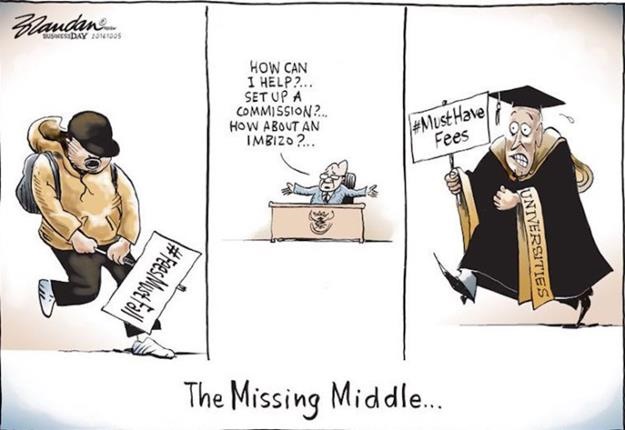

As the #FeesMustFall crisis makes a turn for the worse, many are starting to wonder if free education is still the target. This as the Economic Freedom Fighters take a stranglehold of things, which has seen the movement extend beyond universities. But one must still not lose sight of the crux of the matter, that certain individuals cannot afford tertiary education, and must be in some way afforded this opportunity. Rhodes tax guru Matthew Lester has been wracking his brain for solutions to the chaos. Which it must be said is turning into a crisis, and a solution is needed sooner rather than later. Lester turns his attention to the medium term budget, and says it may be one of the most important budgets yet. And says the short-term solution lies in a response like that given to the devastation from hurricane Matthew. A must read. – Stuart Lowman

By Matthew Lester*

Events of the last week have shown that the #FeesMustFall is not going to go away. Perhaps what students have not yet learned is that a good settlement in a dispute is where both parties walk away with in pain but ready to engage again in the future. And SA’s universities have taken far too much pain already. And the time has come to stop. At least for 2016.

The last hope for 2016 is that perhaps finance minister, Pravin Gordhan, can pull a rabbit out of the hat in the Medium Term Budget Framework Speech ‘MTBF” on 26 October 2016.

Some say that the MTBF is just a ‘mini budget’ that reports on the first 6 months of tax collections. No ways! In the context of the #FeesMustFall crisis the MTBF is perhaps more important than the main budget speech in February.

The MTBF provides a detailed projection of how government is going to spend its money in the medium term. So, if we go back to MTBF 2015 an additional R16 billion was allocated to higher education over the MTBF period. That’s about R5billion a year.

The R5 billion has been allocated primarily to NSFAS and we can only hope that will make a meaningful difference to the poorest of the poor, some 300 000 students, by 2017. But not even national treasury maintains that this is nearly enough.

The prospects for 2016/17 MTBF are not good. There is not a hope in hell that tax collections for the 2016/17 will make the target back in the 2016/17 budget tabled in the February 2016 national budget speech. There will have to be a downward revision in the MTBF 2016/17. And probably an upward projection in debt forecasts.

I have little hope that the downward revision will be contained at R10 billion as has happened in nearly every MTBF since the 2009 financial crisis. We are probably looking at R20 billion at least in the 2016/17 MTBF!

The rating agencies are not going to applaud. And all this will be added to the list of reasons to justify downgrade to junk status being considered for South Africa’s 2016 Christmas present.

The bottom line is that the current tax base cannot come to rescue the #feesmustfall crisis. Not without a tax increase for 2017. But who is going to pay?

Currently personal tax collections are increasing by less than 10%pa, and that’s less than the budgeted 12%. So a personal tax increase in 2017/18 is already almost inevitable.

Publications

Publications

Partners

Partners