<a href=\\http://www.shutterstock.com\\>Shuttertstock</a>

A Fin24 user is about to be retrenched and is looking at the best options for investing his pension. He writes:

I stand on the brink of being retrenched in the next three months. My pension is about R684 000.

I would like to take a certain amount. and want to know at what amount you get taxed, and how much.

Also, what is best: to withdraw the whole amount and invest it in a bank account that draws a nice interest, or to buy an annuity?

Raul Jorge CFP®, a Certified Financial Planner of PSG Tyger Waterfront, responds:

Based on the information provided, your age and career intentions are unclear.

I have therefore assumed that you still want to work and have not yet made sufficient provision towards your retirement.

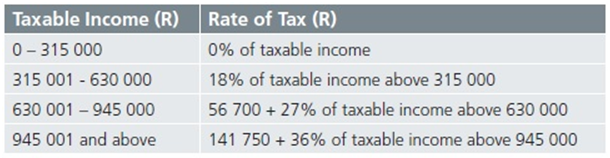

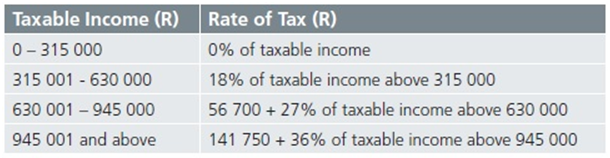

Pension fund withdrawals in the event of retrenchment are taxed as follows:

Assuming that you have not previously withdrawn or taken lump sums from other retirement funds, the first R315 000 plus any contributions, which did not previously qualify as a deduction, would be tax free.

The portion of your lump sum that exceeds this exemption amount will be taxed according to the sliding scales above.

It is, however, important to note that if you withdraw this tax-free benefit, it will reduce the amount you are able to receive tax-free from any other retirement funds to which you belong in future.

This is because all previous withdrawals are taken into account when determining the tax payable on retirement funds.

Based on the tax implications, it would not be in your best interest to withdraw the full amount.

A more favourable option would be to transfer the remaining fund value to a unit trust-based pension preservation fund, so as to reinvest your remaining benefit tax free.

Preservation funds are investment vehicles through which you can preserve your retirement savings upon resignation until retirement.

These funds enable you to preserve your pension savings tax free while still retaining the option to make a withdrawal of up to 100% of the fund value before the age of 55.

Age matters

If you are still young enough to continue working, you should try to preserve as much of your accumulated retirement savings as possible.

If you require further funds in future, you will still have the option to make a withdrawal from your preservation fund as specified above.

You should ideally only withdraw as much as you need to meet your financial obligations (if applicable). to minimise the tax effect and loss of compound interest on your investment.

Bank accounts do not outperform inflation, which will result in a drop in your money’s purchasing power.

If you want to beat inflation, you need exposure to growth assets such as property and equity.

This can be done via your unit trust-based preservation fund.

This response is based on the limited information provided. It is always a good idea to talk to an independent financial planner or tax practitioner who will have all the relevant information to give you the best possible advice.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

I stand on the brink of being retrenched in the next three months. My pension is about R684 000.

I would like to take a certain amount. and want to know at what amount you get taxed, and how much.

Also, what is best: to withdraw the whole amount and invest it in a bank account that draws a nice interest, or to buy an annuity?

Raul Jorge CFP®, a Certified Financial Planner of PSG Tyger Waterfront, responds:

Based on the information provided, your age and career intentions are unclear.

I have therefore assumed that you still want to work and have not yet made sufficient provision towards your retirement.

Pension fund withdrawals in the event of retrenchment are taxed as follows:

Assuming that you have not previously withdrawn or taken lump sums from other retirement funds, the first R315 000 plus any contributions, which did not previously qualify as a deduction, would be tax free.

The portion of your lump sum that exceeds this exemption amount will be taxed according to the sliding scales above.

It is, however, important to note that if you withdraw this tax-free benefit, it will reduce the amount you are able to receive tax-free from any other retirement funds to which you belong in future.

This is because all previous withdrawals are taken into account when determining the tax payable on retirement funds.

Based on the tax implications, it would not be in your best interest to withdraw the full amount.

A more favourable option would be to transfer the remaining fund value to a unit trust-based pension preservation fund, so as to reinvest your remaining benefit tax free.

Preservation funds are investment vehicles through which you can preserve your retirement savings upon resignation until retirement.

These funds enable you to preserve your pension savings tax free while still retaining the option to make a withdrawal of up to 100% of the fund value before the age of 55.

Age matters

If you are still young enough to continue working, you should try to preserve as much of your accumulated retirement savings as possible.

If you require further funds in future, you will still have the option to make a withdrawal from your preservation fund as specified above.

You should ideally only withdraw as much as you need to meet your financial obligations (if applicable). to minimise the tax effect and loss of compound interest on your investment.

Bank accounts do not outperform inflation, which will result in a drop in your money’s purchasing power.

If you want to beat inflation, you need exposure to growth assets such as property and equity.

This can be done via your unit trust-based preservation fund.

This response is based on the limited information provided. It is always a good idea to talk to an independent financial planner or tax practitioner who will have all the relevant information to give you the best possible advice.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners