(Shutterstock)

A Fin24 user wants to know if it would be a good idea to make a once-off investment of a lump sum and then leave it alone for many years. He writes:

We often hear from financial advisers that you need to invest between 10% and 20% of your income for retirement.

I am wondering, what about those who have a lump sum?

I am 33 years old and have R1m in a savings account. I have no debt.

What if I invested this amount between the Coronation Optimum Growth Fund and the Foord Flexible Fund for 30 years, without investing another cent.

Do you think this will enable me to retire comfortably at age 65?

I guess we could also assume that I will have a house by that time that is fully paid for.

Marius Fenwick, chief operating officer of Mazars Financial Services, responds:

In order to answer your question, we need to make some assumptions.

We need to assume a return over a 28 year period, we need to take inflation into account and we need to determine how long your capital will last after retirement.

Since you did not indicate what level of monthly income will be required at retirement, I will attempt to relate all the figures to today’s values.

For simplicity’s sake I will also refer to an income of R 10 000 per month in today’s value.

In today’s value one needs around R2.4m for every R 10 000 per month income required.

This will be sustainable for approximately 35 years (after which the capital will be depleted).

For the income to be sustainable the investment must achieve after retirement returns of 10% per annum with the income escalating at 7% per year.

For this exercise we are going to assume the following (all of which will obviously be variable over the next 28 years):

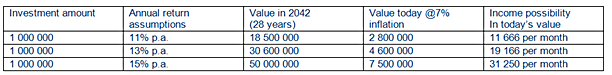

Inflation at 7% per annum over the next 28 years and returns on the selected portfolio at 11% , 13% and 15% per annum to indicate various potential outcomes.

The funds mentioned are solid funds and it is expected that they should provide solid returns over an extended period.

I assume that you are accustomed to the mentioned funds and understand the underlying investment philosophy of the funds along with the relevant volatility applicable to them.

Since the mentioned funds have open mandates returns can vary substantially from year to year. Using an upper level projection of 15% does not imply in any way that I forecast that these funds are going to achieve it.

My example, therefore, is not an endorsement of the funds, but merely a mathematical calculation to indicate what the various outcomes of a R 1m investment can be.

The fact that a higher than normal projection rate is used does indicate that it is expected that these funds will always have a high weighting to equities and offshore exposure.

I earlier referred to a return of 10% per annum after retirement. The principles of investing pre-retirement funds and post-retirement funds do differ.

It is generally accepted that one should adjust your portfolio to be more conservative after retirement, therefore, adjusting expected returns downward.

Drawing against a volatile portfolio will cause havoc in bear markets, resulting in capital losses that will reduce the longevity of your capital.

Now that we have the principles and assumptions out of the way we can look at the various outcomes:

The above should provide some indication of what might play out over the next 28 years.

I must just state that placing all your bets in only one strategy is very dangerous. Diversifying your strategies is always the best route to follow.

Even though the funds mentioned are solid and expected to provide good returns into the future, there are no guarantees and any international variable can derail returns.

It is great to have a lump sum of R 1m to invest, but my advice will be to adopt a strategy where, irrespective of the R1m capital investment, you still embark on a strategy to invest monthly as well.

After all, come retirement (or sooner) it is always better to have too much rather that too little.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

We often hear from financial advisers that you need to invest between 10% and 20% of your income for retirement.

I am wondering, what about those who have a lump sum?

I am 33 years old and have R1m in a savings account. I have no debt.

What if I invested this amount between the Coronation Optimum Growth Fund and the Foord Flexible Fund for 30 years, without investing another cent.

Do you think this will enable me to retire comfortably at age 65?

I guess we could also assume that I will have a house by that time that is fully paid for.

Marius Fenwick, chief operating officer of Mazars Financial Services, responds:

In order to answer your question, we need to make some assumptions.

We need to assume a return over a 28 year period, we need to take inflation into account and we need to determine how long your capital will last after retirement.

Since you did not indicate what level of monthly income will be required at retirement, I will attempt to relate all the figures to today’s values.

For simplicity’s sake I will also refer to an income of R 10 000 per month in today’s value.

In today’s value one needs around R2.4m for every R 10 000 per month income required.

This will be sustainable for approximately 35 years (after which the capital will be depleted).

For the income to be sustainable the investment must achieve after retirement returns of 10% per annum with the income escalating at 7% per year.

For this exercise we are going to assume the following (all of which will obviously be variable over the next 28 years):

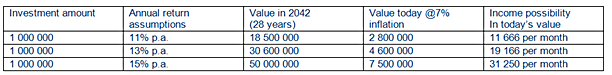

Inflation at 7% per annum over the next 28 years and returns on the selected portfolio at 11% , 13% and 15% per annum to indicate various potential outcomes.

The funds mentioned are solid funds and it is expected that they should provide solid returns over an extended period.

I assume that you are accustomed to the mentioned funds and understand the underlying investment philosophy of the funds along with the relevant volatility applicable to them.

Since the mentioned funds have open mandates returns can vary substantially from year to year. Using an upper level projection of 15% does not imply in any way that I forecast that these funds are going to achieve it.

My example, therefore, is not an endorsement of the funds, but merely a mathematical calculation to indicate what the various outcomes of a R 1m investment can be.

The fact that a higher than normal projection rate is used does indicate that it is expected that these funds will always have a high weighting to equities and offshore exposure.

I earlier referred to a return of 10% per annum after retirement. The principles of investing pre-retirement funds and post-retirement funds do differ.

It is generally accepted that one should adjust your portfolio to be more conservative after retirement, therefore, adjusting expected returns downward.

Drawing against a volatile portfolio will cause havoc in bear markets, resulting in capital losses that will reduce the longevity of your capital.

Now that we have the principles and assumptions out of the way we can look at the various outcomes:

The above should provide some indication of what might play out over the next 28 years.

I must just state that placing all your bets in only one strategy is very dangerous. Diversifying your strategies is always the best route to follow.

Even though the funds mentioned are solid and expected to provide good returns into the future, there are no guarantees and any international variable can derail returns.

It is great to have a lump sum of R 1m to invest, but my advice will be to adopt a strategy where, irrespective of the R1m capital investment, you still embark on a strategy to invest monthly as well.

After all, come retirement (or sooner) it is always better to have too much rather that too little.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners