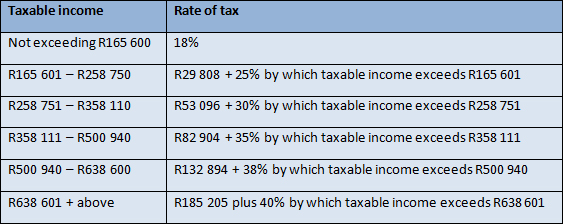

In South Africa individuals are taxed on a sliding scale. See the table below for details of the amount of tax payable in the 2014 tax year (01/03/2013 – 28/02/2014):

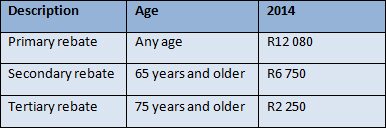

We have a personal tax rebate deductible from the tax liability as follows:

Based on a salary of R700 000 (assuming no taxable investment income or capital gains), your tax liability after rebates will be R197 685, giving you a take home salary of R502 315. Your marginal tax rate is 28.24%.

There is an interest exemption of R23 800 per annum from interest earned on local bank accounts. All dividend income is exempt from tax in the hands of the individual, but subject to a 15% withholding tax by the company paying the dividend.

Becoming a South African resident and taxpayer means that you are taxed on your worldwide income from all investments and bank accounts.

It is important to ascertain whether you will become a permanent resident in South Africa, i e retiring here and making this the place of your permanent residence, or a temporary resident.

If you are temporarily a resident, you only become a tax resident in the fourth year, based on the number of days living in South Africa over a three-year rolling average. There are factors, other than the number of days living in South Africa, that are taken into consideration when determining permanent versus temporary tax residency.

If you return to South Africa as an immigrant, there is a deemed capital gains tax event – although it does not give rise to an immediate tax liability.

Your foreign assets are valued at the date of becoming a South African resident. These assets are then treated as being South African in nature.

When you sell an asset, there will be a capital gains tax effect based on the difference between the value of the asset at the date of entry into South Africa and the proceeds. The capital gains made are included into taxable income at a rate of 33.3%.

There is firstly an annual exclusion of R30 000. So if you have a gain of R100 000, the amount included in your taxable income would be R100 000 – R30 000 = R70 000 * 33.3% = R23 310.

This amount would then be taxed with the rest of your taxable income, and the rate would depend on where you are on the sliding scale table.

The government does provide free medical care, but if it is affordable people elect to go private.

Private medical aid is expensive and for an individual costs approximately R2 500 per month. There is a tax credit of R230 per month deducted from the net tax liability.

The credit is however only computed on assessment. If an employer contributes on behalf of an employee to a medical aid, this would be a taxable fringe benefit and taxed as per the normal income rates.

Contributions to pension, provident funds or retirement annuity funds are either optional or a condition of employment.

A tax deduction is provided where contributions are made, but would depend on which fund you contribute to and the amount of your taxable income.

Other expenses you mentioned were mortgage and travel. Mortgage expenses would be for private account with no tax deduction. If an employer provided housing this would be a taxable fringe benefit in the hands of the individual, subject to a formula.

Travelling expenses are private, but an individual travelling for business purposes can claim a travel allowance, which would be a tax deductible expense as long as the necessary requirements are fulfilled.

Other taxes payable:

• 14% VAT on most purchases (consumables);

• Transfer duty on the purchase of a property, in terms of a sliding scale based on the purchase price of the property;

• Property – rates payable on the value of the property;

• Travelling – toll road taxes (currently being introduced);

• Estate duty – 20% on date of death;

• Donations tax – 20% of donations made (deduction where donations are made to charitable institutions).

In short, in South Africa the more you earn, the more you pay. There are however other advantages to living here, which must be experienced to be understood. We hope this doesn’t deter you!

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners