We often hear or read about how to remove physical clutter from our lives with numerous books and articles on the topic, but what about doing the same with your finances? You can enjoy a more productive and less stressed life with a streamlined approach to managing your finances.

1. Go through the inventory of your assets (and liabilities, if you have debt).

The starting point for managing your finances is to know where you stand. In the same way that you need to know your income and expenditure and have a budget to manage them, you ought to have a list of your assets – effectively your balance sheet. Add any purchases or new debt to the list and remove items that have been disposed of and debt that has been repaid.

2. Ensure that you have a will and that it is up to date.

It does not matter who you are, how wealthy you are or what your circumstances are, having a valid will means that your estate can be wound up more swiftly and in line with your wishes than if you don’t have one.

Once you have a will, use your annual financial spring clean to ensure that it is up to date, especially if significant events have taken place since you last assessed it. The type of events include the birth of children, a change in your marital status, the death of a beneficiary or executor, or if you have acquired new assets. If your financial circumstances have changed, you may need to make provision for this in your will as part of your estate planning.

3. Check that your insurance policies are up to date.

Have you acquired or disposed of assets in the past year? If so, you need to check that you are correctly insured and neither over- nor under-insured. Consider the change in replacement value of your assets and ensure that this is reflected in your insurance policies. Remember that some assets are likely to appreciate (art, jewellery) whereas others will depreciate (cars, technological items).

Also make sure that your long-term insurance is current. Has the number of your dependants changed? Or your marital status? Does this mean that you need to alter life cover? Look at your changed circumstances and adapt your insurance accordingly.

4. Clear your financial files.

If you are in the habit of maintaining files of your financial affairs, well done. However, you shouldn’t hang on to anything longer than you need to – just save the essentials and shred the rest. Keep receipts for major items such as furniture, appliances, vehicles and technological items until they are disposed of, so you can provide proof of ownership and their value if needed for an insurance claim. You can shred non-tax-related credit card receipts once you’ve matched them with your monthly statement.

You will also need to keep records of savings, investments and property until they are sold so that you can have an accurate record of your assets as well as your purchase price when calculating capital gains tax.

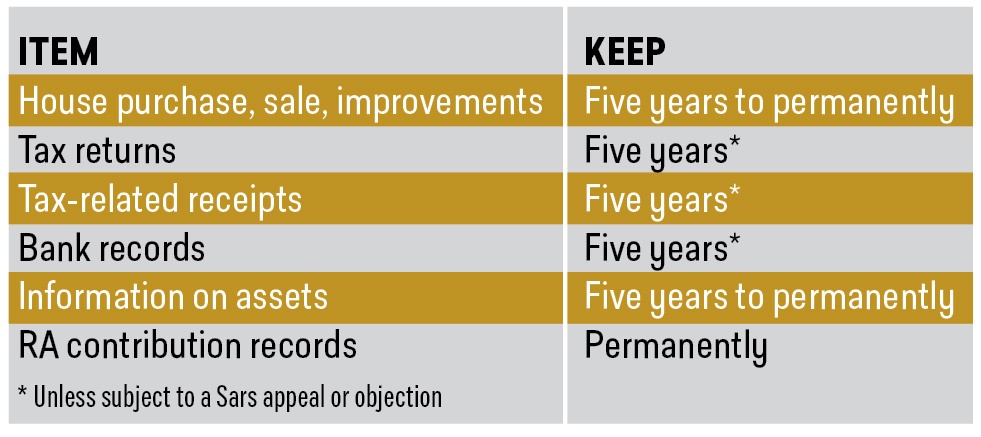

In general, this is how long you need to keep the following documents:

If you want to save even more space, think about scanning your important documents for storing in soft format and then shred the hard copies. It will free up both cupboard and head space!

5. Reconsider your financial plan.

Is your financial plan still suitable for your current circumstances? Are your investments still the most appropriate for the outcome you are trying to achieve? Having taken stock of your financial situation and needs, you are now in a position to revise your financial plan to take your new circumstances into account. Use this opportunity to top up your emergency fund. Ensure that you have the right asset allocation and geographic spread of investments.

Following the tips above will reduce stress associated with money and free you up for more gainful activities. The less you need to focus on remembering to do something or planning to do something, and the more streamlined your financial affairs, the more time you will have available to be more productive and to enjoy life.

Paul Leonard is a regional head at Citadel.

This article originally appeared in the 6 October edition of finweek. Buy and download the magazine here.

Publications

Publications

Partners

Partners