Cape Town - As the cost of living continues to soar, the biggest financial mistake you can make is failing to acknowledge that you might be at risk of becoming over-indebted, according to the Association for Savings and Investments of South Africa (Asisa).

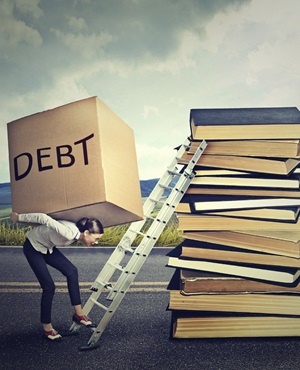

Following a nationwide drought, a rise in fuel prices and an increase in electricity tariffs, more and more South Africans are finding themselves buckling under the financial pressure of rocketing inflation. In addition there is a very real risk that interest rates will increase further.

Therefore, the sooner you take the necessary steps to prevent yourself from getting sucked too deep into the debt trap the better, said Peter Dempsey, deputy CEO of Asisa.

“The perfect storm is brewing for consumers, and the brutal reality is that you may be one of the people becoming trapped in spiralling debt,” he warns.

“However, if you start paying attention and take the appropriate action, it may not be too late to claw your way back to sound financial footing.”

Dempsey offers the following guidelines to help you identify if you are at financial risk, and the steps to take if you find yourself in difficulty.

Step 1: Take a reality check

“The root of financial problems is often a simple lack of awareness of what you are spending, especially the small daily amounts that seem insignificant at the time,” says Dempsey.

For a necessary reality check, he challenges you to record every cent that you spend for a month, whether by using a budgeting app on your mobile phone or keeping a spare sheet of paper in your purse or wallet.

“I would guess that many people will find that their expenses amount to around 30% more than they had expected, because their budget hasn’t captured all those small expenses,” he states.

Only once you have an idea of what you are spending can you begin to make an honest budget that will help you regain control of your financial situation, he says.

Step 2: Draw up a budget

According to Dempsey, having a budget is absolutely crucial, especially in tough times.

“Think of the gauges on your car. You wouldn’t expect to have a safe journey if you weren’t able to constantly monitor how fast you were going, or if you were at risk of running out of fuel. Eventually, you would run into difficulty.”

“Similarly, having a budget will put the necessary checks and balances in place so that you don’t run into trouble along your financial path. Each month you should be able to tell whether your spending is in line with your income,” he explains.

He states that the expenses in your budget should be listed in order of priority, namely:

• High priority expenses – these will include your mortgage repayments or rent, life and disability cover, short-term insurance, medical aid, utilities and outstanding debt. Failing to pay these expenses will carry legal implications, affect your credit rating and negatively impact you in the long term.

• Low priority expenses – these will include comforts such as entertainment, subscriptions and clothing. While it might be unpleasant in the beginning to cut back on these, their absence will not have a major impact on your life.

“Once you have organised your budget, you can identify how much of a financial buffer is built into your budget to absorb future price increases or whether you are at risk of falling into a debt-trap,” he states.

Step 3: Rid yourself of debt

Dempsey notes that maintaining debt places your financial health at increasing risk, as the cost of repaying this debt will continue to rise.

“Debt has become more expensive as the prime lending rate increased by 0.25% in March to 10.5%, and it is predicted to continue increasing this year,” he states.

“Whether you are simply edging closer to the financial brink or are already dipping into the red, now is the time to focus on addressing your debt and lessening its risk to your future financial well-being,” he says.

The following tips will help you to deal with your debt more quickly:

• Prioritise - Your debts should be prioritised in order of the most expensive where you pay the highest interest rate, which will typically include store accounts and credit cards, to the least expensive such as your mortgage bond.

Short-term debt with a higher interest rate will grow and become more expensive more quickly, so you need to address these first if possible, he says.

• Renegotiate – As a last resort, rather than default on debt repayments, go to your bank and creditors and renegotiate your debt, but do not stop paying it as this could have significant legal implications. Your creditors may be willing to accept smaller repayments over a longer period of time, bringing down your monthly expenses.

If you need to, you could also renegotiate your bond and take a ‘payment holiday’, make a special arrangement for reduced payments over a specified period, or extend the term of the bond. You could then channel extra money into ridding yourself of short-term debt before picking up these repayments again.

• Cut back your expenses – Sacrifice comforts such as movie tickets, luxury foods and subscriptions and channel this money towards your debt repayments. You could also look into renegotiating your short-term insurance for a lower monthly premium.

• Look for extra cash - You could look at selling unwanted assets or things that you don’t need such as clothing, electronics or old jewellery, and put this money into your repayments. If you are in trouble, also never underestimate that there may be opportunities to earn some extra income.

• Use your savings – There is nothing wrong with using your savings to rid yourself of debt, as debt compounds and grows much more quickly than money in a savings account or unit trust. However, it is critically important to resume saving or investing as soon as your debt has been settled.

• Downsize – After home loans, motor vehicles are usually the largest debt. If you are on the brink of financial trouble, downsizing may just save you. Sell or trade-in your vehicle for a smaller, less expensive model to remove some pressure from your budget.

• Communicate - If you are facing difficulty, you need to make your partner and family aware of your financial situation so that you can address your spending habits together. There is no shame in admitting a problem, and facing up to reality is part of finding the solution.

Communicating honestly with your family and allowing them to be part of the solution will not only help you out of difficulty more quickly, but may also impart them with valuable financial lessons that will aid them in the future.

If your children are over the age of 16 years, they can also contribute financially by taking on part-time work over weekends and during holidays.

• Debt consolidation agencies – These agencies specialise in packaging your debt and dealing with your creditors. However, make sure the agency is reputable before you sign up. Also consider the fees charged.

Step 4: Implement a long-term financial strategy

Once you have regained sound financial footing, you need to look to the future and prioritise saving and investing again, notes Dempsey.

“It is natural to want a reward yourself after working hard to rid yourself of debt, but you must look ahead. Create a clear set of long-term goals such as saving for a home, a child’s education or your retirement. Focusing on these goals will help to prevent you from wasteful spending and falling back into poor financial habits,” he says.

“Consult a trusted financial adviser to help you devise and implement a financial strategy that will help you deal with any unexpected events or expenses and achieve your long-term goals for a brighter, independent financial future.”

Publications

Publications

Partners

Partners