(Shutterstock)

A Fin24 user is able to save R1 000 per month, but is not sure how. He writes:

I need investment advice on what can I do with a R1 000 per month savings?

Arrie Rautenbach, Absa's head of retail banking responds.

Saving and investing your money is vital to the growth of your financial prosperity.

We understand that you work hard for your money and that you want your money to begin working hard for you.

Saving is a great way of "storing" money safely and putting it away for emergencies or a short-term goal.

Your capital is secure, it can be accessed relatively easily and, typically, you will earn a modest rate of interest in return.

Investing requires more discipline over a longer term to ensure that you grow your money in real terms.

Investing in this manner enables you to plan for significant stages in your life, such as educating your child or planning for your retirement.

The first step is to decide whether a savings account or an investment account will best suit your financial plan.

Then you can choose the one that best suits your needs and budget and begin saving today.

It is never too late to invest in your future.

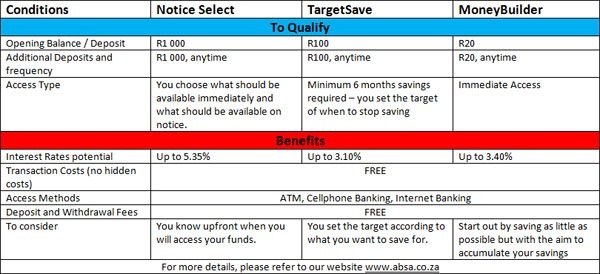

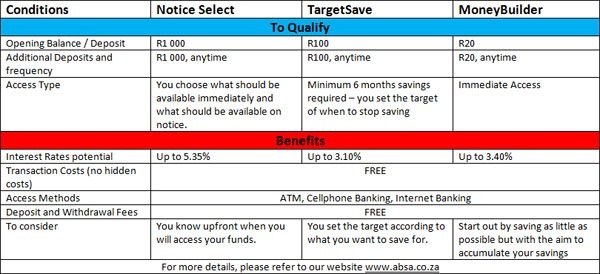

You can start saving as little as R20 per month, but let's look at the options if you would like to save R1 000 per month.

Absa offers a wide range of products and as mentioned the first step is to decide which plan would best suit your financial needs.

Joint Solutions

Absa offers a range of saving and investing solutions for informal groups of two or more people who would like to save together.

Whether you manage a club, or want to contribute with others towards a child’s education, Absa’s joint solutions range offers uncomplicated, flexible ways of sharing a common financial goal with a group of like-minded people.

- Club Account: A group savings and transactional account designed to simplify savings amongst two or more people;

- FuturePlan: A savings plan that allows a number of people to contribute towards a child’s education.

- Absa Islamic Banking also offers a variety of savings and investment solutions that operate in strict compliance with Shar'iah Law.

Absa Islamic Banking is advised and guided by the independent Shar'iah Supervisory Board, a panel of experts in Shar'iah Law and its application in economics.

We understand that customers who seek Shar'iah-compliant banking solutions have essentially the same banking requirements as other customers, and our solutions are developed to ensure you are able to manage your personal finances with ease, freedom and flexibility.

Islamic Banking is an alternative to conventional banking that is available to anyone who seeks a different approach to financial services, not only for members of the Muslim community who wish to operate financially in line with Shar'iah Law.

- Islamic TargetSave: A monthly savings plan that will produce returns at the end of the calendar year, based on the Mudarabah pre-agreed profit-share principle.

- Islamic Term Deposit: A Shari'ah-compliant fixed deposit account that offers a range of returns over a selection of investment periods.

I trust this provides a view of the many solutions that Absa offers our clients.

Remember saving is hard, but the rewards are worth the wait.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

I need investment advice on what can I do with a R1 000 per month savings?

Arrie Rautenbach, Absa's head of retail banking responds.

Saving and investing your money is vital to the growth of your financial prosperity.

We understand that you work hard for your money and that you want your money to begin working hard for you.

Saving is a great way of "storing" money safely and putting it away for emergencies or a short-term goal.

Your capital is secure, it can be accessed relatively easily and, typically, you will earn a modest rate of interest in return.

Investing requires more discipline over a longer term to ensure that you grow your money in real terms.

Investing in this manner enables you to plan for significant stages in your life, such as educating your child or planning for your retirement.

The first step is to decide whether a savings account or an investment account will best suit your financial plan.

Then you can choose the one that best suits your needs and budget and begin saving today.

It is never too late to invest in your future.

You can start saving as little as R20 per month, but let's look at the options if you would like to save R1 000 per month.

Absa offers a wide range of products and as mentioned the first step is to decide which plan would best suit your financial needs.

Joint Solutions

Absa offers a range of saving and investing solutions for informal groups of two or more people who would like to save together.

Whether you manage a club, or want to contribute with others towards a child’s education, Absa’s joint solutions range offers uncomplicated, flexible ways of sharing a common financial goal with a group of like-minded people.

- Club Account: A group savings and transactional account designed to simplify savings amongst two or more people;

- FuturePlan: A savings plan that allows a number of people to contribute towards a child’s education.

- Absa Islamic Banking also offers a variety of savings and investment solutions that operate in strict compliance with Shar'iah Law.

Absa Islamic Banking is advised and guided by the independent Shar'iah Supervisory Board, a panel of experts in Shar'iah Law and its application in economics.

We understand that customers who seek Shar'iah-compliant banking solutions have essentially the same banking requirements as other customers, and our solutions are developed to ensure you are able to manage your personal finances with ease, freedom and flexibility.

Islamic Banking is an alternative to conventional banking that is available to anyone who seeks a different approach to financial services, not only for members of the Muslim community who wish to operate financially in line with Shar'iah Law.

- Islamic TargetSave: A monthly savings plan that will produce returns at the end of the calendar year, based on the Mudarabah pre-agreed profit-share principle.

- Islamic Term Deposit: A Shari'ah-compliant fixed deposit account that offers a range of returns over a selection of investment periods.

I trust this provides a view of the many solutions that Absa offers our clients.

Remember saving is hard, but the rewards are worth the wait.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners