(Shutterstock)

A Fin24 user has a question about capital gains tax. She writes:

I am married out of community of property. I am 60 years old and my husband and I live in a house registered in his name. It is our main residence.

If we buy a property in my name (plot and plan), build a house and put it back on the market, sell it and make about R900 000 in profit, how would this affect me?

I have some money invested, which I will need to build the house. I work part-time during the week for a monthly salary of R3 000 and have no other assets.

What amount will be considered for CGT and how is it going to affect my personal income?

Nichola Walker-Woodard of HWD Attorneys responds:

The first step when looking at any transaction is to decide whether it is an "income of nature" or "capital of nature" transaction.

This will help determine whether the amount is subject to capital gains as capital gains tax applies to disposals of a capital nature, but not to those that are income of nature.

Central to the classification is the taxpayer’s intention.

As this is a very subjective test, the South African Revenue Service (Sars) has needed to establish certain factors which assist it in determining whether the intention of making the profit/gain is revenue or capital in nature.

The following factors are relevant for the current question:

If the dominant intention of buying the plot, building the house and reselling is to do so as an investment, the profit resulting from the transaction is normally regarded as capital in nature and thus subject to capital gains tax.

However, if you purchase the plot, build a house thereon and resell the property to make a profit, you are regarded by Sars as having a "speculative intention" with the plot being acquired as trading stock with the intention of resale at a profit.

If a speculative intention is present, Sars will see the transaction as income of nature.

However, if there were mixed intentions (that is both investment and speculative), the dominant intention needs to be established.

If we assume that your ultimate actions support the deduction/assumption by Sars that the intention of the purchase, development and eventual sale was an investment and thus is capital of nature, we look at the capital gains tax consequences of this transaction:

In order to calculate capital gains, one needs to deduct the “base cost” from the “proceeds”.

Generally, this means the purchase price must be deducted from the proceeds of the sale of the property.

However, the base cost will also be increased if certain improvements or repairs are made to the property.

Given that you intend to build on the plot, the base cost will need to be increased and thus your capital gain will be less, which acts in your favour.

As we do not know what the quantum of the improvement and repair costs will be, let’s assume that none are done and the property is sold resulting in the R900 000 gain.

The next step after calculating the gain is to consider whether any of the deductions allowed by Sars apply to this gain.

For example, if the property is bought and sold in the name of an individual, then an amount of R30 000 is deducted from the capital gain.

Further, if the property that is sold was your primary residence, you will be entitled to deduct up to R2m in the form of a primary residence deduction.

After affecting the deductions, you will arrive at a net taxable capital gain which must be included in your taxable income.

It might be easier to understand by example:

Let’s assume that:

- The gain is R 900 000

- There were no improvements or repair costs;

- Both the purchaser and seller are individuals and

- It was not the seller’s primary residence.

Capital Gain 900 000.00

Less: Individual's annual exclusion -30 000.00

870 000.00

Multiplied by: Inclusion rate of 33.33% 290 000.00

R290 000 will therefore be included in your taxable income. Thus, the ultimate amount of capital gains tax payable will depend on your personal tax bracket.

If you earn income of R3 000 per month, you will, without the sale of the property, not pay any tax as you are earning less than R67 111 per annum.

To explain this in more detail:

