Johannesburg – A new money scheme claims to help blacklisted debtors acquire loans for various financial needs.

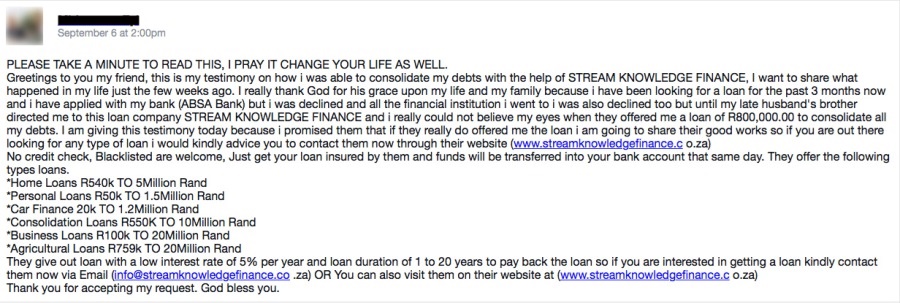

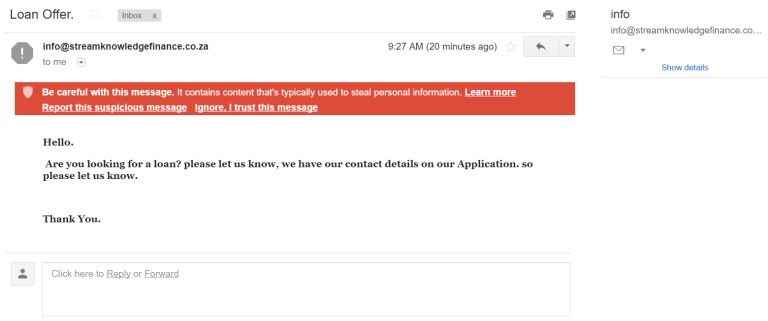

A Fin24 user alerted us to a Facebook message he received from a stranger promoting a credit provider, Stream Knowledge Finance. The company claims to offer loans to individuals without conducting a credit check. Blacklisted individuals are welcome to apply and loans are granted within 24 to 48 hours.

Fin24 contacted the head of the loan department, Reverend Joe Stewart at Stream Knowledge Finance to verify these claims. “It is not possible for us to be a scam, we are registered with the National Credit Regulator (NCR),” he said. “I do not know who sent the allegation, but it is a false allegation.”

Fin24 first tried to verify the registration with the NCR and the details were linked to a different company, Snow Leaf Finance Dealers CC. After raising the query with Stream Knowledge Finance, we were given a second number to verify with the NCR, which checked out.

The company is, however, not registered with the Financial Services Board (FSB). Stewart said that registering with the FSB was a “gradual process”. He added that Stream Knowledge Finance is a legitimate agency and not “fake”.

Eckhard Volker, managing director of Integrated Forensic Accounting Services, explained that if consumers suspect that they have been approached by a scam, they should conduct due diligence to see if an organisation is legitimate.

“If they are offering financial products then check that they are registered with the FSB. If they are not registered then it is a good indication to stay away,” he said.

A Fin24 user received a Facebook message promoting a credit provider.

Stream Knowledge Finance claims to be a “fully approved loan company by the South African financial authority”. Volker said the company should have made reference to “approved financial service provider” or refer to the FSB.

Previously Kalyani Pillay, CEO of South African Banking Risk Information Centre (Sabric), told Fin24 that consumers should verify that organisations are registered with the FSB. This ensures there is oversight and recourse for the consumer, she explained.

READ: How to spot dodgy money schemes

Pillay added that if something seems too good to be true, it probably is.

The credit provider offers loans ranging from R10 000 to R30m at a fixed rate of 5%, confirmed Stewart. It also claims to give out loans in US dollars and British pounds. Loan transfers can be made within three hours or a bank check deposit can be paid out within two days.

Volker said the seamless process to apply for funding and receive it within hours was inconsistent with business reality, but consistent with encouraging people to respond to this opportunity. He also said that it is not normal for South African companies to issue loans in foreign currencies and that there were laws restricting this.

“We offer loans. That is all we do… We give out loans to everybody regardless of your current state. Even if you have an income, you can get a loan,” said Stewart. But Volker said that when people are offering loans with “little effort” then it is suspicious.

The large loans offered at low rates is “ridiculous”, added Volker. “At a time when the prime rate is 10.5% anything less than that is likely to be questionable.”

Possible 419 scam

After viewing the loan application form, Volker said that the scheme appears to be an example of “advance fee fraud”. Here the applicant would be required to make some type of advanced payment for the loan to be “released”, again and again.

In addition, they will try to get a signature and a person’s bank account details which they might try to compromise. All of this is also consistent with the “419 scam”, also styled “Nigerian Letter”, he said.

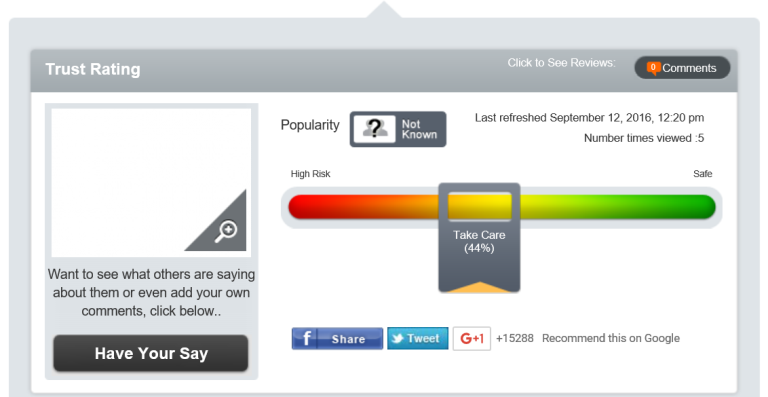

Website scamadviser.com also marked the site as risky. Volker, who had not personally used scamadviser.com before said that it was an option to check the credibility of sites.

Pillay added that people often falls for schemes because they are desperate and trying to find ways to make money.

The Stream Knowledge Finance application form pitches loans to the “financially squeezed”, seeking ways to pay off debt, or even seeking capital funding for businesses and other projects.

Volker said consumers should go beyond reporting schemes to public protectors such as the police, and even use the presidential hotline.

The South African Reserve Bank (Sarb) recently launched a campaign to raise awareness among South Africans about money schemes.

ALSO READ: Sarb warns South Africans of scams

Social media is also being used more prominently to spread schemes. “In the past people were approached via correspondence or telephone calls, social media now makes it easier for people to be reached,” said Volker.

Even though social media is “dangerous” from a fraud perspective, social media should equally be used to raise awareness about scams.

Read Fin24's top stories trending on Twitter: Fin24’s top stories

Publications

Publications

Partners

Partners