Cape Town – With people set to enjoy healthy lives well into their 100s, life and health insurance companies will have to start finding new ways to ensure their customers can afford to live quality lives.

This was according to Professor Sarah Harper, who is the director of the Oxford Institute of Population Ageing, who spoke to Fin24 at the Momentum Risk Summit in Sun City.

An unbelievable one million people in England will live to 100 by the end of the century, Harper said research showed.

While many South Africans have few similarities with those living in the land of pomp and ceremony, the burgeoning middle class could learn a few lessons from the research.

Harper said she was concerned that life insurance companies were not fully aware of the implications of this. “The really interesting question is going to be the relationship between healthy life expectancy and life expectancy,” she said.

“Are those later years [between 100 and 120] going to be healthy or disabled,” she questioned. “If we can keep pushing back the onset of disability to later and later years, then that is actually really good, because we have productive individuals with a short period of disability at the end of their life.

“If, however, longevity is going to be accompanied by increasing years in frailty and disability, then the insurance world is actually going to have to wake up to a very different picture to the one that we have at the moment.

“We are seeing a potential increase of people with frailties living longer and that obviously has implications [for life insurance companies.]”

Listen to the full interview with Harper and Fin24's Matthew le Cordeur:

The inequality of life

Harper said that what was clear from the European data on longevity was that even within a very small income structure, you can have huge inequalities in not only life expectancy but healthy life expectancy.

“The research that we did at Oxford on people with occupational pensions – these are all salaried people – found an 11-year difference in life expectancy at age 65,” she said. “The lower income, poor health, retirees at 65 lived for about 12 years and those that were of a higher income and had had healthier lives could potentially live up to 25 years longer. When you take it outside the occupational pension group … then you see huge inequalities.

“One of the real questions that a country like South Africa has got to face is that it has a very broad income, education and health spectrum among its population,” she said. “Therefore, although the middle class may benefit from advances in both life expectancy and healthy life expectancy, there is going to be a lot of work in providing probably just basic health care and education to some of the lower income groups, to enable them to take up the advantages of these new processes."

Source: Global Age Watch Index

Radical longevity

Most extensions in longevity have occurred due to simple advances in medicine, said Harper. “We’re now getting real increases in science’s ability through things like stem cells, nano technology and 3D printing,” she said. “We’re seeing pieces of the body replaced and it seems like science is pushing back our ability to live longer and longer, potentially to 120 or 150.”

However, she said that society was lagging behind in its understanding of what that will mean.

Pushing back onset of frailty and disability

“In most advanced economies, we are really pushing back the onset of frailty and disability,” said Harper. “Particularly for middle class and high income groups [who are living healthy lives] well into their 80s.

“In Europe, the health status of a 70-year-old man today is roughly the equivalent of what his father had in his late 50s. So in that group, we are pushing back the onset of disability. That’s really good because people can stay working for longer, they can be looking after children and older people for longer, they can be contributing to society.

“When we hit mid-80s and frailty and disability starts inevitably to kick in, we are able to keep people alive longer with the kind of disabilities that even 20 years ago they probably would have died from."

Dropping birth rate

Added to a growing ageing population was the decline in child birth figures.

“If you take the population pyramid in the 1990s, it was a very classic population pyramid,” she explained. “[There were] lots of babies being born at the bottom and then death across the life course, so [there were] very few people in their 80s or 90s – and that was sort of a global picture.

“[That was] with the exception of the advanced economies, where we already had much more of a skyscraper, which meant that most babies who were born had a really good chance of living long, healthy lives.

“What we’re seeing is that child bearing across the world – with the exception of some countries in Sub-Saharan Africa – has been dramatically reduced over the last 25 years, particularly in China … and south-east Asia.”

She said the fact that Africa’s child bearing figures were not dropping meant that in time, the world’s young will come from this continent, which gave it a huge opportunity going forward.

“But people are living longer … so instead of dying across the life course, we have large numbers of people in their 40s, 50s, 60s and 70s who are still alive. They are driving the maximum population numbers on the planet. So, longevity (that is people staying alive longer) at the same time as subsequent generations being born is one of the reasons why the population will increase by about 7 billion to about 10 or 11 billion by the end of the century.”

Watch:

RiskSA interviewed Harper at the Risk Summit.

