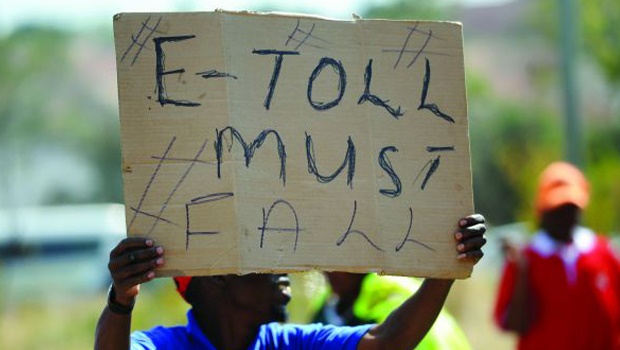

E-tolls is still in the spotlight, Gem Diamonds makes a massive diamond discovery and Fin24 polls economists on what it will take for the country to inch back towards investment grade.

Where your e-toll billions are going

Following the Department of Transport’s revelation this month that R2.2bn has been paid to an Austrian firm to collect e-toll fees, action group OUTA has calculated that this makes up 74% of the system’s total e-toll income.

Transport Minister Joe Maswanganyi said in a parliamentary response earlier this month that Austrian-owned e-toll collection company ETC received R2.2bn for full toll operations since the inception of e-tolls on 3 December 2013.

OUTA has calculated that the total income received from December 2013 to March 2017 was R2.9bn, meaning that 74% of that was being paid to the foreign company.

“At an average of R55m per month paid to ETC, and with the current e-toll income levels at around R63m per month, virtually no money is going toward the e-toll bonds,” OUTA said in a statement on Monday.

Fin24's Matthew le Cordeur has the full story

Two massive diamonds found in Lesotho

Gem Diamonds discovered two diamonds bigger than 100 carats at its Lesotho mine, bringing the struggling miner a step closer to ending a drought of large stones.

Gem Diamonds unearthed a 104.73 carat D colour Type IIa diamond and a 151.52 carat Type I yellow diamond at its Letseng mine, the company said in a statement on Monday. Type IIa diamonds contain very little or no nitrogen atoms and are the most expensive stones.

Until now, Gem Diamonds had reported just one large discovery this year - the unearthing a 114-carat diamond in April. The Letseng mine is renowned for the size and quality of its stones, with an average sales price of almost $2 000 a carat, the highest in the industry. Yet the company has suffered recently from a lack of big finds and discovered just five stones bigger than 100 carats last year, fewer than half as many that it found in 2015.

Click here to view the images of the diamonds

INFOGRAPHIC: SA's top 10 risks ... and what to do about it

South Africa faces many daunting risks - from corruption and droughts to an economic recession and unemployment. SA’s leading risk managers reveal how we can respond.

How SA can get back to investment grade

A new president is among the first steps South Africa has to take to become investment grade again, said an economist.

Fin24 spoke to several economists who shared on what it will take for the country to inch back towards investment grade.

Ratings agencies Fitch and Standard & Poor’s recently affirmed the country’s credit rating at BB+. Fitch changed its outlook to stable, and S&P affirmed the negative outlook.

On Friday ratings agency Moody’s downgraded both the local and foreign currency rating to Baa3 and maintained a negative outlook.

Although Moody’s rating is still one notch above junk status, the country is still at risk of being downgraded further if the economy does not recover from a recession, said Thabi Leoka, Argon Asset Management economist.

Among the things that could lead to an upgrade of the rating is more policy certainty, said Leoka. “Ratings agencies have mentioned policy uncertainties are impacting on growth… The political environment not conducive for an upgrade.”

Read this story by Fin24's Lameez Omarjee

South Africa last in healthcare efficiency study

South Africa was ranked last among 19 nations in a global survey that measured healthcare system efficiency, writes Fin24's Yolandi Groenewald.

The Future Health Index, commissioned by Dutch tech company Philips, gives a snapshot of current realities, and how well a country’s healthcare system is set up for the future.

The study asked 33 000 ordinary people as well as healthcare professionals how they viewed health care in their country. The authors then compiled data of the actual reality that citizens had to contend with, using input from leading academic and global non-profit organisations.

The index showed that South Africa’s efficiency ratio was the lowest out of the 19 countries in the study, which included countries such as France, the US, Argentina, United Arab Emirates, China and Brazil. South Africa scored 4.4 compared to the group average of 10.5.

But despite the health index’s worrying findings, South Africans perceived health care much more positively than what actually happened on the ground.

Read Fin24's top stories trending on Twitter: Fin24’s top stories

Publications

Publications

Partners

Partners