Cape Town – Wednesday's budget confirmed the largest revenue shortfall relative to budgeted estimates since 2009/10, necessitating tax hikes bringing in an additional R28bn.

The tax proposals increase the tax burden from 26% of gross domestic product in 2016/17 to 26.7%. The tax-free threshold will go up from R75 000 to R75 750.

The October 2016 mini budget already noted that revenue collection would fall well below estimates. According to the Budget Review, the 2016 Budget estimated government would receive total tax revenue of R1.175trn during 2016/17. The mini budget projected a revenue shortfall of R22.8bn, which is now revised to R30.4bn, meaning an estimated R1.144trn will be collected.

This is the largest tax revenue shortfall in eight years. Projections have fallen short in three of the four main tax instruments.

Calculate your tax burden

Personal income tax, value-added tax (VAT) and customs duties are down by an estimated R15.2bn, R11.3bn and R6.5bn respectively relative to the 2016 Budget estimate. Lower wage increases and bonuses reduced personal income tax collection.

The decline in import VAT has been partially offset by strong domestic VAT collection, but VAT refunds have been higher than anticipated, reducing net revenue. Corporate income tax collection is expected to exceed 2016 Budget estimates.

Tax collection projections are based on economic growth forecasts, the effectiveness of the tax administration in closing the compliance gap and tax policy changes. A protracted period of low economic growth has negatively affected job creation and tax bases.

Although economic growth for 2016/17 remains in line with previous estimates, decreased imports and slower wage growth have contributed to lower revenues.

The Budget Review states that raising taxes in a struggling economy is undesirable but unavoidable, given current fiscal circumstances and to ensure that the state has adequate resources to fund existing spending programmes.

Gordhan stressed in his speech that growth incentives should not be neglected, but although acutely aware of the difficult economic conditions facing the majority of South Africans, deferring tax increases by accumulating more public debt would ultimately impose a greater burden on citizens.

Main tax proposals

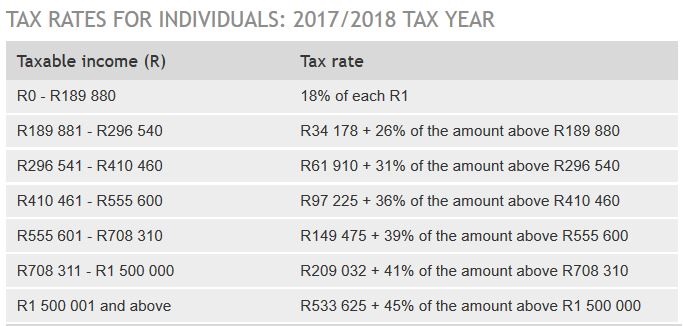

- A new top personal income tax bracket of 45% for taxable incomes above R1.5m. About 100 000 taxpayers will be affected by the new bracket.

- Limited relief for bracket creep.

- An increase in the dividend withholding tax rate from 15% to 20%. The reason is that increasing the top marginal rate without concurrently raising the dividend withholding tax rate would increase the arbitrage opportunity for some individuals to pay themselves with dividends rather than salaries.

- A 30 cents per litre increase in the general fuel levy and a 9c/litre increase in the Road Accident Fund fuel levy.

- Relief for home buyers by raising the amount exempted from transfer duty from R750 000 to R900 000.

* Visit our Budget Special for all the budget news and in-depth analysis.

Read Fin24's top stories trending on Twitter: Fin24’s top stories

Publications

Publications

Partners

Partners