Although Telkom’s mobile unit is at last profitable, it faces an uphill battle to sustain profitability.

To maintain its winning streak, it would have to lead an ongoing price war in a fairly saturated local market amid a stagnant economy.

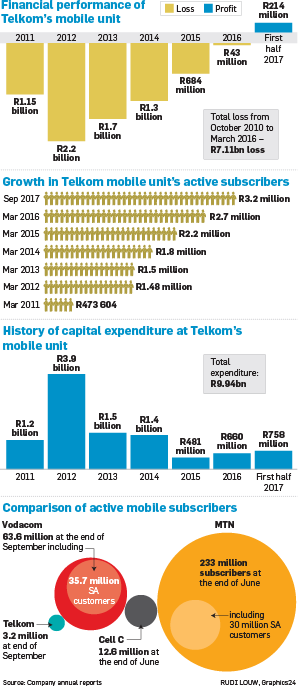

Six years after launching its mobile business, Telkom’s cellular unit this week turned an operating profit for the first time.

This follows almost R10 billion in investment in the mobile division up until the end of the September and more than R7 billion in operating losses from its launch in October 2010 to March this year.

Richard Hurst, director of enterprise research at Africa Analysis, said that Telkom had turned a profit by positioning itself as the “cheaper alternative”, as well as containing its costs.

Sipho Maseko, Telkom CEO, said that the company would continue to play “an insurgency role in the market”, referring to the ongoing price war that Telkom had led together – but to a lesser extent – with Cell C.

“The smaller operators like Telkom and Cell C must play on price to increase their market share,” Hurst said.

Hurst questioned how long the price war in the telecommunications sector could be sustained. “Who can hold their hand in the paper shredder the longest?” he asked.

The problem Telkom faces is that its two biggest rivals, MTN and Vodacom, had much bigger financial resources to ward off a price war.

Hurst said that it was unlikely that Telkom would advance its mobile division by a merger or acquisition or that an international player would step in because the government – which owns almost 40% of the company – would probably oppose such a move.

Currently, South Africa had 154% mobile penetration and this was forecast to grow to 194% by 2022, he said.

“There will be growth in the local mobile sector, but it will be sluggish. However, there won’t be that many new customers. If an operator wants to gain new subscribers, they will need to poach them from a rival,” Hurst said.

Despite 15 years of operation, Telkom’s larger rival, Cell C, is largely a marginal business that vacillates between profits and losses.

Cell C, which started operations in 2001 and has more than 25 million subscribers, only generated a profit of R2.8 million for the half-year ended in June on revenue of almost R7 billion.

In the half-year ended in June last year, Cell C sustained a loss of R1.1 million on revenue of just over R6 billion.

A demonstration of how tough it is to build a cellular business in South Africa, where there are already two entrenched incumbents, is evident from the fact that as at the end of June, Cell C had an accumulated loss of R26.4 billion.

Hurst said Telkom, unlike Cell C, had a number of businesses that could use the “backhaul” that had been developed for the mobile unit and this would help Telkom turn a profit more easily, as the costs related to the mobile infrastructure would be spread across a number of Telkom’s units.

The backhaul of a telecommunications network comprises the intermediate links between the core network and the small subnetworks at the “edge” of the entire hierarchical network.

Maseko said that he expected that Telkom’s mobile division would continue to see improved profitability.

He identified a number of threats the company was facing, including local growth that is just north of zero, many players entering the fibre space, Liquid Telecom’s acquisition of Neotel and more over-the-top content players entering the market.

Read Fin24's top stories trending on Twitter: Fin24’s top stories

Publications

Publications

Partners

Partners