Most consumers need a home loan when purchasing a house as, generally, it is the largest amount a consumer will spend on a purchase in their lifetime.

It is well worth the time to understand how to use your home loan responsibly in order to capitalise on the low-cost borrowing that it offers.

At a very basic level, a home loan is a sum of money lent to you by a financial institution that uses a secured asset, for example the property you are buying, as security against the money you borrow.

Without a home loan, most consumers would not have a roof over their heads, or would be left having to rent property indefinitely, or at least while trying to save up the funds required to acquire property on a cash basis.

The fact that over the long term, property prices are usually expected to increase at or around the level inflation, makes this an especially challenging purchase.

The structure of the loan allows consumers to borrow a large sum of money (multiples of an annual income) to purchase a property on their present income and pay it back over a long period of time.

Unlike a personal loan, or credit card, the financial institutions have a way of recouping some of their losses if you fail to service your home loan.

This essentially means that the home loan's interest rates are almost without exception the cheapest form of finance that consumers can access.

The trick is being able to best utilise your home loan as a flexible money management tool. One particular underutilised tool is provided by most banks, known as further lending.

Further lending is a product offered by most home loan lenders. It is actually a fairly simple concept, with a lot of power, allowing you to capitalise off the low cost of your home loan to fund almost all of your borrowing requirements.

Further lending works by using the equity, which is the difference between the value of your property and what you owe on the property, available in your property to unlock further funds from your home loan.

By registering a bond in the Deeds Office that is higher than the one you need to facilitate the initial purchase of your property, you have access to credit on short notice and would not have to again go through a fairly lengthy process of registering a further bond in the Deeds Office.

Because the home loan product is structured in a way that you only pay interest on the outstanding balance, all the extra funds you pay into your home loan effectively earns you a return at your home loan rate of interest.

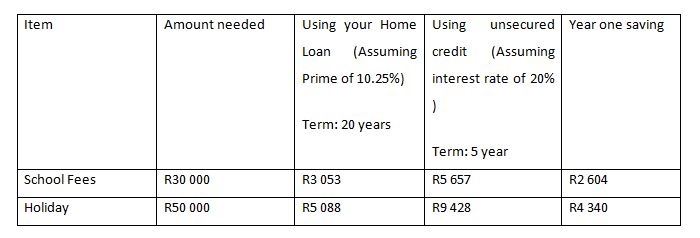

To illustrate how this plays out for a home owne with a home loan, let's say you gave school fees of R30 000 due at the beginning of the year. If you utilise your future use to pay the fees, you will pay the same interest as you do on your home loan. Assuming an interest rate of prime (currently 10.25%), the interest you will be charged over the first year will be around R3 053, compared to a personal loan with, for argument's sake, a 20% interest rate, which will result in R5 657 in interest over the first year.

Thus, using your future use results in a saving R2 604 in the first year, with further benefits also accruing in future years.

It is also important to further note that the repayment on the home loan would be around R500 a month cheaper than the unsecured loan used in this example.

The home loan's instalment would always be lower than the unsecured loan instalment, even at the same interest rate, by virtue of the longer term.

The trick, however, is to not finance items like, holidays, a car or school fees over the full 240 month (20 year) period of the home loan, but to commit to paying off these debts over shorter periods, and paying more than the minimum bank-required payments in order to make full use of the savings in interest.

Example

*Tommy Nel is head of credit at FNB Home Loans.

Publications

Publications

Partners

Partners