Despite cash injection and loan conversion, Eskom still needs more money.

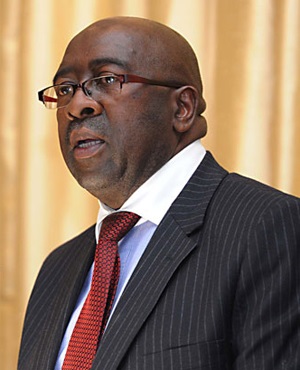

The state’s sale of its stake in Vodacom to the Public Investment Corporation (PIC) this week wrapped up slightly more than nine months of deal making for Treasury, which initiated talks on the sale shortly before the preparation of Finance Minister Nhlanhla Nene’s medium-term budget policy statement.

Nene told City Press that Treasury’s asset and liability management department sounded out about 20 financial services institutions in the market – whose names he could not disclose without first consulting with those institutions – to identify a number of assets that could be sold to support state power utility Eskom.

“Some of them were actually bidders [for the Vodacom stake],” he said. A few more institutions tabled unsolicited offers.

The state found a number of aspects of the PIC’s offer attractive, most significantly its pricing, which Nene said was “the best offer on the table” despite the 10% discount that the state offered because of the large 13.91% stake being sold.

The shares were sold at a 30-day volume-weighted average price. If this was calculated at the end of October – the month Nene released his budget policy statement – the state would have pocketed R23.8 billion from the deal. If it was calculated ahead of the conclusion of the deal this week, the amount could be closer to R27 billion.

Treasury is not revealing the deal value, but says the proceeds are more than the R23 billion set aside for Eskom’s equity injection.

However, this – in addition to the conversion of a R60 billion loan into shares – will not solve the utility’s problems.

“It’s always been our view that Eskom should recover [its] costs,” said Nene. “It is for that reason that we will support Eskom in getting cost-reflective tariffs.”

Nene’s view on what makes a cost-reflective tariff – especially during a week in which National Energy Regulator of SA chairperson Jacob Modise slammed the utility for receiving “excessive” increases since 2008 – is that these cannot be determined overnight.

“It is my view that we need to move to a cost-reflective tariff; it must not put undue pressure on poor households, but Eskom must recover [its] costs.”

Given the utility’s poor credit ratings – Standard and Poor’s and Moody’s recently slashed its debt to junk status – and high debt levels, it has become difficult for Eskom to raise funds for its R280 billion programme to build new power stations.

Makgola Makololo, acting deputy director general of energy at the department of public enterprises, said the equity injection and loan conversion would reduce Eskom’s debt levels from “at least 75% to 67% to enable it to borrow”.

“From a credit rating perspective, it will not immediately improve the rating, but there was positive response to Eskom’s [recent] international road show,” said Makololo.

More than half of the state’s loan has already been converted in Eskom’s books, and only about R26.6 billion – the expected value of the loan to be published in its 2015 annual report later this month – is still to be converted into shares.

Publications

Publications

Partners

Partners