Johannesburg - Unless government and the private sector implement drastic measures to ensure that female entrepreneurs are mentored about access finance for their businesses, women in South Africa will continue to face massive barriers in the country’s economy.

This is according to Farzanah Mall, president of the Businesswomen’s Association of SA (BWA), commenting on the presidency’s release by President Jacob Zuma of The Status of Women in the SA Economy report last Sunday.

Authored by the department of women, the report found that a lack of financial literacy was among the main barriers of access to finance for women in business or those who had start-ups.

The department has called for the private and public sectors to improve financial education for women to empower them to use financial products to their benefit.

Its report states: “Women score significantly lower relative to men in areas of financial control, financial planning, choosing financial products and general knowledge and understanding of finance. This lack of financial literacy can keep women from being able to know what financial products are available to them and how to utilise [them] to improve their economic situation.”

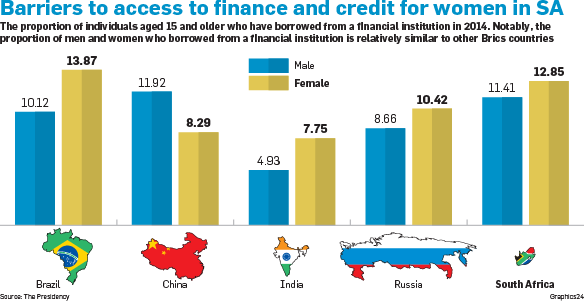

Despite positive policies that had helped women in other areas of the economy, the report found that many barriers in accessing finance and credit for women still existed.

Mall said the BWA’s 2015 Women in Leadership Census, which was released last month, also showed that drastic measures were needed to mentor women to be financially savvy.

“Part of the drastic measures we’re talking about are that we need to become investment partners with women because access to cash alone doesn’t guarantee success. You can give them R10 000 to start up the funding, but you don’t equip them with business knowledge in terms of what it takes to make a business successful,” she said.

Government also found that lower incomes compared with men and the negative attitudes financial institutions had about women were among the barriers to access to finance and credit.

The presidency has called for more “gender-focused” black economic empowerment (BEE) and business strategies for women, as they are the largest group of entrepreneurs in the country.

“Gender-focused business strategies must inform all BEE and financial-access measures.

“Institutions that act now to better understand and service this large, growing segment of South Africa’s business population will reap the benefit in the future,” government said.

Mall added: “We need to become equity partners with women in start-up businesses or in the informal sector because you will have more of a vested interest for the business to succeed. While a person in the informal sector might have a great business idea, they might not have the business savvy to make it succeed. So, looking at newer models of equity partnership with start-up businesses and walking the journey of success with them means you will help ensure that all areas of that business succeed, including branding, marketing, HR practices and more.”

The state also found that the proportion of women who borrowed money to start, operate or expand a farm or business was very small when compared with male entrepreneurs and this highlighted “an important inequality that should be addressed more thoroughly in a national development framework”.

It wrote that although government had made massive strides in increasing the percentage of women with formal bank accounts – from 44% in 2004 to 76% last year – more than half of women borrowed money to buy food.

The fact that they earned up to 42% less on average than men also placed “a greater debt burden on women who borrow relative to men”, it added.

The presidency lamented the fact that while women made up the majority of small business owners, they were in the minority of workers in the formal sector, which limited their access to productive resources that could be used as collateral for financing.

“Thus women lag behind men in the ability to obtain finance. This barrier in and of itself prevents poor South Africans in general, and women in particular, from improving their respective economic situations. In 2009, it was estimated that only 2.9% of female entrepreneurs received assistance from a commercial bank,” said government’s report.

“The barriers and prejudice in South Africa that women in business face is surprising, especially since credit repayment records show women are more diligent in repaying loans,” it added, citing studies done by the International Finance Corporation.

It also cited other studies that viewed women’s lower financial literacy when compared with men as another barrier that was preventing them from accessing finance and credit

Publications

Publications

Partners

Partners