A Fin24 user wants to know more about lump sum withdrawals from the various types of retirement vehicles and their tax implications. He writes:

I am 55 years old and would like to know about my retirement options.

I know there are various options such as lump sum withdrawals or changing my retirement annuity to a life or living annuity.

Could you please explain the different tax implications of the various options?

Also, I was retrenched five years ago and received a R30 000 tax -free contribution in the retrenchment package.

Will this affect the R315 000 tax free benefit of withdrawing my retirement annuity?

Soré Cloete, senior legal manager at Old Mutual, responds:

There are three types of retirement funds:

* Pension funds;

* Provident funds; and

* Retirement annuities.

Each of these is governed by a set of rules, the Income Tax Act and the Pension Funds Act, which determine when you may retire from these funds, usually from the age of 55 (like with a retirement annuity).

In the case of a retirement annuity and pension fund, you will only be allowed to take a third of the fund value as a lump sum upon retirement. The balance must provide you with a monthly pension or annuity.

In the case of a provident fund, you may take the full fund value as a lump sum upon retirement.

With a pension and provident fund, you may withdraw from the fund prior to retirement age, but with a retirement annuity you cannot withdraw from the fund prior to retirement age.

In addition to the retirement funds mentioned above, we also have preservation funds, where funds are preserved upon resignation until retirement.

When retiring from a retirement fund, you are required to purchase an annuity or pension. You will then have the option to either purchase a life annuity or a living annuity.

A life annuity pays a guaranteed income to you, the annuitant (person who will receive the annuity) until you pass away. The annuity then ends and the capital is lost unless a guaranteed term has been placed on the annuity.

With a life annuity, you can also add an option that the income is paid to you until you die and then to your spouse until he/she dies.

With a living annuity, your funds are invested and you may draw an income of between 2.5% and 17.5% of the capital value of the assets in the fund.

The amount drawn from a living annuity can be reviewed on an annual basis. The type of annuity selected will depend on your circumstances.

Tax implications on lump sums from retirement funds

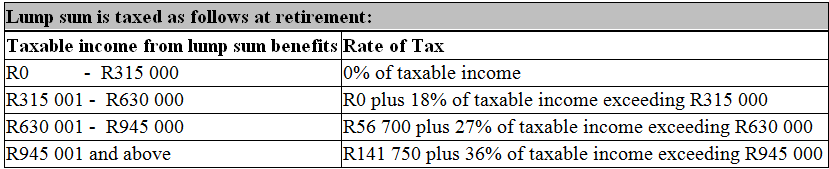

Upon retirement from a retirement fund, your taxable lump sum will be taxed according to the following table:

To determine your taxable lump sum from your retirement fund, the following amounts may be deducted:

* Contributions you made to the retirement fund that did not previously rank as an income tax deduction;

* Any amount previously taxed in terms of a divorce award;

* Certain amounts transferred from a government employee’s pension fund;

* Any amount taxed previously when transferring from one retirement fund to another.

Where a taxpayer has received lump sums before, the lump sum received upon retirement will be taxed as follows:

Step 1: The current taxable lump sum is determined, which includes lump sums from retirement funds and severance/retrenchment benefits;

Step 2: Add the following benefits received before:

* Taxable lump sums received from retirement funds upon retirement as from Oct 1 2007;

* Taxable lump sums received from retirement funds upon withdrawal as from March 1 2009;

* Severance/retrenchment benefits received as from March 1 2011.

Step 3: Add the lump sums in step 1 and step 2;

Step 4: Calculate the tax payable on the total calculated in step 3 as per the table above;

Step 5: Calculate the tax payable on the total calculated in step 2 as per the table above;

Step 6: Tax payable = Tax calculated in step 4 less tax calculated in step 5.

You indicated that you received a retrenchment benefit five years ago.

If we assume that this was prior to March 2011, then such a benefit will be ignored when calculating the tax payable on the lump sum that you receive now.

