A Fin24 user has a question about how much can be withdrawn from a preservation fund and the tax on such a withdrawal. He writes:

What percentage can one withdraw on a preservation fund and how much tax is deducted on such a withdrawal?

Pieter-Jan Bestbier, a director of auditing firm LDP, responds:

When you retire and you are a member of a provident preservation fund, your retirement interest is usually paid by way of a lump sum, unless the rules of such a fund provide for the payment of an annuity on a member’s retirement.

When you retire and you are a member of a pension preservation fund and you wish to take a portion of your retirement interest as a lump sum, you are allowed to take a lump sum up to a maximum of one-third of the retirement interest in that fund.

This is unless the entire value of the fund does not exceed R75 000, in which case you can take the full retirement interest as a lump sum.

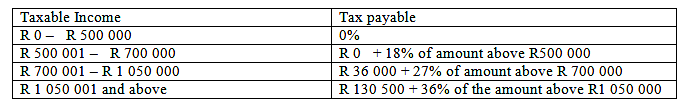

For the year of assessment ending February 28 2015 the lump sum portion of the retirement interest is taxed using the following special tax rates:

A withdrawal from a fund prior to retirement is regulated by the rules of the fund and these withdrawals are taxed at rates that differ from the rates for retirement lump sums.

The tax payable on a withdrawal benefit are calculated as follows:

Tax on a retirement fund lump sum withdrawal benefit is equal to:

- Tax determined by applying the tax table to the aggregate of that lump sum plus all other retirement fund lump sum withdrawal benefits accruing from March 1 2009 and all retirement fund lump sum benefits accruing from October 1 2007 and all severance benefits received or accruing from March 1 2011;

less

- Tax determined by applying the tax table to the aggregate of all retirement fund lump sum withdrawal benefits accruing from March 1 2009 and all retirement fund lump sum benefits accruing from October 1 2007 and all severance benefits received or accruing from March 1 2011.

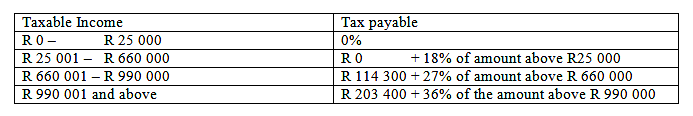

For the year of assessment ending February 28 2015 the withdrawal benefit is taxed using the following rates:

- Fin24

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners