Tax season – the period during which you are required to submit your annual income tax return – started on 1 July, and so I thought it would be interesting to look at how long we work for the taxman in South Africa, metaphorically speaking.

If we assume that you do not work on weekends or on public holidays, then you have 250 work days for which you will be paid this year.

For this illustration I have ignored your annual leave – you are paid for those days of leave anyway, so I just kept them in as part of the 250 work days you have.

The tax threshold is R75 750 per year for people younger than 65 this year, which is just above R6 300 per month. This means that anyone earning R6 300 per month or less will pay no tax and they don’t spend any time working for the government.

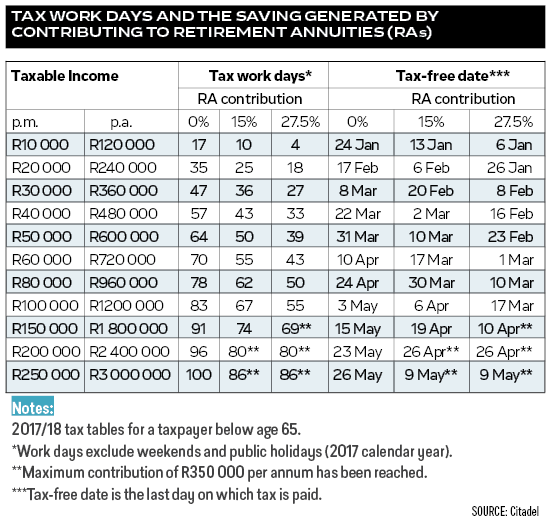

If you earn R10 000 per month, or R120 000 this year, then you will pay R7 900 (the tax figures in this article have been rounded off) in tax this year and 17 of your working days, in other words up until 24 January, will have been spent working to pay tax to the government. Since then you have been working for yourself.

At an income of R25 000 per month or R300 000 this year, you will spend 41 of your work days working to pay just short of R50 000 in tax.

If you earn R50 000 per month or R600 000 this year, you will pay just over R153 000 in tax and it will have taken you 64 of your working days, in other words until 31 March to pay your income tax.

If you earn R100 000 per month, then you will spend 83 of your 250 working days this year to pay just short of R400 000 (R396 990) in income tax and it will have taken you until 3 May to do so.

Just for interest’s sake, if you earn between R1.14m and R4m this year, you will have completed your tax days sometime in May.

People earning more than R4m in taxable income this year will spend at least 103 of their 250 working days to pay income tax and will have finished working to pay their taxes in the first two weeks of last month.

By 14 June everyone, including those with ultra-high incomes, will have finished working to pay income tax.

You can reduce your number of tax working days by contributing to retirement funds

If, for example, you earn R50 000 per month, you will have 64 tax working days, but if you put 15% of your taxable income into a retirement fund, like a retirement annuity (RA), then you will reduce your tax days from 64 to 50 tax days. That is a reduction of 14 working days.

Remember that does not include weekends, so it actually means a reduction of almost three weeks. To put it differently, in this example, contributing 15% to an RA amazingly reduces your tax work days by 22% because you have reduced your income tax by 22%.

You are currently able to contribute 27.5% of your taxable income towards an RA. Remember that this is limited to R350 000 for the year.

If you earned R50 000 per month and your retirement contribution was 27.5%, then you would reduce your tax work days down to 39. So instead of working for the taxman until 31 March, you would have finished working for the taxman by 23 February this year.

This is a great example of where it is valuable to pay yourself first using retirement funds – as this case shows, if you earn R50 000 per month, you could cut the amount of time you spend working for the taxman by a whole month.

Paul Leonard is regional head: Eastern Cape at Citadel. He is a certified financial planner.

This article originally appeared in the 27 July edition of finweek. Buy and download the magazine here.

Publications

Publications

Partners

Partners