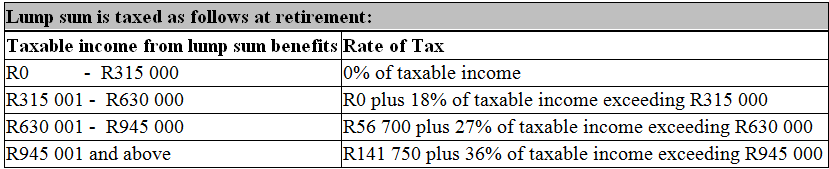

Should you however withdraw from a retirement fund, then a different tax table will apply:

The same principles as discussed in terms of retirement will apply upon withdrawal when calculating the tax payable.

The information provided above is only of a general nature and it is advised that you should consult with an expert, like a financial adviser or broker in terms of all your options available upon retirement from a retirement fund.

The taxable explanations are quite technical. Please let me know if you need any more information.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

I am 55 years old and would like to know about my retirement options.

I know there are various options such as lump sum withdrawals or changing my retirement annuity to a life or living annuity.

Could you please explain the different tax implications of the various options?

Also, I was retrenched five years ago and received a R30 000 tax -free contribution in the retrenchment package.

Will this affect the R315 000 tax free benefit of withdrawing my retirement annuity?

Soré Cloete, senior legal manager at Old Mutual, responds:

There are three types of retirement funds:

* Pension funds;

* Provident funds; and

* Retirement annuities.

Each of these is governed by a set of rules, the Income Tax Act and the Pension Funds Act, which determine when you may retire from these funds, usually from the age of 55 (like with a retirement annuity).

In the case of a retirement annuity and pension fund, you will only be allowed to take a third of the fund value as a lump sum upon retirement. The balance must provide you with a monthly pension or annuity.

In the case of a provident fund, you may take the full fund value as a lump sum upon retirement.

With a pension and provident fund, you may withdraw from the fund prior to retirement age, but with a retirement annuity you cannot withdraw from the fund prior to retirement age.

In addition to the retirement funds mentioned above, we also have preservation funds, where funds are preserved upon resignation until retirement.

When retiring from a retirement fund, you are required to purchase an annuity or pension. You will then have the option to either purchase a life annuity or a living annuity.

A life annuity pays a guaranteed income to you, the annuitant (person who will receive the annuity) until you pass away. The annuity then ends and the capital is lost unless a guaranteed term has been placed on the annuity.

With a life annuity, you can also add an option that the income is paid to you until you die and then to your spouse until he/she dies.

With a living annuity, your funds are invested and you may draw an income of between 2.5% and 17.5% of the capital value of the assets in the fund.

The amount drawn from a living annuity can be reviewed on an annual basis. The type of annuity selected will depend on your circumstances.

Tax implications on lump sums from retirement funds

Upon retirement from a retirement fund, your taxable lump sum will be taxed according to the following table:

To determine your taxable lump sum from your retirement fund, the following amounts may be deducted:

* Contributions you made to the retirement fund that did not previously rank as an income tax deduction;

* Any amount previously taxed in terms of a divorce award;

* Certain amounts transferred from a government employee’s pension fund;

* Any amount taxed previously when transferring from one retirement fund to another.

Where a taxpayer has received lump sums before, the lump sum received upon retirement will be taxed as follows:

Step 1: The current taxable lump sum is determined, which includes lump sums from retirement funds and severance/retrenchment benefits;

Step 2: Add the following benefits received before:

* Taxable lump sums received from retirement funds upon retirement as from Oct 1 2007;

* Taxable lump sums received from retirement funds upon withdrawal as from March 1 2009;

* Severance/retrenchment benefits received as from March 1 2011.

Step 3: Add the lump sums in step 1 and step 2;

Step 4: Calculate the tax payable on the total calculated in step 3 as per the table above;

Step 5: Calculate the tax payable on the total calculated in step 2 as per the table above;

Step 6: Tax payable = Tax calculated in step 4 less tax calculated in step 5.

You indicated that you received a retrenchment benefit five years ago.

If we assume that this was prior to March 2011, then such a benefit will be ignored when calculating the tax payable on the lump sum that you receive now.

Should you however withdraw from a retirement fund, then a different tax table will apply:

The same principles as discussed in terms of retirement will apply upon withdrawal when calculating the tax payable.

The information provided above is only of a general nature and it is advised that you should consult with an expert, like a financial adviser or broker in terms of all your options available upon retirement from a retirement fund.

The taxable explanations are quite technical. Please let me know if you need any more information.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners