Johannesburg – Last week the JSE's All Share [JSE:203] index

rose above 35 000 points for the first time.

Investors may now justifiably ask whether this means that

the market has become cheap or expensive.

A further question is which sectors have pushed the index to

this level. Resources shares represent a large part of the JSE's market value,

and recently they have not done well.

Francois du Plessis‚ a director at Vega Asset Management‚

says it is important for people to realise first of all that an index's level

does not indicate whether the stock market is expensive or cheap.

"The fact that the Alsi has tested a new high does not

necessarily make the market expensive," says Du Plessis.

The Alsi is currently trading at a historical price to

earnings ratio (p:e) of about 12.6, compared with the long-term average of 13

to 14.

"It's therefore relatively cheaper than the long-term

average."

In 2007, when the market breached 32 000 points for the

first time, the p:e was around 18.

In March the JSE again broke through the 32 000 level, but

with a p:e of about 14.5.

This indicates that company earnings have risen faster than

share prices. "Now we are at 35 000 and people say this is high, but it

needs to be seen inperspective," says Du Plessis.

A p:e of about 12.6 also does not necessarily mean the market is currently cheap, and investors should refrain from buying left, right and centre.

The p:e is only one of several factors that need to be taken

into account, says Du Plessis.

In his view the market is currently "correctly priced",

but he says analysts worldwide, as well as those in South Africa, are busy

adjusting their profit expectations downwards for a number of JSE-listed companies.

The expectation is that companies forming part of the Alsi

will show profit growth of 12% over the next 12 months.

Du Plessis points out that this is considerably lower than

the 16.7% expectation prevalent at the end of June.

Profit forecasts for diversified mining and platinum

companies have been dramatically scaled down.

Industrial shares have the highest anticipated profit

growth, with consensus forecasts of around 20.7% over the next 12 months.

Earnings in the financial sector are expected to grow by

11.6%.

Over the past year, industrial and financial shares have

been the best-performaning sectors.

Du Plessis explains that should earnings rise, or increase

in line with expectations, this would further depress p:es. "That's why

it's important for investors to look at future p:es," he says.

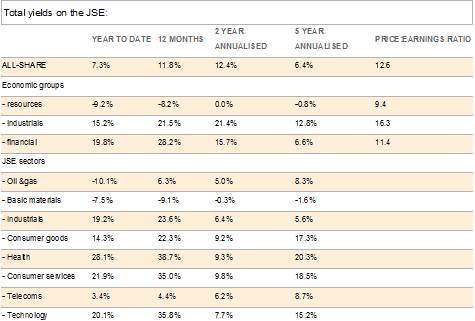

Total yields on the JSE:

How global markets take heart

The JSE's all-share index closed the week 1.65% up at 35 244

points.

On Friday the rand strengthened to R8.13 to the dollar – its

strongest level against the greenback in more than a month.

On Friday global markets were encouraged by the news of 163

000 new jobs in America in July. Economists had not expected this figure to

exceed 100 000.

Members of German Chancellor Dr Angela Merkel's ruling party

also said on Friday that they would not stand in the way of the European

Central Bank's (ECB's) plan to purchase government bonds from debt-laden eurozone

countries.

On Thursday markets were somewhat disappointed when Dr Mario

Draghi, president of the ECB, left the eurozone's interest rate unchanged and

did not say much about the bank's plans to resolve the region's debt crisis.

Great expectations had rested on Draghi's shoulders following earlier promises that the ECB would do everything within its mandate to relieve pressure on Spain and Italy, which are having to pay increasing rates for new debt.

- Sake24

For more business news in Afrikaans, go to Sake24.com.

Publications

Publications

Partners

Partners