Cape Town - Bigger is not always better, and cheap can be nasty, so do your homework and make sure you take the medical aid benefit option that will provide the best cover considering your healthcare needs along with what you can afford, said Genesis Medical Scheme in a statement.

Genesis finds the idea that only the largest medical aid schemes can safely pay consumers' claims "a very odd sentiment given that as brokers accredited in terms of the Financial Advisory and Intermediary Services Act (Fais) and the Council of Medical Schemes (CMS) they should certainly know better".

"While these opinions are expressed on various public platforms, an aspect that certain brokers conveniently choose to omit is how they can 'legally' optimise their commission earnings – and that they champion membership to larger (and often more expensive) medical schemes because it suits their own interests," Genesis points out.

"A broker may, for instance, say a more expensive scheme will be the better option for you as it will cover all your health funding needs, when actually their recommendation simply stems from the fact that they will be able to earn a higher commission."

Genesis says it does not make sense to pay more than one has to for a hospital bed.

"Beds are not reserved especially for members of a particular medical scheme. They are reserved for whoever can pay for them," according to Genesis.

"There most certainly is no special preference given in terms of which medical aid you belong to, and it should also be remembered that you also have the option of going to any medical scheme directly without making use of a broker."

Type of cover

First decide on the type of cover that suits your family, even if you self-insure some of the risk, and then get quotes from all of the medical schemes that offer the type of cover that you are looking for.

Choose the medical scheme that best suits your needs and your pocket.

Broker's commission

A broker’s commission is based on the contribution that you pay to your medical aid. That means, the higher your contribution, the higher his or her commission.

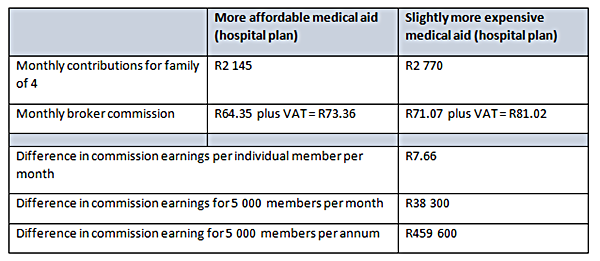

The Medical Schemes Act determines that the maximum amount payable to a broker by a medical scheme shall not exceed R71.07 plus VAT per month, or 3% plus VAT of the monthly contributions paid by the member, whichever is the lesser.

While that might not sound a great amount, consider what happens in the event of a broker having a medical book of 5 000 members, such as in the instance of 5 000 company employees, according to Genesis.

For argument’s sake, let us presume they all are on a hospital plan and that the main member has an adult dependant (spouse) and two children.

The table below speaks for itself.

"It is not hard to see that encouraging members to join a more expensive medical aid may well and truly be in a broker’s best interests, while not necessarily those of the client," according to Genesis.

"The opposite is of course also true - that is your broker may recommend a more expensive medical aid, because the benefits offered are better suited for your individual healthcare needs and this of course would be in your best interest."

- Fin24

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners