A startup entrepreneur wants to know the best way to save on tax. He writes:

I have a franchise business expecting a turnover of less than R1m in the next tax year.

What would be the legal entity that will ensure that I pay the least tax for my business?

I have just started and must make a decision.

Kobus Engelbrecht of Sanlam Business Market responds:

I think you should consult a tax specialist to help you with your decision, but here are some pointers. You do not have to register for VAT as your turnover is less than R 1 000 000.

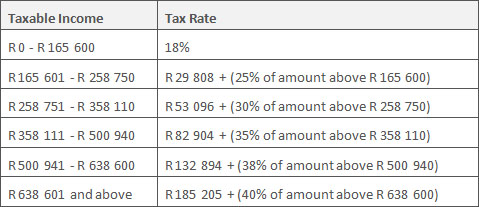

If you operate your business as a sole proprietor, you will pay tax on a progressive scale. Here is the latest income tax table:

Income tax tables

March 1 2013 - February 28 2014

If you operate your business as a company, the company will pay tax at a flat rate of 28%. If the company then distribute dividends, 15% tax will be then payable on that dividend.

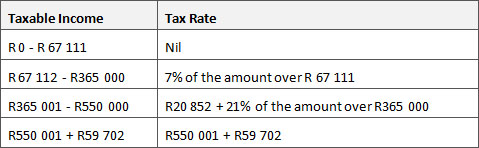

However, your business could qualify as a small business corporation if all the criteria are met and then the following tax table will apply:

If your business is run as a company you could also be an employee of that company, which means that whatever the company pays you, will lessen the profit of the company as well as its tax burden.

You will obviously be taxed on your salary on the individual taxpayer scale. You could also employ your family.

As you can hopefully see by now, your question does not have an easy answer, as there are many possible legal ways to lessen your tax burden and you therefore do need to consult a professional to help you with your tax planning.

He or she will also be able to guide you through the intricacies of the other tax liabilities you might have like capital gains tax, estate duty, etc.

Anita du Toit of Franchise Plus agrees that the Fin24 user should seek expert advice to discuss the most suitable options.

Says Du Toit: The entity you register would depend on the nature of the business and your personal circumstances.

With the demise of close corporations, small businesses can basically choose between a private company (Pty Ltd) or being a sole proprietor.

In a private company you would pay company tax, and tax on any dividends declared. In a sole proprietorship, you would be taxed in your personal capacity.

- Fin24

*Share your experience of setting up your own business and get published, or simply ask a question. Our business panel can put you on the right path.

I have a franchise business expecting a turnover of less than R1m in the next tax year.

What would be the legal entity that will ensure that I pay the least tax for my business?

I have just started and must make a decision.

Kobus Engelbrecht of Sanlam Business Market responds:

I think you should consult a tax specialist to help you with your decision, but here are some pointers. You do not have to register for VAT as your turnover is less than R 1 000 000.

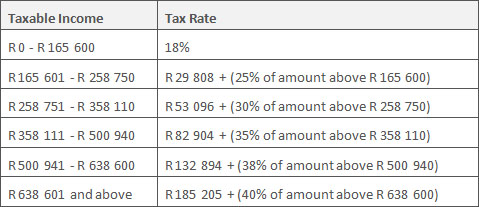

If you operate your business as a sole proprietor, you will pay tax on a progressive scale. Here is the latest income tax table:

Income tax tables

March 1 2013 - February 28 2014

If you operate your business as a company, the company will pay tax at a flat rate of 28%. If the company then distribute dividends, 15% tax will be then payable on that dividend.

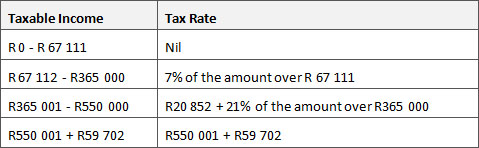

However, your business could qualify as a small business corporation if all the criteria are met and then the following tax table will apply:

If your business is run as a company you could also be an employee of that company, which means that whatever the company pays you, will lessen the profit of the company as well as its tax burden.

You will obviously be taxed on your salary on the individual taxpayer scale. You could also employ your family.

As you can hopefully see by now, your question does not have an easy answer, as there are many possible legal ways to lessen your tax burden and you therefore do need to consult a professional to help you with your tax planning.

He or she will also be able to guide you through the intricacies of the other tax liabilities you might have like capital gains tax, estate duty, etc.

Anita du Toit of Franchise Plus agrees that the Fin24 user should seek expert advice to discuss the most suitable options.

Says Du Toit: The entity you register would depend on the nature of the business and your personal circumstances.

With the demise of close corporations, small businesses can basically choose between a private company (Pty Ltd) or being a sole proprietor.

In a private company you would pay company tax, and tax on any dividends declared. In a sole proprietorship, you would be taxed in your personal capacity.

- Fin24

*Share your experience of setting up your own business and get published, or simply ask a question. Our business panel can put you on the right path.

Publications

Publications

Partners

Partners