Global and Regional Population Pyramids

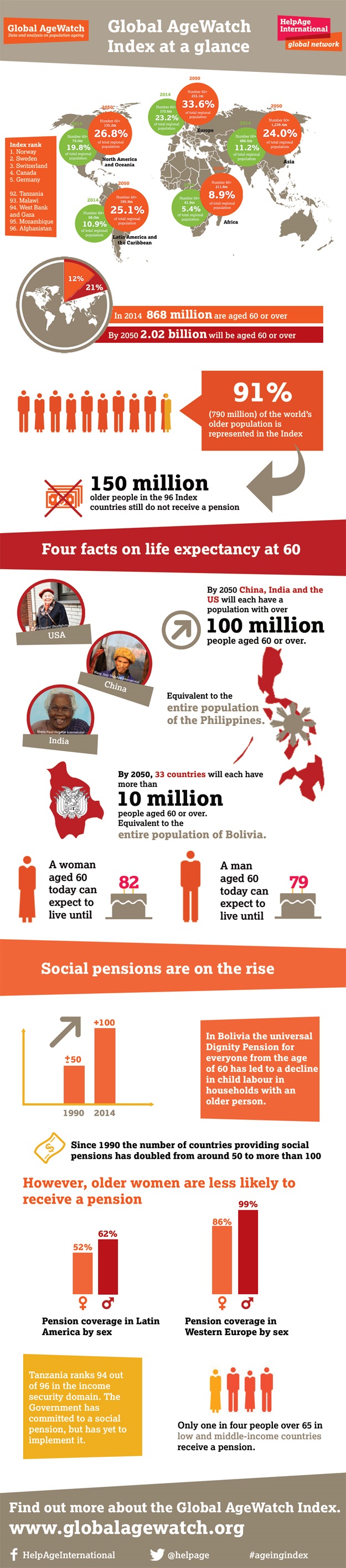

See the key points from the 2014 Global Age Watch Index:

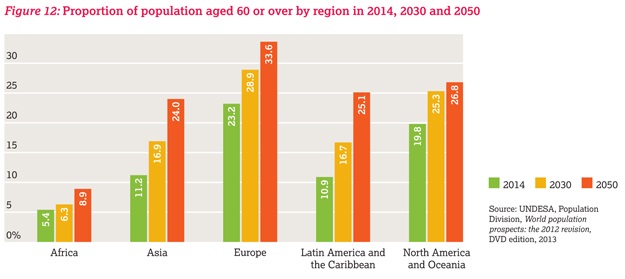

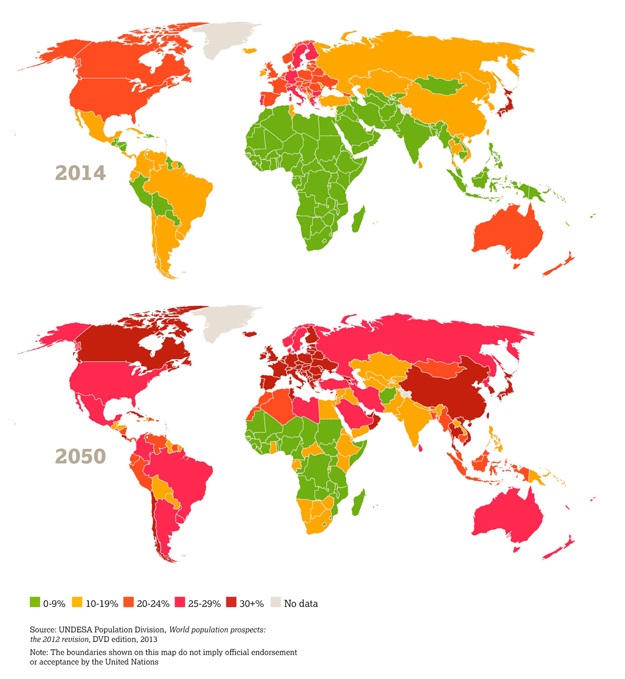

Comparison in the percentage of the global population living after the age of 60 between 2014 and 2050:

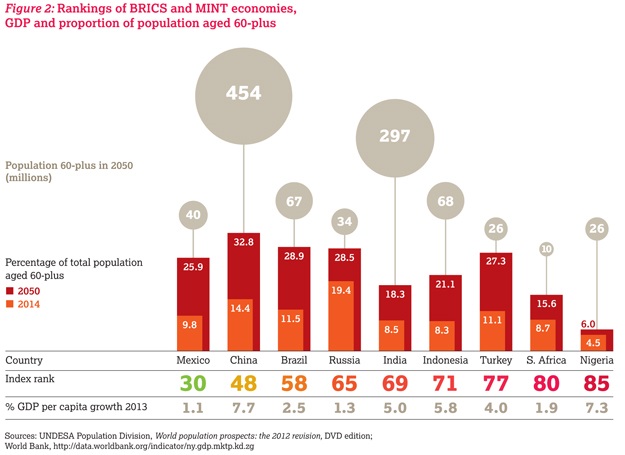

Source: Global Age Watch Index.

Source: Global Age Watch Index.

* Fin24 was hosted by Momentum at the Momentum Risk Summit 2015.

Publications

Publications

Partners

Partners