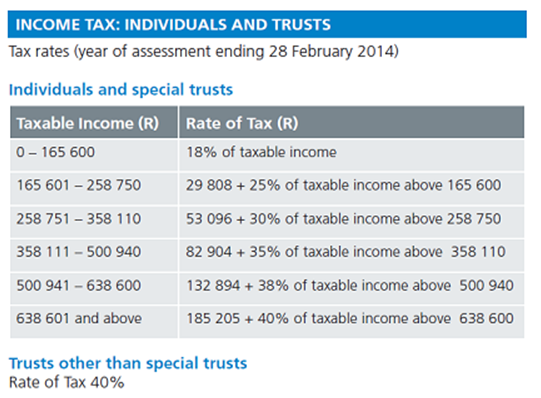

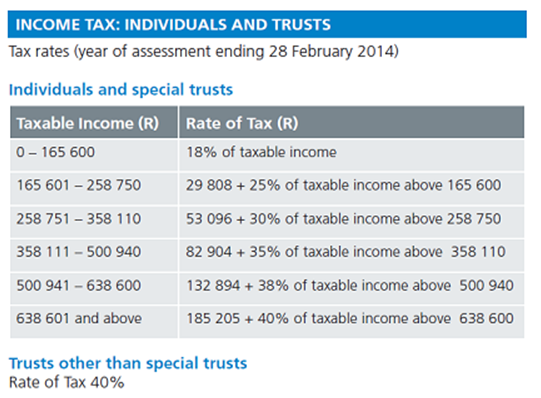

When you are looking at what your taxable income will be, you need to look at which tax bracket you fall under:

If your taxable income is less than R 165 600, your income is subject to an 18% income tax rate.

In other words, if you are earning R36 000 per annum, your income tax would be R 36 000 x 18% = R 6480.

However, each individual (irrespective of his/her age) is entitled to a primary rebate of R12 080.

This means that you deduct up to R 12 080 from your income tax calculated in terms of the table.

As the R6 480 is less than R12 080, there is no income tax payable if you are earning R36 000 per annum.

An easy way to get to the same conclusion is to say that R36 000 is below the "tax threshold" of R 67 111 (R67 111.00 * 18% = the R 12 080 primary rebate).

However, when we add the gain of R 290 000 to the R36 000 annual salary, you again need to consider what tax bracket you fall into due to the additional amount added to your taxable income.

In the present case, a taxable income of R326 000 results in the obligation to pay R53 096 together with 30% of the taxable income above R 258 750.

In other words: R 53 096.00 + [(R326 000.00- R 258 750.00)*30%] = R 53 096.00 + R 20 175.00 = R 73 271.00, less the primary rebate of R 12 080.00 = R 61 191.00.

Thus, the gain from the sale of the developed plot results in you moving from not being liable for any income tax to paying a substantial amount.

In summary:

- If the purchase of the plot, the development thereon and the subsequent sale of the property is seen by Sars as being a speculative transaction, the profit will be regarded as revenue of nature.

Then, the entire profit made from the sale will be subject to income tax rather than capital gains tax.

- However, if the purchase of the plot, the development thereon and the subsequent sale of the property is seen by Sars as being capital of nature, the gain will be subject to capital gains tax with the capital gain being included in taxable income at the capital gain inclusion rate.

- Either way, the result to you will be that you will jump from being an individual with a income tax payable of nil to an individual that will, in the year of sale, be subject to income tax depending on the gain and the tax bracket you are pushed into due to the said gain.

A suggestion made by a Fin24 user is that you could purchase the plot with your spouse so that the eventual gain can be split between you two.

However, be sure to determine what the consequences for your spouse are if half of the gain is to be taken into account when calculating his/her income tax.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

I am married out of community of property. I am 60 years old and my husband and I live in a house registered in his name. It is our main residence.

If we buy a property in my name (plot and plan), build a house and put it back on the market, sell it and make about R900 000 in profit, how would this affect me?

I have some money invested, which I will need to build the house. I work part-time during the week for a monthly salary of R3 000 and have no other assets.

What amount will be considered for CGT and how is it going to affect my personal income?

Nichola Walker-Woodard of HWD Attorneys responds:

The first step when looking at any transaction is to decide whether it is an "income of nature" or "capital of nature" transaction.

This will help determine whether the amount is subject to capital gains as capital gains tax applies to disposals of a capital nature, but not to those that are income of nature.

Central to the classification is the taxpayer’s intention.

As this is a very subjective test, the South African Revenue Service (Sars) has needed to establish certain factors which assist it in determining whether the intention of making the profit/gain is revenue or capital in nature.

The following factors are relevant for the current question:

If the dominant intention of buying the plot, building the house and reselling is to do so as an investment, the profit resulting from the transaction is normally regarded as capital in nature and thus subject to capital gains tax.

However, if you purchase the plot, build a house thereon and resell the property to make a profit, you are regarded by Sars as having a "speculative intention" with the plot being acquired as trading stock with the intention of resale at a profit.

If a speculative intention is present, Sars will see the transaction as income of nature.

However, if there were mixed intentions (that is both investment and speculative), the dominant intention needs to be established.

If we assume that your ultimate actions support the deduction/assumption by Sars that the intention of the purchase, development and eventual sale was an investment and thus is capital of nature, we look at the capital gains tax consequences of this transaction:

In order to calculate capital gains, one needs to deduct the “base cost” from the “proceeds”.

Generally, this means the purchase price must be deducted from the proceeds of the sale of the property.

However, the base cost will also be increased if certain improvements or repairs are made to the property.

Given that you intend to build on the plot, the base cost will need to be increased and thus your capital gain will be less, which acts in your favour.

As we do not know what the quantum of the improvement and repair costs will be, let’s assume that none are done and the property is sold resulting in the R900 000 gain.

The next step after calculating the gain is to consider whether any of the deductions allowed by Sars apply to this gain.

For example, if the property is bought and sold in the name of an individual, then an amount of R30 000 is deducted from the capital gain.

Further, if the property that is sold was your primary residence, you will be entitled to deduct up to R2m in the form of a primary residence deduction.

After affecting the deductions, you will arrive at a net taxable capital gain which must be included in your taxable income.

It might be easier to understand by example:

Let’s assume that:

- The gain is R 900 000

- There were no improvements or repair costs;

- Both the purchaser and seller are individuals and

- It was not the seller’s primary residence.

Capital Gain 900 000.00

Less: Individual's annual exclusion -30 000.00

870 000.00

Multiplied by: Inclusion rate of 33.33% 290 000.00

R290 000 will therefore be included in your taxable income. Thus, the ultimate amount of capital gains tax payable will depend on your personal tax bracket.

If you earn income of R3 000 per month, you will, without the sale of the property, not pay any tax as you are earning less than R67 111 per annum.

To explain this in more detail:

When you are looking at what your taxable income will be, you need to look at which tax bracket you fall under:

If your taxable income is less than R 165 600, your income is subject to an 18% income tax rate.

In other words, if you are earning R36 000 per annum, your income tax would be R 36 000 x 18% = R 6480.

However, each individual (irrespective of his/her age) is entitled to a primary rebate of R12 080.

This means that you deduct up to R 12 080 from your income tax calculated in terms of the table.

As the R6 480 is less than R12 080, there is no income tax payable if you are earning R36 000 per annum.

An easy way to get to the same conclusion is to say that R36 000 is below the "tax threshold" of R 67 111 (R67 111.00 * 18% = the R 12 080 primary rebate).

However, when we add the gain of R 290 000 to the R36 000 annual salary, you again need to consider what tax bracket you fall into due to the additional amount added to your taxable income.

In the present case, a taxable income of R326 000 results in the obligation to pay R53 096 together with 30% of the taxable income above R 258 750.

In other words: R 53 096.00 + [(R326 000.00- R 258 750.00)*30%] = R 53 096.00 + R 20 175.00 = R 73 271.00, less the primary rebate of R 12 080.00 = R 61 191.00.

Thus, the gain from the sale of the developed plot results in you moving from not being liable for any income tax to paying a substantial amount.

In summary:

- If the purchase of the plot, the development thereon and the subsequent sale of the property is seen by Sars as being a speculative transaction, the profit will be regarded as revenue of nature.

Then, the entire profit made from the sale will be subject to income tax rather than capital gains tax.

- However, if the purchase of the plot, the development thereon and the subsequent sale of the property is seen by Sars as being capital of nature, the gain will be subject to capital gains tax with the capital gain being included in taxable income at the capital gain inclusion rate.

- Either way, the result to you will be that you will jump from being an individual with a income tax payable of nil to an individual that will, in the year of sale, be subject to income tax depending on the gain and the tax bracket you are pushed into due to the said gain.

A suggestion made by a Fin24 user is that you could purchase the plot with your spouse so that the eventual gain can be split between you two.

However, be sure to determine what the consequences for your spouse are if half of the gain is to be taken into account when calculating his/her income tax.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners