Fund manager insights:

The Sasfin BCI Flexible Income Fund is ideal for investors who are looking for a high level of income but don’t want to take the risk of investing in the stock market and have a time horizon of 12 months or longer, says Philip Bradford, fund manager.

The fund currently yields nearly 11% and is a good alternative to longer-term fixed deposits and bonds, according to him.

The portfolio is an actively managed, flexible income portfolio that effectively makes asset allocation decisions across high-yielding asset classes such as preference shares, non-equity securities, fixed interest instruments and assets in liquid form.

The portfolio may from time to time invest in listed and unlisted financial instruments.

The fund manager may also include unlisted forward currency as well as interest rate and exchange rate swap transactions for efficient portfolio management purposes.

Bradford says the fund gives investors access to investments that pay a very high income, something that is typically reserved for large institutional investors.

“As fund managers we search for high-yielding investment opportunities and then diversify broadly and manage all the risks.”

“The fund only invests in rand-denominated cash and bonds, but investors can expect around half the volatility of the All Bond Index because we invest in floating and fixed rate bonds.”

He says the main risks to consider when investing in the fund are credit and interest rate risks.

“Our job as fund managers is to manage these risks. As an example we are prudently holding around 20% in cash in preparation of further downgrades from the ratings agencies. A subsequent sell-off may create a good opportunity for our investors.”

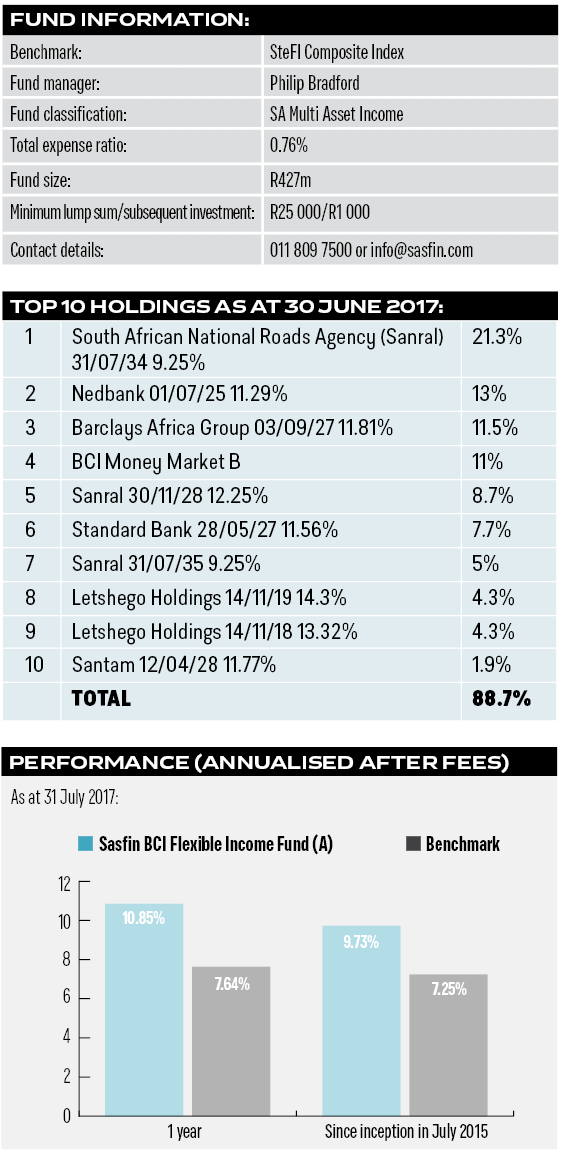

The portfolio size is currently at R427m, and Bradford sees this as an advantage.

“It is a big advantage not being a huge fund because we can be nimble and take advantage of opportunities in the market and make them meaningful for our investors,” Bradford adds.

Why finweek would consider adding it:

The fund is relatively new but has outperformed its benchmark over the last year and since inception in July 2015, delivering a return of 9.73% versus the return of 7.25% delivered by the benchmark.

This fund provides a high level of income, and the portfolio has no equity exposure, resulting in low risk and stable investment returns.

This article originally appeared in the 21 September edition of finweek. Buy and download the magazine here.

Publications

Publications

Partners

Partners